END OF DAY

Another nasty day as the ASX 200 fell 96 points to 8323 (1.2%) as results and bank falls dominated. WBC fell another % and ANZ joined in to falling % with the Big Bank Basket down to $251.27 (-2.4%). MQG dropped 1.0% with financial sunder a little pressure. REITs fell as GMG returned to trade down 5.0% after the $4bn capital raise. Industrials were mixed, ALL dropped 4.3% despite a new buy back, WES rose 1.3% on good results, TLS also did well, up 5.6% after announcing a buy back. Retail stocks suffered, JBH down 4.2% and BRG falling 3.0%. CTD continued the positive vibes from the results up 4.7%. UNI did very well on results up 9.7%. In healthcare, PME dropped 3.7% and CSL down 2.3%. Resources suffered as RIO cut its dividend, falling 1.5% and BHP fell 2.0% as FMG were savaged on results, down 6.2%. Lithium stock surprisingly rose after PLS results, up 6.0% and oil and gas stocks rose, WDS up 1.0% and STO rising 2.1%. Coal stocks gained 8.9% on WHC results. Uranium stocks were mildly lower. In corporate news, MAF rose 8.7% on good numbers, WTC in a trading halt on governance issues. MP1 had stellar gains on beating expectations. Casualties included, SUL, MFG, and MGH. On the economic front, jobs data came in as expected at 4.1% unemployment and record participation. Asian markets fell, Japan under pressure on proposed car tariffs. Down 1.5%, HK off 1.4% and China down 0.4%. 10-year yields steady at 4.52%.

HIGHLIGHTS

- Winners: NAN, MP1, DRO, UNI, WHC, MAF, MIN, CHC

- Losers: RDX, SUL, MGH, MFG, DYL, SKC, CRN.

- Positive Sectors: Oil and gas. Telcos. Lithium.

- Negative sectors: Banks. Healthcare. REITS. Tech. Retail.

- ASX 200 Hi 8402 Lo 8288

- Big Bank Basket: Eases to $251.27 (-2.4%)

- All-Tech Index: Down 0.8%.

- Gold: Rises to AUD$4620

- Bitcoin: Rises to US$97220

- 10-year yield rises to 4.52%.

- AUD: Steady at 63.64c.

- Asian markets Japan down 1.5%, HK off 1.4% and China down 0.4%.

- Dow futures down 100 Nasdaq down 78

MARKET MOVERS

- NAN +23.1% results cheer.

- MP1 +19.5% beats expectations.

- DRO +15.9% surprising really.

- UNI +9.7% good results. Not all retail is the same.

- PLS +6.0% results better than expected.

- MIN +6.8% bargain hunters.

- MAF +8.7% good results.

- TRS +19.5% no longer rejected.

- BET +4.4% supply agreement to Sportradar.

- DRR -4.3% follows BHP down.

- MFG -10.1% new management and results.

- FMG -6.2% smacked on numbers.

- GMD -3.4% broker downgrades.

- NAB -3.3% sell-off continues.

- RRL -3.5% conference presentation.

- DYL –9.3% Legal proceedings in Namibia.

- EGL -15.1% investor presentation.

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

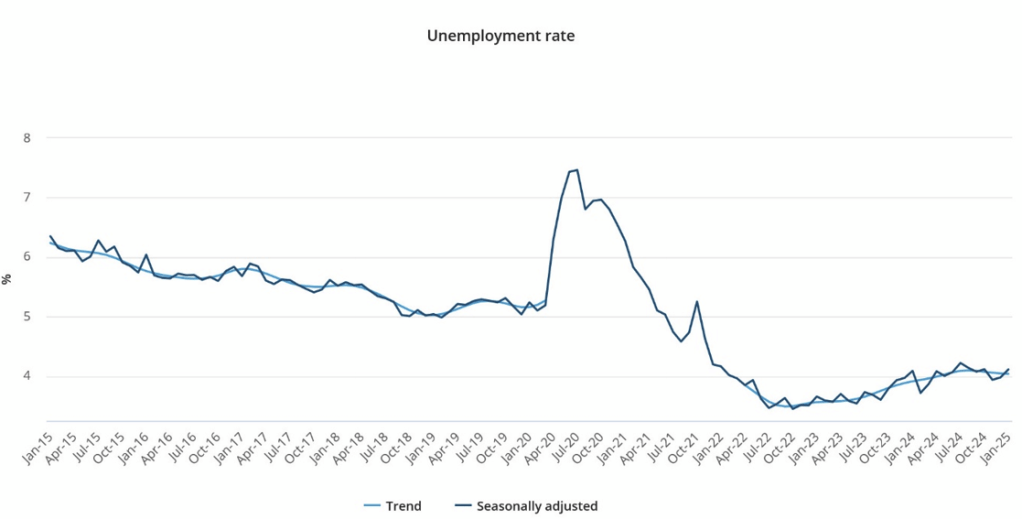

Local jobs data. In seasonally adjusted terms, in January 2025:

- unemployment rate increased to 4.1%.

- participation rate increased to 67.3%.

- The People’s Bank of China held the 1-year loan prime rate unchanged at 3.1%, and the 5-year LPR at 3.6%.

- Almost nine out of 10 Japanese companies expect U.S. President Donald Trump’s policies to negatively affect business, a Reuters survey showed.

- US President Donald Trump said it would be possible to reach a fresh trade deal with China.

- Trump makes push for control of independent US regulators.

- Trump administration moves to halt New York congestion scheme.

- Morgan Stanley strategists ended their bearish view on Chinese stocks. They expect the MSCI China Index to reach 77 by the end of 2025. That’s 22% higher than its earlier target, and indicates another 4% rise from Wednesday’s close.

- US congressional committee warns on new Chinese embassy in London.

- France and UK plan air power-backed ‘reassurance force’ in postwar Ukraine.

And finally….

Clarence

XXXX