The ASX 200 rallied hard despite negative US futures with a 82-point gain to 7925 (+1.0%). The RBA left rates on hold as expected. Banks were the turn around story with CBA up % and the Big Bank Basket up to $248.66 (1.2%). REITs also in demand as GMG bounced 2.7% and SCG up 1.8%. Financials services still under some pressure, IFT down 1.4% and ASX off 3.0%. Industrials generally firmed, WES up 1.3% and WOW and COL better; Retail was back in demand, as retail sales numbers were released, JBH up 1.1% and PMV up 0.9%. Tech was better, WTC up 2.3% and XRO up 1.2% with ORG rallying 2.7% on news from Earring power station. JHX remained under pressure as the recent acquisition plan continues to spur selling, down 3.9%. Resources were back in demand, BHP bouncing % and FMG up %. Gold miners limped higher, NEM up 1.1% and RMS better by 0.8%. EVN doing well up 1.7%. PLS crumbled 5.5% again as shorts took control, MIN fell 0.8% and LTR down 6.4%. Oil and gas positive as crude rose, WDS up 1.7% and STO up 1.7%. Uranium under pressure again. In corporate news, AVJ gained 8.3% as it agreed terms with AVID. Looks like Virgin is heading for a June listing. On the economic front, retail sales rose 0.2% slightly below forecasts. Asian markets better across the board, Japan up 0.2%, China up 0.3% and HK up 1.1%. 10-year yields steady at 4.40%.

HIGHLIGHTS

- Winners: BC8, HLI, CHC, CAR, IFM, ZIP, DRR

- Losers: DYL, AEL, LTR, BCI, FFM, PDN, PLS

- Positive Sectors: Banks. Iron ore. RETs. Tech. Gold.

- Negative Sectors: Lithium. Uranium.

- ASX 200 Hi 7925 Lo 7859 – RBA stays its hand.

- Big Bank Basket: Rises to $248.66(+1.2%)

- All-Tech Index: Up 1.3%

- Gold: Rises to $5019

- Bitcoin: Rises to US$83203

- 10-year yield steady at 4.40%.

- AUD: Falls to 62.65c

- Asian markets: Japan up 0.2%, China up 0.3% and HK up 1.1%.

- Dow futures down 100 Nasdaq down 83

MARKET MOVERS

- BC8 +8.3% Kal East – Processing commenced at Lakewood.

- BSL +2.6% bouncing on tariffs.

- IFM +3.4% buyback notification.

- SGM +2.9% no reason.

- SXE +9.6% recent acquisition cheers.

- MM8 +7.8% exceptional copper hits yesterday.

- CYC +12.2% Technegas US momentum accelerates.

- AVJ +8.3% scheme of Arrangement at 65.5c. Dividend and franking appeal.

- DYL -7.6% bears are back.

- PDN -5.7% PLS -5.6% shorts in charge

- STK -12.7% investor presentation.

- BMN -9.8% uranium sell off.

- PNR -2.9% results of meeting to consolidate.

- Speculative Stock of the Day: WHK up 225.0% on US contract win.

ECONOMIC AND OTHER NEWS

- RBA left rates unchanged. Short statement nothing either way. Bullock said an improved quarterly CPI reading next week will not guarantee a rate cut in May.

- RBA chief says the upcoming federal election was not factored into the Reserve Bank board’s decision to leave the cash rate unchanged.

- Tariff uncertainty is not having a ‘specific’ impact on policy decision at the moment.

- OpenAI secures $300bn valuation after $40bn SoftBank-led funding round. Late last year it was worth half that!

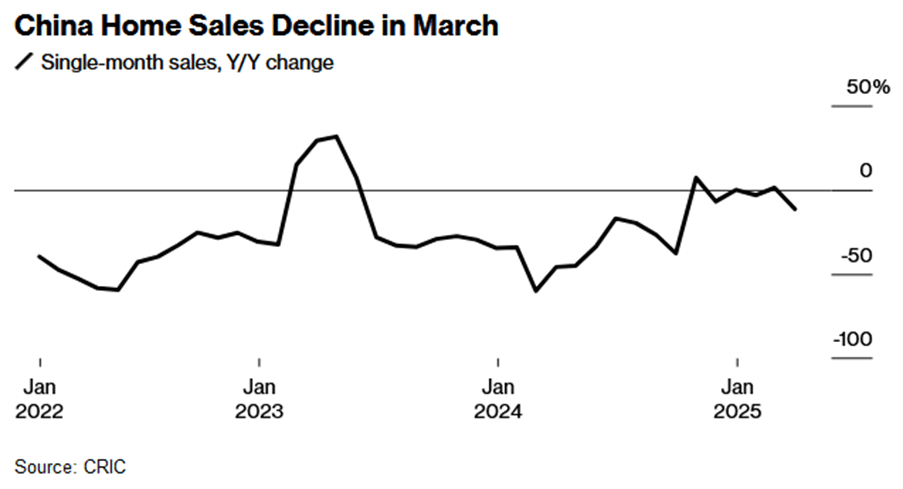

- China saw the value of new homes sales tank 11% in March. State-backed Vanke reported a record 49.5 billion yuan ($6.8 billion) loss last year, its first full-year loss since 1991.

- China’s military on Tuesday said it had begun joint army, navy and rocket force exercises around Taiwan to “serve as a stern warning and powerful deterrent against Taiwanese independence”, calling Taiwan’s President Lai Ching–te a “parasite”.

- A U.S. bankruptcy judge on Monday rejected Johnson & Johnson’s $10 billion proposal to end tens of thousands of lawsuits alleging that its baby powder and other talc products cause ovarian cancer.

- Hyundai warned U.S. dealers it is evaluating its pricing strategy in the face of forthcoming 25% tariff. Cox Automotive estimates that 25% tariffs will add $3,000 to the cost of a U.S.-made vehicle and $6,000 to vehicles made in Canada or Mexico.

- Trump administration to review $9bn in federal grants to Harvard.

- Rocket to buy Mr Cooper in $9.4bn deal to create US mortgage giant.

And finally……

It’s important we remember the true meaning of Easter says the Archbishop of Cadbury.

Clarence

XXXX