The ASX 200 closed up 12 points at 8308 (0.1%) in a good recovery from early 70-plus point losses. Banks were the turnaround story as buyers went shopping. ANZ and NAB leading the sector higher with the Big Bank Basket at $252.96 (2.5%). MQG gained 1.5% as insurers also saw a positive turnaround. NHF dropped good numbers and rose 12.5%. PPT knocked back the Barbarians at the Gate falling 2.3% with XYZ falling 12.9% on disappointing numbers. REITs slipped again as GMG fell 4.1% and VCX down 4.4%. Industrials were mixed, ALL bounced 2.9% with WOW and COL better on defensive buying., Utilities also did well with APA rising 7.7% on numbers. Tech was hit hard as news of WTC directors resigning en masse saw losses of 20.1% in WTC and XRO slipped 1.2% with the All–Tech Index dropping 3.2%. Resources succumbed to gravity after holding up well last week, BHP, RIO and FMG all lost ground. Gold miners eased back, NEM fell 2.8% and NST off 2.1% with lithium plays falling but off lows. PLS down 3.4% and MIN off 0.7%. Oil and gas remained neglected and uranium stocks fell on profit taking. In corporate news, plenty of results, IRE fell 14.5% as guidance came in below forecasts, PRN, REH also under pressure on disappointing results. GYG fell 7.0% as brokers downgraded, XYZ hit hard falling 12.9% as crypto lost ground and LOV felt no love at all down 3.8%. Nothing on the economic front today. Asian markets mixed, Japan on a holiday, China and HK taking a break with HK off 0.6% and China unchanged. 10-year yields steady at 4.44%

HIGHLIGHTS

- Winners: OML, EVT, NHF, DRO, RUL, APA, ING, AAC

- Losers: WTC, PRN, IRE, REH, XYZ, PNV, RPL

- Positive Sectors: Banks. Insurers. Defensives.

- Negative Sectors: Iron ore. Lithium. Gold miners. REIT. Tech.

- ASX 200 Hi 8310 Lo 8216

- Big Bank Basket: Rallies to $252.96 (2.5%)

- All-Tech Index: Down 3.6%

- Gold: Rises to AUD$4608

- Bitcoin: Falls to US$95305

- 10-year yield falls to 4.44%.

- AUD: Steady at 63.80c.

- Asian markets a little weaker, Japan on holiday.

- Dow futures up 212 Nasdaq up 100

MARKET MOVERS

- NHF +12.5% good results.

- APA +7.7% results cheer.

- NEU +4.1% FDA announcement.

- MPL +2.3% follows NHF.

- IGL +% announces buyback.

- DXB +7.3% listen to the podcast.

- GNG +4.9% results

- WTC -20.1% Four directors resign – Guidance downgrade.

- PRN -15.9% results.

- IRE -14.5% transformation complete.

- XYZ -12.9% results reaction.

- NXL -7.7% results.

- GYG -7.0% broker downgrades.

- ALC -12.7% profit taking.

- SBM -7.7% gold sold off.

- RXL -5.7% sells non-core assets.

- Speculative Stock of the Day: ARN +15.71% ASX Speeding ticket.

ECONOMIC AND OTHER NEWS

- Germany’s conservative opposition leader Friedrich Merz said he’ll move quickly to form a new government after he won Sunday’s federal election with a result that will require him to form a coalition. Merz pledges independence from US.

- Merz’s CDU/CSU bloc won 28.6% of the votes, followed by 20.8% for the far-right Alternative for Germany.

- BMW pauses £600mn investment plan to produce electric Minis in Oxford .

- Pollution from Big Tech’s data centre boom costs US public health $5.4bn.

- Israeli tanks moved into the occupied West Bank on Sunday for the first time in decades in what Palestinian authorities called a “dangerous escalation,” after the defense minister said troops will remain in parts of the territory for a year and tens of thousands of Palestinians who have fled cannot return.

- US Earnings reports from Home Depot and Lowe’s on Tuesday and Wednesday, respectively, will give investors a better sense of how U.S. consumers are faring. Nvidia’s earnings report on Wednesday evening.

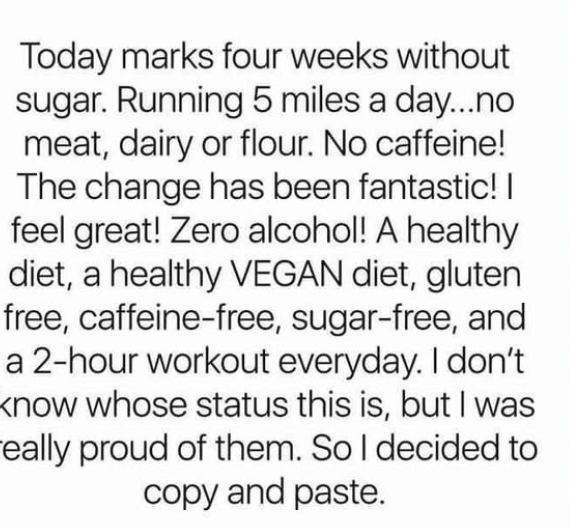

And finally…..

Shakin’ Stevens once bought a country estate in Scotland

Thistle House

Clarence

XXXX