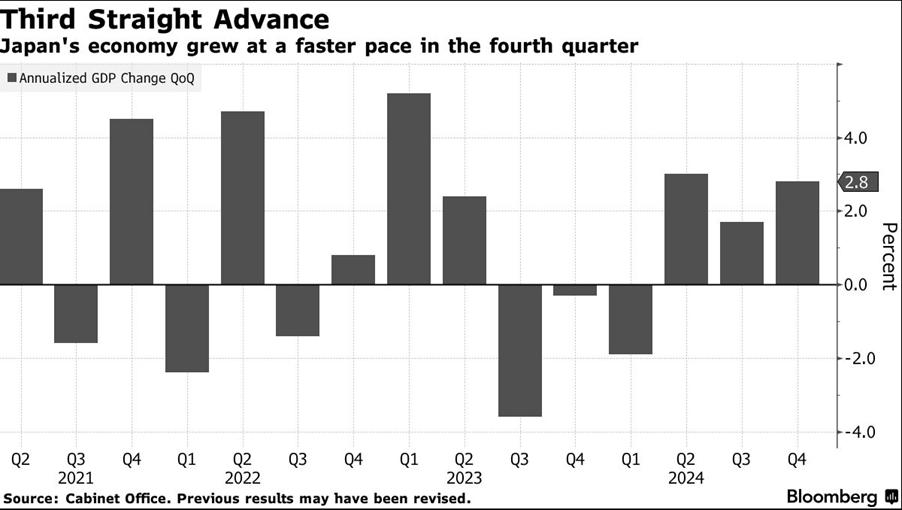

ASX 200 fell 19 points to 8537 well off the lows for the day. Results dominated as the Banking sector had two to contend with WBC underwhelmed falling 4.1%, and BEN crashed 15.3% on higher costs and lower margins. The Big Bank Basket fell to $269.95 (-0.9%). Financials were missed with MQG up 0.7% and GQG putting on another 3.3% but insurers slipped on Dutton’s comments and IAG downgrades. SUN down 7.2%. REITs are in demand on rate cut hopes, GMG down 1.1% but SGP up 3.2% and GPT up 4.5% on better-than-expected rates. Industrials mixed, AD8 smashed the bears on a decent outlook, rising 26.5%, tech fell as WTC back on the front page again. The All–Tech Index up 0.2%. Utilities firmed with ORG up 2.7% and retail mixed, JBH up 0.3%, and PMV off 0.9%. Resources were very mixed, gold miners saw profit takers move in following bullion falls, GMD down 3.3% and NEM off 2.8%. Iron ore stocks eased, FMG down 0.6% with energy under pressure, WDS off 2.9% on reserve statement and dividend concerns, STO down 0.9%. Uranium did better than expected, NXG off 4.2% though. In corporate news, WBC disappointed, BEN really disappointed. A2M +19.7% saw good traction in China, BSL rose 13.0% on a positive outlook statement and SGR rose 12.5% on an offer from Oaktree to refinance $650m of debt. Nothing on the economic front. Japanese GDP was better than expected. Asian markets slightly better, Japan up 0.1%, China up 0.1% and HK up 0.2%. 10-year yields rose to 4.45%.

HIGHLIGHTS

- Winners: AD8, A2N, BSL, VUL, ZIP, IPX, SHV

- Losers: BEN, SUNDD, CVL, AMP, DEG, NXG

- Positive Sectors: Retail. REITs. Utilities. Financials ex banks

- Negative sectors: Banks. Gold miners. Oil and gas.

- ASX 200 Hi 8555 Lo 8480

- Big Bank Basket: Eases to $269.95(-0.9%)

- All-Tech Index: Up 0.2%

- Gold: Steady at AUD$4556

- Bitcoin: Back to US$96179

- 10-year yield rises to 4.44%.

- AUD: Better at 63.67c.

- Asian markets, Japan up 0.1%, China up 0.1% and HK up 0.2%.

- US markets closed for President’s Day.

MARKET MOVERS

- AD8 +26.5% upside result surprise.

- A2M +19.7% China kicks.

- BSL +13.0% CEO positive outlook statement.

- ZIP +7.9% nice to see.

- IPX +6.5% awarded $47.1m contract by US DoD. Titanium.

- SIG +4.8% CW keeps on going.

- CHN +22.9% breakthrough met tests.

- SGR +12.5% Oaktree moves.

- FND +10.8% results.

- BEN -15.3% rising costs.

- SUNDD -7.2% insurers down on Dutton consolidation.

- WBC -4.1% results disappoint. Downgrades to come.

- NXG -4.2% uranium remains toxic.

- AMP -4.7% downgrades.

- NST -3.5% NEM -2.8% bullion falls.

- IAG -2.8% downgrades.

- FBR -43.2% JV Option period concludes.

- Speculative Stock of the Day: Nothing on any volume today.

COMPANIES

ECONOMIC AND OTHER NEWS

- US markets closed tonight.

- Tencent shares rose to their highest since 2021 after DeepSeek, the AI service that’s shaken up the industry since its emergence this year, debuted on the big tech company’s WeChat social media platform.

- Japan’s GDP expands at annualised clip of 2.8%, giving yen a boost. Private consumption edged higher in the quarter, exceeding forecasts, but it slowed markedly versus the prior quarter.

- Intel’s rivals Taiwan Semiconductor Manufacturing Co. and Broadcom are each eyeing potential deals that would break the U.S. chipmaking icon in two

- Ukraine rejects Trump bid to take rights to half its mineral reserve.

- EU plans Trump-style import ban on food.

And finally….

Clarence

XXXXX