The ASX 200 fell another 48 points today to 8198(0.6%). Trump’s tariff chaos continues with Mexico and Canadian levies due to take effect in days. Canada has already fired back, losses were tempered as banks found a footing. CBA rose 0.4% with WBC up 0.2% and the Big Bank Basket at $254.30 (). Financials were weaker, MQG down 1.2% and insurers down heavily as Alfred comes to QLD. QBE down 2.0% and SUN down 2.0%. REITs were weaker, GMG off another 0.9% with DXS bucking the trend up 1.6%. Healthcare weaker though CSL up 1.0% in defensive buying. Industrials fell across the board. Some love found for rate sensitive stocks, QAN rose 2.1% on oil price falls. Retail pushed lower, LOV down 3.5% and TPW off 5.3% with WEB falling 4.4% and GYG dropping another 4.4%. Tech dropped with the index down 0.8% Resources could have been worse. Iron ore stocks found some buying, BHP down 0.3% with RIO similar, FMG fell 3.4% with PLS down 3.8% and MIN off 10.2%. Gold miners firm but unspectacular, NEM down 0.9% and EVN up 1.6%. Energy stocks suffering big falls, WDS off 3.1% and STO down 4.7% with uranium stocks still toxic. In corporate news, IFL fell 5.6% as it declined to make an early debt repayment, HCW dropped 7.8% as Healthscope failed to pay some rental invoices. In economic news, RBA minutes showed RBA in no hurry to cut rates and retail sales rose by 0.3% in January. Steady as she goes. Asian markets weaker but 10-year yields continuing to fall to 4.27%.

HIGHLIGHTS

- Winners: PPM, SPR, LYC, FPR, TLC, HLS, BFL

- Losers: MIN, OPT, BOE, MSB, DVP, HCW

- Positive Sectors: Gold miners.

- Negative Sectors: Everything else.

- ASX 200 Hi 8231 Lo 8150

- Big Bank Basket: Steady at $254.30

- All-Tech Index: Down 0.8%

- Gold: Rises to AUD$4659

- Bitcoin: Falls to US$83836

- 10-year yield falls to 4.26%.

- AUD: Falls to 61.99c.

- Asian markets down, Japan down 1.7%, HK up 0.1% and China up 0.1%.

- Dow futures up 71 Nasdaq up 106

MARKET MOVERS

- SPR +6.3% gold exposure.

- LYC +2.9% rare earth rally.

- FPR +2.7% broker upgrade.

- CSL +1.0% defensive.

- AFG +3.5% broker upgrade.

- BOE -9.9% shorts in control.

- MIN -10.2% breaks technical levels.

- HCW -7.8% Healthscope update.

- NEU -6.7% buy back update.

- XYZ -5.0% crypto on the nose.

- DUG -8.9% back in a hole.

- IFL -5.6% declines NAB debt payment early.

- PDN -4.9% uranium is toxic it seems.

- Speculative Stock of the Day: EGR +19.1%

ECONOMIC AND OTHER NEWS

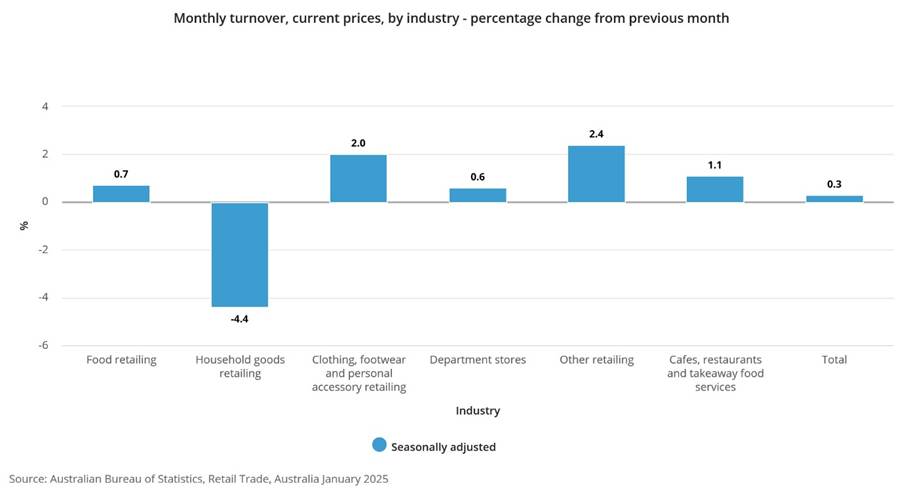

Retail Trade

- Rose 0.3% month-on-month.

- Rose 3.8% compared with January 2025.

- The Reserve bank of Australia has published the minutes from its first board meeting of 2025. No commitment to further rate cuts.

- Board members expressed “caution about the prospect of further policy easing, which could also be seen in the forecast for inflation based on the market path.”

- Suncorp (SUN) said the federal government’s cyclone reinsurance pool provides cover for damage when a storm is classified as a cyclone and for an additional 48 hours after it is downgraded.

- NSW government considering ‘range of contingencies’ on Star casino.

- Iron ore slumped below $US100 a tonne for the first time since mid-January as some steel mills curbed production to ensure blue skies during the government’s upcoming policy meetings in Beijing.

- Canada moves to put tariffs on US$160bn worth of US goods.

- China ‘firmly rejects’ additional U.S. tariffs, says it will implement countermeasures. One state media outlet said Beijing was considering retaliatory tariffs on U.S. agricultural products.

- Tencent’s AI Bot Passes DeepSeek as China’s Favorite on iPhones.

- Record number of Americans apply for UK citizenship.

- Europeans move towards seizing €200bn of Russian assets.

And finally…….

Theft in a muti storey carpark is wrong on so many levels…

My obese parrot ![]() died yesterday

died yesterday ![]()

It’s a huge weight off my shoulder!

Clarence

XXXX