A solid end to the week with the ASX 200 up 41 points to 7790 (0.5%). For the week the ASX 200 is down 2%. Resources leading the charge higher and Asian markets soaring. Banks flat with the Big Bank Basket down to $233.56 (-0.7%). Insurers gained a little QBE up 1.2% and financials generally better, GQG up 1.4% with MQG rallying 0.8%. REITs were better generally, SCG up 0.9% and GPT up 1.4%. Industrials also saw bargain hunting, WES up 0.8% with BXB up 0.8% and utilities bouncing, ORG up 1.9% and TWE up 1.9% on wine tariffs. Healthcare also back in demand, SIG rising 2.9%. Tech slightly better, TNE up 2.1%. Resources were the stars today, iron ore miners finding some love with BHP up 1.1% and FMG up 2.7%. Gold miners celebrated record gold prices NST up 2.8%, NEM up 5.7% and EVN up 4.6%. Lithium stocks also saw gains with PLS up 4.3% and MIN gaining 0.9%. MLX soared 22.2% as tin erupted as a mine in Africa closed. Even uranium stocks managed a small bounce, PDN up 2.2% and BOE up 4.5%. In corporate news, MYR announced some C-Suite changes. CYL up 5.2% after initiating production at Plutonic. Nothing on the economic front. Asian market bouncing hard. Japan up 0.9%, HK up 2.5% and China up 2.4%. 10-year yields steady at 4.42%.

HIGHLIGHTS

- Winners: DRO, FCL, A2M, WGX, PNR, SPR, SGM

- Losers: C79, VUL, BCI, CRN, BC8, CAR

- Positive Sectors: Gold. Tin. Iron ore. Uranium. Lithium.

- Negative Sectors: Banks.

- ASX 200 Hi 7795 Lo 7740

- Big Bank Basket: Falls to $233.56 (-0.7%)

- All-Tech Index: Up 0.3%.

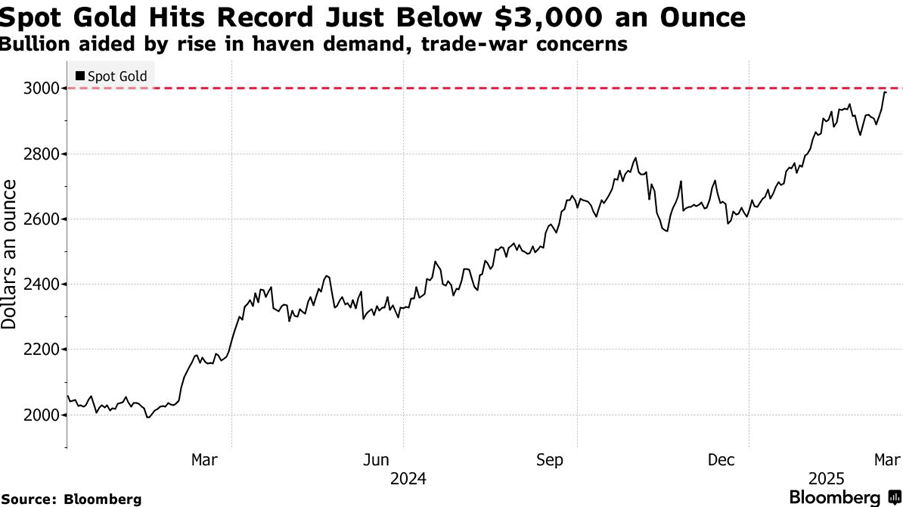

- Gold: Rises to AUD$4751!

- Bitcoin: Falls to US$81946

- 10-year yields steady at 4.41%.

- AUD: Falls to 62.90c

- Asian markets: Japan up 0.9%, HK up 2.1% and China up 2.4%.

- Dow futures up 213 Nasdaq up 192

MARKET MOVERS

- DRO +12.4% rally extends.

- PNR +6.7% gold play.

- LTR +4.9% results better than expected.

- SPR +6.7% WGX +7.2% gold exposure.

- NEM +5.7% go baby.

- MLX +22.0% tin goes nuts on Alphamin Resources temporary shutdown.

- RAC +21.4% ethics approval for Phase 1 Trial.

- AZY +10.6% solid buying.

- VUL -4.8% volatility continues.

- BCB -unchanged- investor presentation.

- CAR -3.0% ex dividend.

- ETM -5.8% Greenland still happy with long road to independence.

- AAC -1.6% US tariffs

- Speculative Stock of the Day: WOA +11.5% again. No new news.

ECONOMIC AND OTHER NEWS

- Has the US government shutdown been averted?

- China stands to gain from the ongoing trade wars between the US and its allies, the European Union’s foreign policy chief Kaja Kallas said.

- Kallas reiterated the EU’s readiness to retaliate while calling for restraint as trade wars usually trigger inflation peaks that harm consumers.

- Gold rose to a record as President Donald Trump’s aggressive tariff agenda and a weak inflation report.

- Putin sets tough conditions for Ukraine ceasefire.

- Judges order US government to rehire thousands of workers.

- Starmer suffers cabinet uprising over UK spending cuts.

And finally…….

The most terrifying moment in life is when the toilet refuses to flush at someone else’s house.

Just a few more thoughts……………..

How old do you have to be before you die of old age?

If love is blind how can you have love at first sight?

If someone owns a piece of land, do they own it to the centre of the Earth?

Do colour-blind people dream of a green Christmas?

Why would anyone want to put a square peg in a round hole?

If feathers tickle why aren’t birds always giggling?

What shape is the sky?

If cod liver oil is so good for you why don’t cod live longer?

Clarence

XXXX