Tags

The ASX 200 took a tumble today down 51 points to 8379 (0.6%) as resources came under pressure on Trump tariffs fears. Asian markets were resilient and iron ore unchanged in Singapore, but miners still sold off. BHP down 1.7% with FMG off 2.2% on quarterly numbers, lithium also under pressure too with PLS down 3.7% and MIN off 3.3%. Gold miners eased and uranium stocks help relatively firm. Banks held steady with the Big Bank Basket at $260.17. Financials slipped slightly, ASX off 1.2% with insurers mixed. QBE up 1.0% and IAG down 0.5%. Industrials saw modest broad-based losses, retail slid, JBH down 2.2% and WES off 1.5%. Both WOW and COL fell and ALL dropped 2.7% with tech mixed, XRO up 1.1% and WTC off 0.4%. In corporate news, PMV and MYR voted yes to the deal. FMG had production numbers in line, PPS jumped on FUA numbers and EVN dropped 3.9% on broker research. Nothing on the economic front locally, BoJ tomorrow widely expected to raise rates. Asian markets firm Japan up 0.8%, HK up 0.2% and China up 0.6%. 10-year yields rising to 4.47%.

HIGHLIGHTS

- Winners: MYR, SLX, PNR, RRL, OPT, NEU

- Losers: VUL, ILU, LTR, FCL, DVP, OML, FFM

- Positive Sectors: None

- Negative sectors: Iron ore. Lithium. REITs. Retail.

- ASX 200 Hi 8421 Lo 8366

- Iron ore up 0.4% in Singapore.

- Big Bank Basket: Steady at $260.17

- All-Tech Index: Unchanged.

- Gold: Higher at AUD$4388

- Bitcoin: Steady at US$102031

- 10-year yield rises to 4.47%

- AUD: Rises to 62.71c

- Asian markets better with Japan up 0.8%, HK up 0.2% and China up 0.6%

- Dow Futures down 8 Nasdaq down 32

MARKET MOVERS

- MYR +6.1% they said yes.

- SLX +5.5% uranium play in US.

- NEU +3.9% rally continues.

- OPT +3.9% still looking good.

- RRL +3.9% quarterly activities.

- CYL +3.2% broker upgrades.

- PPS +11.8% quarterly FUA update.

- CVN +13.0% bounces back a little.

- OCC +7.3% rally kicks again.

- LTR -6.4% lithium under pressure and profit taking.

- ILU -6.5% downgrades on quarterly.

- VUL -6.5% SPP raises only $8m

- CSC -4.1% metals slip.

- INR -9.5% lithium stocks under pressure.

- CXO -7.0% quarterly.

- Speculative Stock of the Day: AQD +200% significant gold discovery at Cangallo. Good volume as well.

ECONOMIC AND OTHER NEWS

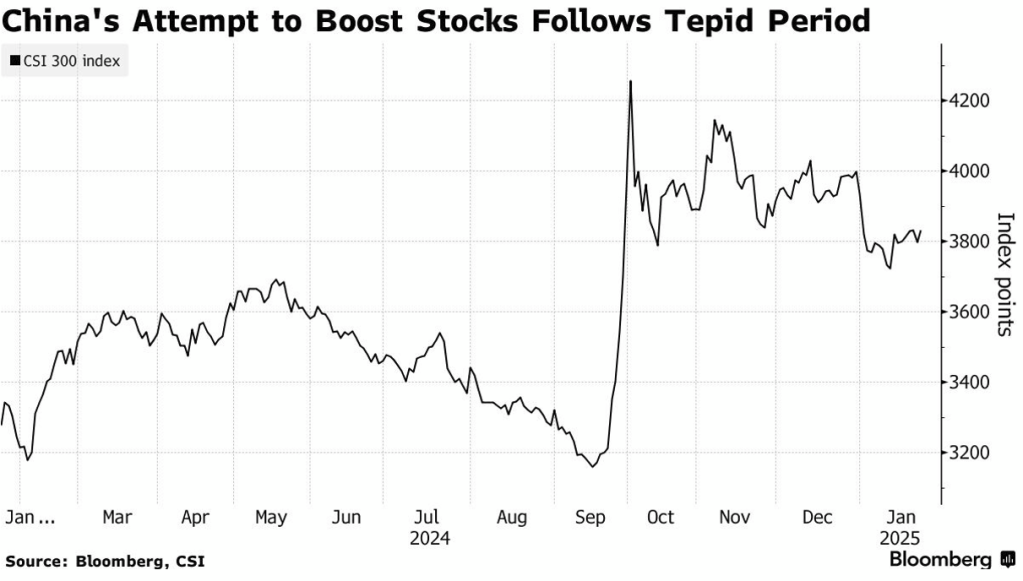

- China pushes insurers to buy stocks. Chinese officials reassured investors of the government’s commitment to supporting the market and boosting share prices.

- South Korea’s economy continued to sputter in the last quarter, with gross domestic product growth missing estimates.

- SK Hynix profit soars to a record high on AI boom, but shares drop on demand uncertainty. Revenue rose about 75% in the October-December quarter compared with the same period a year earlier, while operating profit surged 2,236% to 8.08 trillion, year on year.

- Trump halts more than $300bn in US green infrastructure funding.

- Samsung unveils new AI-powered smartphone in fight against Apple.

- LNG exporter Venture Global slashes IPO valuation target by $45bn.

- Jamie Dimon praises Musk’s various business ventures and compared him to legendary physicist Albert Einstein.

And finally…

Clarence

XXXX