Tags

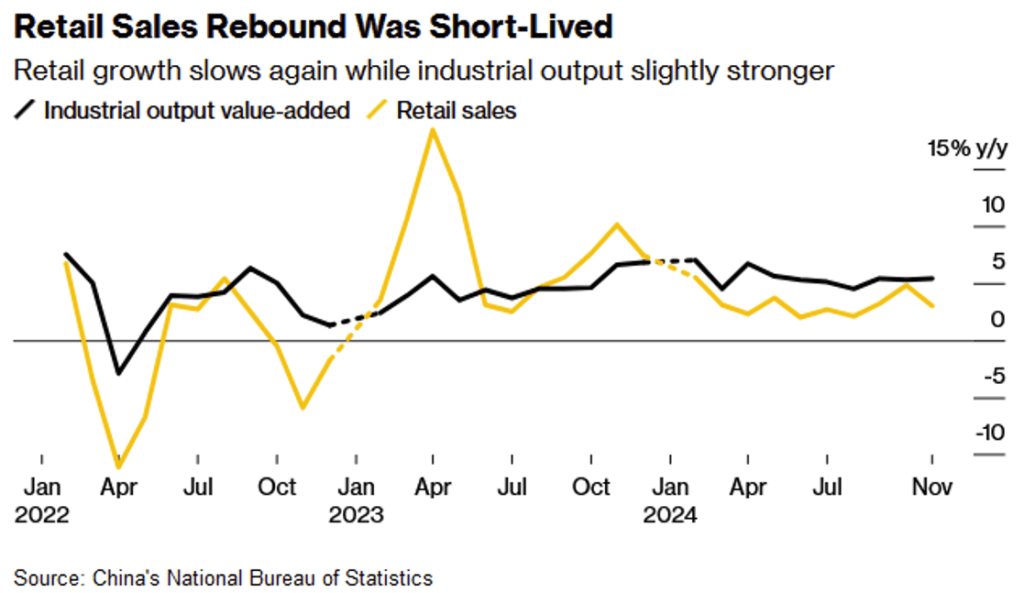

ASX 200 slid 47 points to 8250 (0.6%) as banks remained solid and resources sunk. Iron ore stocks fell hard as Chinese retail data showed no real sign of a stimulus helping. BHP down 2.0% and FMG off 3.8%. Lithium stocks remain depressed, PLS off 3.1% and MIN falling 2.0%. Gold miners too under pressure as bullion comes off the boil. NEM down 3.6% with NST off 2.1% and VAU dropping 8.0%. Oil and gas eased with uranium stocks under pressure on a spot price downgrade from UBS. Banks help up with the Big Bank Basket solid at $257.88 (+0.3%). Insurers are also doing well, SUN up 0.8% and IAG up 1.2%. Other financials withered and died, ASX off 0.7% with HMC down 13.7% following DGT much lower. REITs fell, GMG down 1.8% with SGP down 1.0%. Tech eased back, WTC lost 1.8% with XRO down 0.3%, the All-Tech Index fell 1.0%. Retail was mixed, LOV up 0.5% and PMV down 1.8%. GYG dropped 3.6% with LNW down 1.9% too. In corporate news, not much around today. In economics, the RBA has been shaken up a little bit with two new appointments to the Interest rate-setting committee. Chinese data was lacklustre. Again. Asian markets drifted lower, Japan down 0.1% and China and HK falling 0.4% and 0.6% respectively. 10-year yields rose to 4.31%.

HIGHLIGHTS

- Winners: SGR, SDR, ASB, SXG, FPH, ACL

- Losers: HMC, APX, VNT, SLX, CYL, FFM, BOE

- Positive Sectors: Banks. Insurers.

- Negative sectors: Iron ore. Uranium. REITs. Tech. Gold miners.

- ASX 200 Hi 8287 Lo 8249

- Big Bank Basket: Higher at $257.88 (+0.3%)

- All-Tech Index: Down 1.0%.

- Gold: Down to $4158

- Bitcoin: Higher at US$104118

- 10-year yields higher at 4.31%.

- AUD: Lower at 63.78c

- In Asian markets, Japan down 0.1% and China and HK falling 0.4% and 0.6% respectively.

- Dow Futures up 38 Nasdaq down 2

MARKET MOVERS

- SGR +5.1% slight rebound.

- SXG +4.1% kicks again, thin volume.

- VUL +1.7% recovering after capital raise.

- BRN +4.2% Frontgrade Gaisler licences Akida IP.

- HMC -13.7% follows DGT down.

- APX -13.2% profit taking.

- VNT -9.2% ACCC concerns.

- BOE -8.1% broker downgrades uranium forecasts.

- SOM -11.5% change in substantial holding.

- Speculative Stock of the Day: ICE +56.3% First order for AI software from Malaysia.

ECONOMIC AND OTHER NEWS

- China’s retail sales growth unexpectedly weakened in November, highlighting the urgency for Beijing to further encourage residents to spend.

- Retail sales rose 3% from a year ago, the National Bureau of Statistics said Monday. That was the slowest pace in three months and significantly undershot forecasts of 5% growth by economists.

- China’s home-price declines eased for a third month in November.

- Foreign investment panel split on Nippon’s bid for US Steel.

- Bitcoin rises to new record above $106,000

And finally…..

Clarence

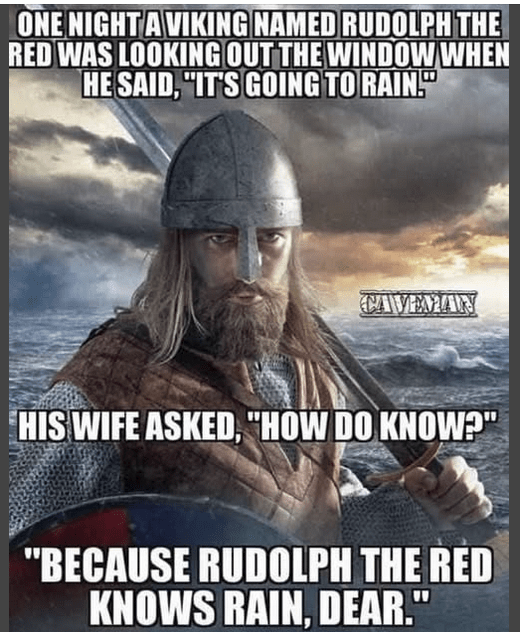

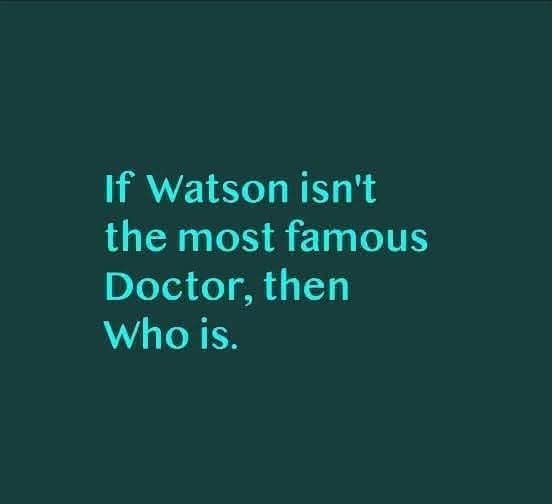

XXX