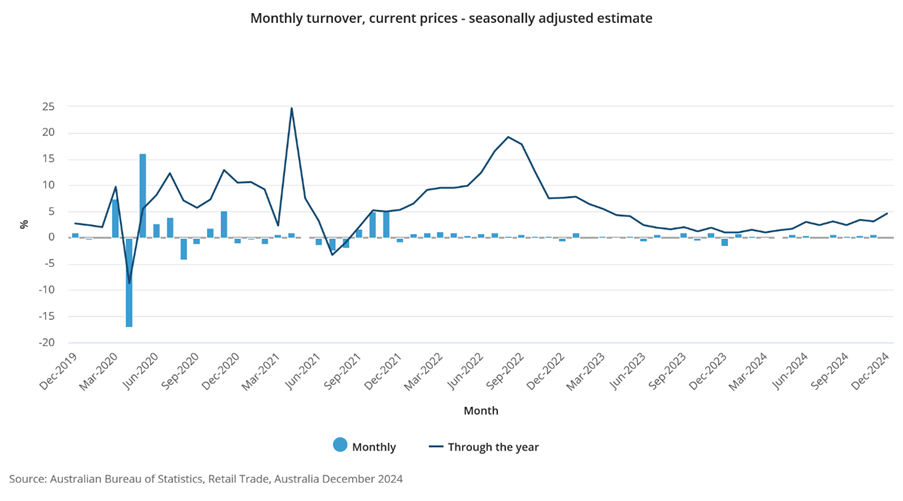

ASX 200 kicks off February with a Trump Tariff induced loss of 153 points to 8379 (1.8%). No sign of any rally as US futures point to further loses. Across the board falls with the Big Bank Basket down to $260.71(-1.6%). CBA off 1.5% with MQG falling 1.6% and insurers weaker, QBE down 2.3% and SUN off 3.2%. REITs also under pressure, GMG off 1.6% and SCG down 1.6%. Healthcare eased with FPH warning on falling margins, RMD down 3.1% on quarterly update. CSL down 1.8%. Industrials also eased back, WES down 1.9% and ALL falling 2.0% after a great run. REA off 2.2% and tech sank, WTC down 2.9% and 360 dropping 5.1%. HSN rose 2.2% on a trading update, the All–Tech Index down 2.1%. Retail slid, JBH down 0.3% but SUL worse falling 2.2% and CTT off 19.0% on US concerns. In resources, iron ore miners on the nose, FMG down 4.4% and RIO off 2.1% on aluminium issues, gold miners were firm relatively, oil and gas were flat despite rising crude prices. Uranium found some sellers. In corporate news, MFG sell-off continues following the recent management changes; RSG CEO resigned with the stock falling 9.6% on the news. WGX fell 12.4% on a production update and FPH warned on Mexican implications. In economic news, retail trade came in with a 0.1% fall, better than expected. Asian markets are still playing second fiddle to New Year holidays. Japan off 2.8% with car makers getting smacked on tariff news. HK down 0.7%. 10-year yields 4.38%.

HIGHLIGHTS

- Winners: LYC, HM1, HSN, RMS, RRL, CMM, LTM

- Losers: CTT, WGX, BRN, VUL, MFG, RSG, FFM, DRO

- Positive Sectors: None.

- Negative sectors: Everything else.

- ASX 200 Hi 8508 Lo 8354

- Big Bank Basket: Falls to $260.71(1.6%)

- All-Tech Index: Down 2.1%

- Gold: Higher AUD$4546

- Bitcoin: Rises to US$93,649

- 10-year yield steady at 4.38%.

- AUD: Falls to 61.16c

- Asian markets lower, Japan down 2.8%. HK down 0.7%

- Dow Futures down 692 Nasdaq down 583

MARKET MOVERS

- LYC +3.6% rare earth potential.

- RRL +2.0% revolving credit facility.

- HSN +2.2% strategic agreement and trading update

- HM1 +2.8% NTA

- LTM +1.4% AUD falls.

- SWF +2.8%new 28c bid.

- FND +11.1% Indian Bank approval.

- CTT -19.0% US tariffs hit.

- WGX -12.4% production downgrade.

- VUL -9.9% runs into brick wall.

- DRO -8.2% retraces recent rise.

- MFG -9.7% key dates for 2025

- OPT -7.9% profit taking.

- SIG -% CW gets the ok.

- MEI -9.8% falls to earth.

- Speculative Stock of the Day: OZM +% – High-grade gold discovery at Mulgabbie North.

ECONOMIC AND OTHER NEWS

- Australian retail sales slipped 0.1% from November to December, beating forecasts of a 0.7% drop and following two months of solid gains.

- China’s manufacturing activity unexpectedly declined for a second straight month in January.

- The Caixin manufacturing purchasing managers index fell to 50.1, the lowest in four months, from 50.5 in December, according to a report released by Caixin and S&P Global today.

- US tariffs threaten to deepen Chinese deflation, says Morgan Stanley.

- Musk vows to cancel grants after gaining access to US Treasury payment system.

- US aid agency in doubt after website goes dark and officials put on leave.

- “Fentanyl is America’s problem,” China’s foreign ministry said. “The Chinese side has carried out extensive anti-narcotics cooperation with the United States and achieved remarkable results.”

- EU futures down in early trade. EU next.

And finally….

Clarence

XXXX