The ASX 200 dropped another 57 points to 8141 (-0.7%) partially ignoring a decent rally in US futures as Trump gave his Claytons State of the Union address. China now targeting 5% GDP growth in a separate proclamation. Banks dragged us down with the Big Bank Basket down to $251.84 (-1.0%). CBA down 0.9% and MQG off 1.3% with XYZ continuing to stumble down another 4.1%. REITs slipped lower, VCX down 0.5% and GPT off 0.9%. Healthcare also down, RMD falling 2.3% and TLX off 1.2%. Industrials under pressure across the board with ex dividends not helping. WES dropped 0.8% with WOW and COL sliding on ex-dividend as did TWE off 5.6%. Retail eased back, PMV off 2.4% and JBH down 1.8% with GYG up 2.1% on a broker upgrade. Tech stocks mixed, WTC up 1.2% and XRO down 0.7%. The All–Tech Index off 0.4%. Resources were mixed, iron ore stocks seeing some buying, BHP up 0.2% and RIO up 0.2%. MIN still under pressure on debt and governance issues, down 1.9%. Gold miners were positive, WAF up 6.5% and EVN up 1.4%. Energy stocks still falling, WDS down 1.5% and STO falling 1.6%. Uranium stocks finding some support. In corporate news, Virgin gets approval for Qatar investment. WTC said it expects to appoint new directors very soon. MIN saw a downgrade by Fitch and SUN and IAG clarified Alfred impacts. In economic news, we saw a better than expected 0.6% rise in GDP. Asian markets were steady on Chinese stimulus talk, Japan up 0.7%, HK up 1.7% and China up 0.3%. 10-year yields 4.35%.

HIGHLIGHTS

- Winners: VUL, RSG, WAF, CUV, LTR, BG, IFL, OBM

- Losers: OPT, IPX, WA1, AEF, TWE, AD8, IEL

- Positive Sectors: Gold miners.

- Negative Sectors: Banks. Financials. Retail. Industrials.

- ASX 200 Hi 8193 Lo 8096

- Big Bank Basket: Falls to $251.84 (-1.0%)

- All-Tech Index: Down 0.4%

- Gold: Steady at AUD$4660

- Bitcoin: Rises to US$87082

- 10-year yield rises to 4.35%.

- AUD: Falls to 62.53c

- Asian markets steady Japan up 0.7%, HK up 1.7% and China up 0.3%.

- Dow futures up 186 Nasdaq up 115

MARKET MOVERS

- VUL +15.1% big jump late.

- RSG +6.8% gold exposure.

- IFL +5.0% negativity passes for now.

- CHN +4.5% resumes rally.

- HM1 +1.3% buyers are back.

- GYG +2.1% broker upgrade.

- APX +10.8% broker upgrade.

- EIQ +8.2% strong progress in first two months.

- OPT -13.3% big drop. No news.

- SSG -8.3% ex dividend.

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

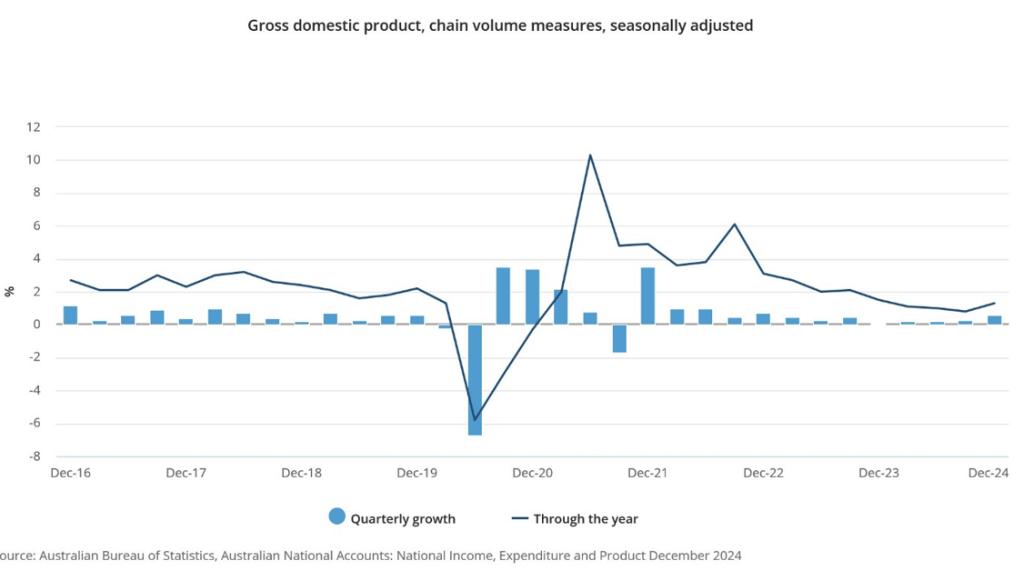

Australian gross domestic product (GDP) rose 0.6% in the December quarter 2024 and 1.3% through the year (seasonally adjusted, chain volume measure).

- New Zealand RBNZ Governor Adrian Orr has resigned after seven years and will finish the role on March 31, according to an official statement.

- China Sets GDP Target at About 5% Despite Trump Tariffs.

- Fiscal deficit target set at around 4% of GDP, highest in over three decades.

- Beijing lowers CPI target to around 2% for first time in more than 20 years.

- Boosting domestic demand made top priority as Trump imposes tariffs.

- Speech before Congress from Trump says a ‘little disturbance’ from tariffs is OK, as markets reel from trade war fears. Longest ever address at around 100 minutes.

- BlackRock to buy Panama Canal ports after pressure from Trump.

- Trump still wants Greenland.

- Trump’s tariffs will bring ‘nothing but pain’ to rural America, farmers say .

- Ukraine to run out of US weapons by summer.

And finally…..

Clarence

XXXX