The ASX 200 pushed up 57 points to 7999 (0.7%) after a better lead from the US and benign CPI numbers. Banks once again leading us higher with the Big Bank Basket up to $245.09 (+1.3%). ANZ bouncing back from the big sell down yesterday. Other financials also in demand, MQG up 0.5% and ASX up 1.3% as volumes pick up. REITs better led by GMG up 1.0% and SCG rising 3.3% on Budget news and CPI. Industrials also feeling the love, WES up 0.7% and TCL rising 2.0% with WOW and COL rising 1.7 and 1.5%. Retail was mixed with SUL off 0.8% and LOV falling 1.7% as JBH bounced back 2.5%. Tech was mixed, WTC up 0.3% and XRO down 0.2%. Resources were a happy place as US copper hit record levels. BHP and RIO doing well with FMG up 0.8%. Gold miners were back in demand, NEM up 1.1% and SPR doing well up 4.9% on a RMS upgrade. BGL in a trading halt pending another production issue. MIN bounced 1.8% with LTR up 4.0%. PDN collapsed 11.6% as more issues with rain and production in Namibia, BOE off 4.0% and NXG falling 2.9%. Both WDS and STO were firmer. In corporate news, TUA fell 7.5% on disappointing results, VUL up 12.8% on EU critical project status. WOR CFO resigned. In economic news, CPI fell to 2.4% perhaps opening the door for a rate cut. Budget had no impact. Asian markets mixed again, Japan up 0.8% and HK finding support up 0.3% with China flat. 10-year yields rising to 4.47%.

HIGHLIGHTS

- Winners: VUL, TEA, FFM, BCI, RMS, HLI, SX2

- Losers: SVM, PDN, TUA, DVP, NEU, DYL, CRN

- Positive Sectors: Gold miners. Iron ore. Banks. REITs

- Negative Sectors: Uranium.

- ASX 200 Hi 8015 Lo 7957

- Big Bank Basket: Rises to $245.09 (+1.3%)

- All-Tech Index: Unchanged.

- Gold: Slips to $4779

- Bitcoin: Rises to US$87295

- 10-year yield higher at 4.47%.

- AUD: Rises to 63.10c

- Asian markets: Firmer, Japan up 0.8%.

- Dow futures unchanged Nasdaq unchanged.

MARKET MOVERS

- VUL +12.8% EU critical project status.

- FFM +6.7% copper play.

- SX2 +5.1% gold explorer- continues to run.

- SPR +4.9% RMS gets upgrade.

- LTR +4.0% nice bounce.

- LRV +19.9% IP Trial survey planned for Clarks Gully.

- TLG +10.7% critical project status.

- GG8 +11.8% doing well in the mist.

- SVM -16.5% $40m placement at 85c.

- TUA -7.5% results disappoint.

- PDN -11.6% rains down in Africa hurt production.

- NEU -5.5% buyback update.

- DYL -4.5% slips again.

- DGT -3.7% data centres out of favour.

- BKY -11.1% reverses recent rise.

- 4DX -9.9% cost reduction program.

- Speculative Stock of the Day: EMH +112% – EU Critical project designation.

ECONOMIC AND OTHER NEWS

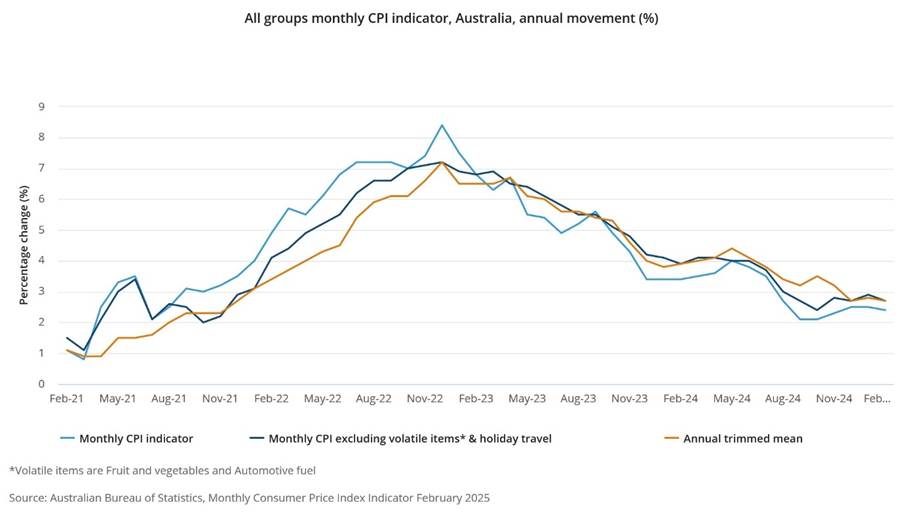

Australian CPI better than forecast.

- The monthly CPI indicator rose 2.4% in the 12 months to February.

- The largest contributors to the annual movement were Food and non-alcoholic beverages (+3.1%), Alcohol and tobacco (+6.7%), and Housing (+1.8%).

- Ukraine ceasefire in the Black Sea.

- UK Spring statement from Chancellor Reeves.

- CK Hutchison’s plan to sell two Panama ports to a BlackRock Inc.-led group is moving ahead as scheduled.

- US tariffs on copper imports could be coming within several weeks, months earlier than the deadline for a decision. US copper hits a record high of $5.3740 a pound, before paring its gain to around $5.3005 a pound.

- The world’s largest copper-trading firm, Trafigura, has said the price could hit $12,000, from about $10,000 currently.

- CATL has received China’s approval to proceed with a potentially blockbuster share sale in Hong Kong.

- Moody’s warns on deteriorating outlook for US public finances.

- JD Vance to visit military base in Greenland to ‘check out security’. Just loves dog sled racing.

And finally….

Clarence

XXXX