The ASX dropped hard and bounced a little closing down 72 points at 7890 (0.9%) after touching 7818. MQG suffered as US investment banks have sunk. Other financials were also sold down hard, GQG off 3.2% and XYZ falling 6.3% with insurers slipping lower as government warns on Alfred issues. REITs fell back to earth, DGT dropped 7.4% on a broker downgrade, as HMC fell 9.7% too, SCG off 0.9%. Industrials slipped across the board, QAN fell 8.9% with it ex-dividend too, SGH down 3.2% and CPU falling 3.6%. Retail under pressure, JBH down 2.5% and TPW sliding 3.7%. Travel stocks took their cue from Delta Airlines, CTD off 0.5% and FLT falling 3.6%. Tech was also on the nose for obvious reasons, WTC down only 1.9% after bouncing hard off the lows, XRO saw no real bounce with the All–Tech Index down 4.0%. Resources was an interesting space. BHP and RIO both rallied hard, gold miners fell hard despite bullion prices picking back up. NST fell 1.9% and NEM dropped 2.6%. Lithium stocks under pressure as usual, oil and gas stocks better, WDS up 1.2% and uranium remains under a toxic cloud. In corporate news, NIC saw a large block trade causing a drop of 19.9% combined with possible tax changes. ASB in a trading halt as it seeks $200m at 380c together with a founder partial sell down. PNV lost its CEO and more value, GYG fell 2.2% on details of recently released escrow stock. In economic news, consumer confidence rose in March. In Asia, Japan down 1.3%, HK off 0.9% and CSI China off 0.5%. 10-year yields 4.36%.

HIGHLIGHTS

- Winners: BOT, VUL, BFL, NHC, RMD

- Losers: NIC, RMS, CAT, DRO, CYL, OBM, CSC, PME

- Positive Sectors: Oil and gas. Coal. Utilities. Supermarkets.

- Negative Sectors: Tech. Gold miners.

- ASX 200 Hi 7959 Lo 7818

- Big Bank Basket: Falls to $240.73(-0.2%)

- All-Tech Index: Down 4.0%%

- Gold: Steady at AUD$4616

- Bitcoin: Falls to US$80014 – Bounces off lows.

- 10-year yields fall to 4.36%.

- AUD: Falls to 62.79c

- Asian markets: , Japan down 1.3%, HK off 0.9% and CSI China off 0.5%

- Dow futures up 131 Nasdaq up 22

MARKET MOVERS

- BOT +12.3% conference commercial update.

- VUL +6.4% defies sell-off.

- NHC +3.2% coal doing well.

- EIQ +3.7% looking good still.

- AVH +3.9% change of director’s interest.

- NIC -19.9% large block trade and Indonesian tax changes?

- DRO -12.2% profit taking.

- HMC -9.7% DGT -7.4% cops downgrade.

- PME -10.5% risk off sell down.

- OBM -11.0% volatile.

- HLO -8.3% ex -dividend.

- SBM -6.8% broker downgrades.

- Speculative Stock of the Day: MPW +155.2% 7m shares traded on its first day of trade.

ECONOMIC AND OTHER NEWS

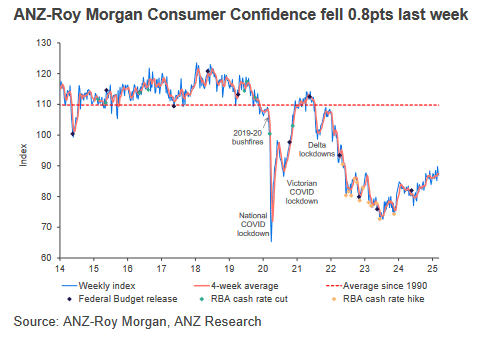

- Australian Consumer confidence fell 0.8pts last week to 86.9pts. The four-week moving average rose 0.1pts to 87.4pts. ‘Weekly inflation expectations’ rose 0.2ppt to 4.7%, while the four-week moving average was steady at 4.6%.

- Citi has downgraded US stocks to “neutral” and upgraded Chinese shares to “overweight”, declaring that US exceptionalism has at least paused.

- The Indonesian government is consulting on a proposal that would raise royalties for operators to a range of 14% and 19%, up from the current 10% on nickel ore.

- The National People’s Congress seven-day gathering, which concludes Today in Beijing has been fired up by China’s home-grown startup DeepSeek.

- Apparently talks between the US and China on trade and other issues are stuck at lower levels.

- Musk claims cyber-attack on social network X came from ‘Ukraine area’ .

- Ontario hits power exports to US with 25% surcharge as trade war escalates.

- Delta warns on profit as economic ‘uncertainty’ dents US demand.

- DOGE chief Elon Musk said that he is running his businesses “with great difficulty.”

And finally…..

Clarence

XXXXX