The ASX 200 finished down around 11points at 8241 (0.1%) with CPI coming in as expected. Once again results were the focus, banks found buyers with the Big Bank Basket up to $253.05 (+1.1%) with CBA leading the way up 1.3%. MQG rose 0.6% and insurers flat. REITs were weaker, GMG falling 1.6% and SCG off 3.3% on results. Industrials mixed again, WTC rose 2.1% as White became Chair and results showed no further surprises, the All–Tech Index still fell 1.3% with TLS under pressure off 1.9% and QAN down 2.3%. Retail stocks mixed, JBH off 0.6% with LOV finding friends in all the right places up 5.7%. Travel stocks arrived jet lagged as FLT touched down 10.2% and CTD fell 3.6%. DMP hit another 3.7% with LNW better by 7.8% on results. Resources were back in the doghouse as iron ore fell, FMG dropped 6.2% as it went ex-div, BHP off 1.5% and RIO down 3.4%. Gold miners ran out of luck, NST down 2.8% and EVN off 1.7%. NEM off just 2.0%. LYC fell 1.7% after results showed the effects of low REE prices. Uranium stocks showed more fall out with PDN results bringing no joy and coal down too. WDS gained 3.4% after broker comments. STO going nowhere. In corporate news, WOW fell 3.0% after cutting its dividend, PBH had an abundance of bid interest around the 106c level, up 32.5%. BAP rose 13.4% and WOR up 10.3% on results whereas APX crashed 33.3% on disappointment. PTM also suffering as results were nasty, off 20.0%. KLS was another casualty today, maybe just a flesh would, but down 15.2%. In economic news, the CPI came in as expected and hardly moved the dial. Asian markets mixed, Japan down 0.7% and HK up 3.2% with China up 0.4%. 10-year yields at 4.48%.

HIGHLIGHTS

- Winners: BAP, WOR, JLG, MGH, FFM, LNW, SIQ

- Losers: APX, BRN, KLS, IDX, SDR, ACL, FLT

- Positive Sectors: Banks.

- Negative Sectors: Iron ore. Gold miners. REITs. Tech. Travel.

- ASX 200 Hi 8251 Lo 8210

- Big Bank Basket: Rises to $253.05(+1.1%)

- All-Tech Index: Down 1.3%

- Gold: Rises to AUD$4616 Copper prices surging on tariff threat.

- Bitcoin: Falls to US$88369

- 10-year yield fall to 4.37%.

- AUD: Falls to 63.27c.

- Asian markets down, Japan down 1.1% and HK up 2.5% with China up 0.1%.

- Dow futures up 78 Nasdaq up 108

MARKET MOVERS

- BAP +13.4% results better than expected.

- WOR +10.3% results.

- LNW +7.9% results.

- JLG +8.3% slight rebound.

- MGH +8.2% buy back update.

- DRO +6.9% defence spending play.

- JIN +4.5% bargain hunters.

- LOV +5.7% finding some love.

- HLI +3.5% kicks again.

- SIQ +7.4% results.

- PBH +32.5% two bids in a day.

- EML +14.6% good results.

- ARU +16.7% rare earth play,

- BBT +8.8% bids for PBH +32%.

- AGI +5.0% broker upgrade.

- APX -33.3% results underwhelm.

- KLS -15.2% bus leaves station.

- FLT -10.2% results.

- RPL -6.7% results not so good.

- PTM -20.0% results.

- FMG -6.2% ex dividend.

- ALA -30.8% reinstatement after placement.

- Speculative Stock of the Day: HTM +56%- gold project acquisition Honourable mention WOA again, up 25%.

ECONOMIC AND OTHER NEWS

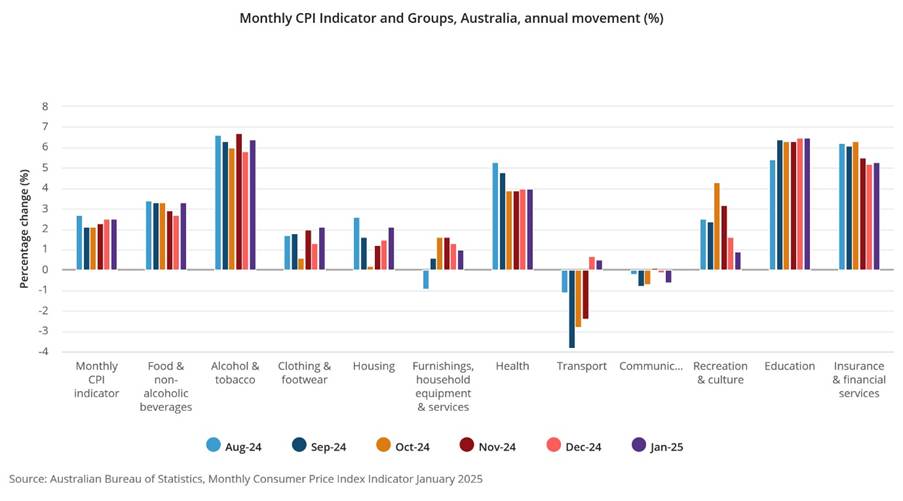

- The monthly CPI indicator rose 2.5% in the 12 months to January.

- Nvidia reports fourth-quarter financial results on Wednesday after the bell.

- DeepSeek is rushing out a new model. H20 chip is in high demand, designed to circumvent the barriers.

- HK expects modest growth in 2025 as China looks to fight deficit.

- U.S. President Donald Trump floated the idea of replacing a visa program for foreign investors with a so-called “gold card” that could be bought for $5m as a route to American citizenship.

- US House passes budget resolution to cut taxes and spending by trillions.

- Apple promises to fix dictation bug that replaces ‘racist’ with ‘Trump’.

- White House to choose which reporters get close access to Trump.

- US orders probe into copper dumping, opening door to new tariffs.

And finally…

Some wise words…

The ability to speak several languages is an asset, but the ability to keep your mouth shut in any language is priceless !

When I get a headache I take two aspirin and keep away from children just like the bottle says.

If you see me talking to myself, just move along. I’m self-employed. We’re having a meeting.

I hate it when I can’t figure out how to operate the iPad and my tech support guy is asleep. He’s 5 and it’s past his bedtime.

Lately, you’ve noticed people your age are so much older than you.

Clarence

XXXX