Tags

ASX 200 fell 18 points to 8213 (-0.2%) in quiet trade after a positive start gave way to some caution ahead of the US CPI tonight. Banks flat as yields firmed to 4.62% in 10-years. Financials mixed with MPL down 1.6% on news of potential premium increases. NWL continued to fall. REITs firm with GMG under some pressure as a ‘tech’ stock off 0.6%. Tech stocks remain on the nose here with WTC down 3.7% and TNE off 1.9%. REA and CAR also fell whilst TLS announced a new AI deal and fell 1.2%. Retail mixed with PMV still under pressure, MYR down 1.8% and travel stocks a little higher with CTD up 2.0%. GYG jumped 4.4% on a broker upgrade. Resources mixed, iron ore miners a mixed bag, BHP fell 1.0% and FMG up 1.8%. Gold miners better with NST up 1.0% and NEM up 1.3%. Lithium stocks saw some short covering with PLS up 4.1% and LTR rising 7.4% on hopes for lithium prices bottoming and some WA funding. Energy and uranium were slightly weaker. In corporate news, AVJ got a new 70c bid, ARU rose 17.4% on the government support for a convertible note. BBN rallied 13.9% on a trading update. In economic news, China’s central bank pumped a near-historic amount of short-term funds into its financial system today. Asian markets slightly weaker.

HIGHLIGHTS

- Winners: NGI, LTR, PNR, OML, IEL, BAP

- Losers: NEU, PYC, OPT, SXG, IFM, DRO, BOT

- Positive Sectors: Gold miners. Lithium.

- Negative sectors: Tech. Utilities.

- ASX 200 Hi 8264 Lo 8213

- Big Bank Basket: Lower at $ 249.72 (-0.1%)

- All-Tech Index: Down 1.2%

- Gold: Higher at AUD$4320

- Bitcoin: Higher at US$97091

- 10-year yields back to 4.62%

- AUD: Higher at 61.94c

- In Asian markets, Japan unchanged, HK up 0.2% and China down 0.4%.

- Dow Futures up 16 Nasdaq up 13

MARKET MOVERS

- LTR +7.4% has lithium bottomed.

- GYG +4.4% broker upgrade.

- PLS +4.1% short covering.

- IEL +4.4% no real reason.

- MSB +3.9% finding buyers after fall yesterday.

- ARU +17.4% government funding with convertible note.

- BBN +13.9% positive trading update.

- EIQ +10.0% resumes the uptrend.

- AVJ +7.8% new bid at 70c.

- NEU -8.3% EU approval application.

- JLG -3.6% announces results date.

- WTC -3.7% tech sell off.

- QAN -2.7% higher fuel prices?

- ETM -3.0% Redland not Greenland.

- SBM -5.8% falls continue.

- SGR -7.1% normal service resumed.

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

- US CPI – Forecasters see core CPI up 0.3% in December for fifth month. The core consumer price index, which excludes food and energy, is seen rising 0.3% in December alongside a 0.4% advance in the overall index.

- South Korean investigators arrested President Yoon Suk Yeol on Wednesday following the brief martial law period.

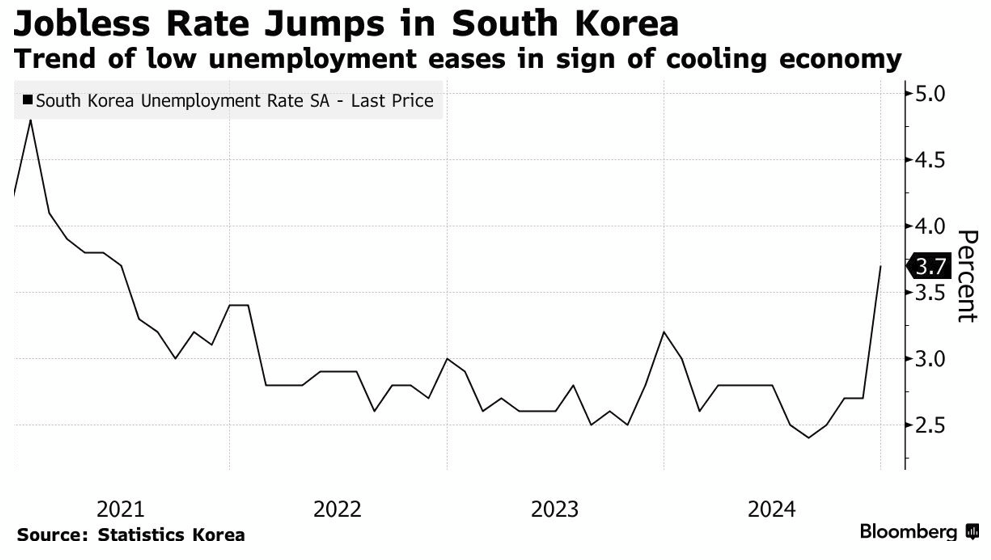

- S. Korean jobless rate rises to 3.7% after staying low for most of 2024.

- Elon Musk accused by SEC of bilking Twitter investors out of millions.

- Meta is set to cut about 5% of its workforce. Zuckerberg told employees 2025 will “be an intense year,” focused on artificial intelligence, smart glasses and the future of social media.

- UK City minister Tulip Siddiq resigns. She became the second UK government minister to resign in two months.

And finally….

Clarence

XXX