Tags

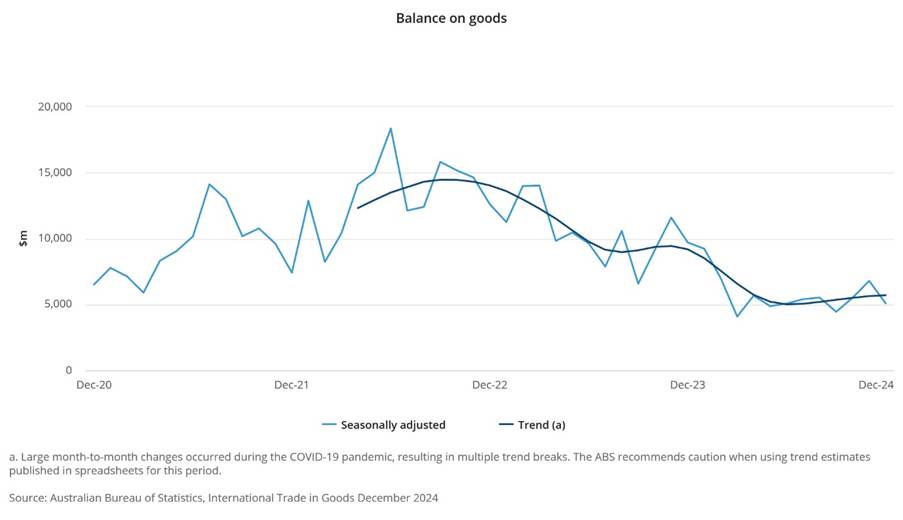

TheASX 200 continues to march ever higher gaining 104 points to 8521 with a cooee of the record close. Banks led, everything else follows. CBA is up %, and ANZ is playing some catch-up football is up %, with the Big Bank Basket up to a new record of $267.97 (2.5%). MQG bounced 0.9% but still some question marks given the banks green and clean push in recent years. Insurers gained, QBE up 0.7% and SUN up 1.6%. GQG continue to push higher up 3.6% and MFG up 2.0% on FUM news. REITs pushed up, GMG up 1.5% and VCX up 0.9% as yields fell. 10-year yields falling to 4.30%. Healthcare mixed, CSL bounced 0.9% with RMD still finding it tough going. Industrials firmed, WES up 3.2% on a broker upgrade with Bunnings the driver. ALL up 1.6% with BXB up 2.1% and REA gaining 1.2% despite the CEO announcing his retirement. NWS results cheered, up 5.8%. Retail mildly positive, MYR fell 5.6% as the in-specie distribution came to pass. In resources, iron ore majors were slightly firmer, gold miners striong as bullion hit new records, NEM up 2.1% ahead of results. WGX bouncing 3.7% with SPR doing well up 4.3%. Some firmness in the lithium market, but energy stocks under a little pressure. STO down 0.6%. Uranium stocks weaker along with coal. In corporate news, NWS released good results, PEXA disappointed with an update, BPT fell 5.0% on a tightening of guidance. In economic news, the seasonally adjusted balance on goods decreased $1,707bn in December. Asian markets better. 10-year yield down to 4.32%.

HIGHLIGHTS

- Winners: WA1, PYC, GDG, NWS, OPT, PDI, SPR, PNR

- Losers: MYR, BRN, BPT, CU6, ZIP, 360, MSB

- Positive Sectors: Gold. Banks. REITs. Industrials.

- Negative sectors: Energy.

- ASX 200 Hi 8523 Lo 8417

- Big Bank Basket: Record high at $267.97(2.5%)

- All-Tech Index: Up 0.3%

- Gold: Rises to AUD$4579

- Bitcoin: Back to US$97641

- 10-year yield falls to 4.30%.

- AUD: Rises to 62.62c.

- Asian markets lower, Japan up 0.6%. HK up 0.6%. China up 0.9%.

- Dow Futures up 97 Nasdaq up 55

MARKET MOVERS

- NWS +5.8% read all about it – good results.

- WA1 +6.7% rally continues.

- PDI +4.6% strategic placement continues to draw buyers on Bankan project.

- WGX +3.7% bouncing back.

- OPT +5.0% Wet AMD data featured at Macula Society meeting.

- EOS +8.6% increased defence spending.

- BET +4.6% acquires new technology.

- AZY +8.3% Livewire write-up.

- MYR -5.6% in-specie distribution finalised. Few sellers already.

- BPT -5.0% narrows guidance.

- PXA -3.0% operating update and guidance.

- ZIP -4.0% Conference call details.

- SGR -8.0% Black Hole?

- CTT -5.0% becoming a substantial holder.

- PTR -24.0% drilling confirms world-class titanium project.

- Speculative Stock of the Day: OZM +28.6% again! Update on Mulgabbie gold project. Assays next week!

ECONOMIC AND OTHER NEWS

- The seasonally adjusted balance on goods decreased $1.707bn in December.

- A gauge of business conditions remained in negative territory in the fourth quarter for the eighth consecutive period, as wage costs weighed on companies.

- The mining sector posted the largest jump in business conditions – up 25 index points – and conditions in the retail sector fell 15 points.

- The Bloomberg Commodity Total Return Index, which trades a basket of 24 energy, metals, and agricultural futures, has already jumped 5.9 per cent this year to its highest level since the end of 2022

- NAB’s quarterly business survey found business conditions rose 3 index points, but remained in negative territory at -4 points.

- Nomura soars to 16-year high as profit jump cements recovery

- White House insists Trump has ‘not committed’ to sending US troops to Gaza.Hottest January on record shocks scientists

- US Treasury Secretary Scott Bessent said the Trump administration’s focus with regard to bringing down borrowing costs is 10-year Treasury yields, rather than the Federal Reserve’s benchmark short-term interest rate.

- Colombian president Petro claims cocaine is no worse than whisky.

And finally….

Clarence

XXXX