ASX 200 rallied 16 points to 8556(0.2%) after stalling at record highs. For the week the index is up 45 points. RBA next week. Once again results dominated after a strong lead from US markets. Banks flat with the Big Bank Basket at $272.43 (-0.5%). CBA lost 0.8% and MQG eased 0.3%. AMP results saw a big rerating downwards, off 14.9% and GQG rose another 3.0% on FUM and results. ASX saw some upgrades and rose 1.0%. Insurers bounced back a little with IAG finding some support rising 0.1%. REITs mixed, GMG down 1.8%, the remainder better. Industrials were firm again, JBH up 0.6% with WES up 0.8% and ALL up 0.7%. SGH continued 2.4% higher with CPU flat. TWE bounced 3.0% after broker comments on results. Tech slightly better, WTC up 0.5% and the All– Tech Index up 0.9%. Resources mixed, iron ore miners opened very firm on cyclone news, but iron ore failed to kick in Asian trade. Lithium back in the canine club. MIN down 4.9% and PLS off 0.9%. Gold miners were again in demand, NEM up another 1.6% with GMD up 2.5%. BSL continued to push higher up 1.6%. Energy stocks listless. In corporate news, COH results were at the bottom end of expectations and we saw another downgrade, down 13.7%. MGR jumped 5.5% on results, WGX doubled half year revenue and rose 2.4% with URW down 4.4% on earnings. Nothing on the economic front today. RBA the focus. Asian markets mixed again, HK continuing to power ahead up 2.2%. Japan down 0.6% and China up 0.7%.

HIGHLIGHTS

- Winners: TPW, SIG, HLS, DHG, MGR, BGL, OBM

- Losers: AMP, COH, CVL, CU6, MIN, URW, SLC

- Positive Sectors: Insurers. Tech. Gold. Utilities.

- Negative sectors: Banks. Lithium. Iron ore.

- ASX 200 Hi 8615 Lo 8547 Up 45 points for the week.

- Big Bank Basket: Eases to $272.43 (-0.5%)

- All-Tech Index: Up 0.9%

- Gold: Steady at AUD$4629

- Bitcoin: Back to US$96940

- 10-year yield falls to 4.41%.

- AUD: Better at 63.20c.

- Asian markets, Japan down 0.6%, China up 0.7% and HK up 2.2%

- Dow Futures up 50 Nasdaq up 26

MARKET MOVERS

- TPW +11.8% broker upgrades.

- HLS +6.5% merge talks with ACL.

- DHG +6.2% broker upgrades.

- BGL +5.4% corporate presentation.

- SIG +7.2% Day Two of CW.

- GQG +3.0% FUM and results.

- AIS +16.7% about time.

- AVH +11.2% Annual report and upgrades.

- AMP -14.9% results disappointment.

- COH -13.7% downgrades.

- CVL -13.1% results.

- MIN -4.9% reverses Thursday gain.

- CXL -10.2% rethink.

- MEI -6.2% falling back to earth.

- Speculative Stock of the Day: Nothing on any volumes today.

ECONOMIC AND OTHER NEWS

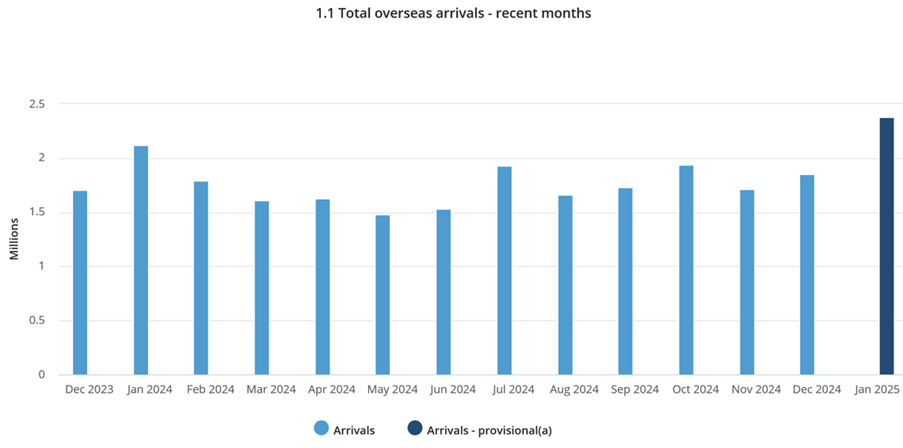

- In December 2024: Short-term visitor arrivals: 945,280 – an increase of 7.8% on one year earlier.

- Two additional banks have refused to provide funding for the large Papua LNG project in Papua New Guinea in which Santos is involved.

- A hedge fund startup that uses artificial intelligence to do work typically handled by analysts has outperformed the global stock market in its first six months while slashing research costs. The model for global stocks returned 13.7% in the six months ending January, versus 6.7% for the MSCI All-Country World Index.

- Donald Trump said Indian Prime Minister Narendra Modi agreed to begin negotiations to address the US trade deficit.

- Iron ore held above $US106 a tonne on Thursday but extended a fall in the previous session.

- Apple is working to bring its AI features to China by the middle of this year.

- Singapore’s annual GDP expands at fastest pace since 2021, lifted by trade, finance and manufacturing sectors. In 4Q, GDP rose 5% YoY.

- Europe must respond to Trump ‘electroshock’, says Macron.

- Arm to launch its own chip in move that could upend semiconductor industry.

- Porsche to cut 1,900 jobs in Germany as weak EV demand bites.

And finally,

Clarence

XXXX