Tags

ASX 200 fell 34 points to 8300 (-0.4%) with a late rally saving some blushes. Down 1.5% for the week. Banks showed some resilience, with CBA attracting investor interest as a safe-haven option. The Big Bank Basketrose to $257.08 (+0.2%), with MQG up 0.3% with insurers easing slightly. REITs fell with NKOTB DGT falling 9.0% on debut. Not a great debut. Industrials were mixed, WOW up 0.3% and ALL rallying 1.2% as WES fell 1.3% and QAN dropped 1.2% on more industrial action. Resources fell significantly as iron ore prices dropped in Asia. BHP lost 1.5% with FMG continuing its wild ride down 3.7%. Gold miners sagged on lower bullion prices following the US PPI last night. Uranium stocks surged following the coalition’s announcement of plans to establish seven nuclear power plants across the country. PDN up 4.7% and DYL rising 2.8%. Oil and gas stocks better with WDS up 0.5%. In corporate news, IFL was on the receiving end of a NBIO from Bain at 400c, up 6.2%. S32 fell 1.1% on WA extending the Worsley alumina project. SDF fell 0.5% on some insider trading charges and TCL fell 0.9% on an update on NSW government negotiations. Nothing on the economic front locally. Asian markets eased despite Chinese stimulus talk. Japan down 1.0%, HK down 1.7% and China down 1.5%. 10-year yields back to 4.3%.

HIGHLIGHTS

- Winners: MSB, APX, VNT, IRE, WBT, IFL

- Losers: VUL, HMC, SXG, OBM, PNR, BGL, FFM

- Positive Sectors: Banks. Uranium. Oil and gas.

- Negative sectors: Iron ore. Gold miners. Lithium. Tech.

- ASX 200 Hi 8315 Lo 8263

- Big Bank Basket: Higher at $256.62

- All-Tech Index: Unchanged.

- Gold: Higher at $4221

- Bitcoin: Higher at US$100,046

- 10-year yields higher at 4.29%.

- AUD: Lower at 63.66c

- In Asian markets, Japan down 1.1%, HK down 1.7% and China down 1.8%.

- Dow Futures down 7 Nasdaq up 30

MARKET MOVERS

- MSB +13.9% good volume too.

- APX +11.3% kicks

- IRE +8.2% update and dividend resumption.

- VNT +10.8% oversold yesterday.

- SGR +2.6% Cherries?

- IFL +6.2% Bain Capital in NBIO at 400c cash.

- PDN +4.7% Coalition Nuclear policy.

- ART +8.3% takeover target perhaps?

- OCC +10.1% finding buyers.

- JMS +3.7% Tshipi interest.

- VUL -12.4% capital raise weighs.

- SXG -6.7% scheme meeting results.

- FFM -4.6% change of director’s interest.

- VAU-1.3% RRL -4.2% RMS -4.2% golds lose lustre.

- SBM -7.5% sinking feeling.

- PAR -9.5% falls below cap raise price.

- IPO of the Day: DGT –9% Sinking feeling!

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

- Overseas migration added 446,000 people to Australia’s population in the 2023-24 financial year, compared to 536,000 people in 2022-2023.

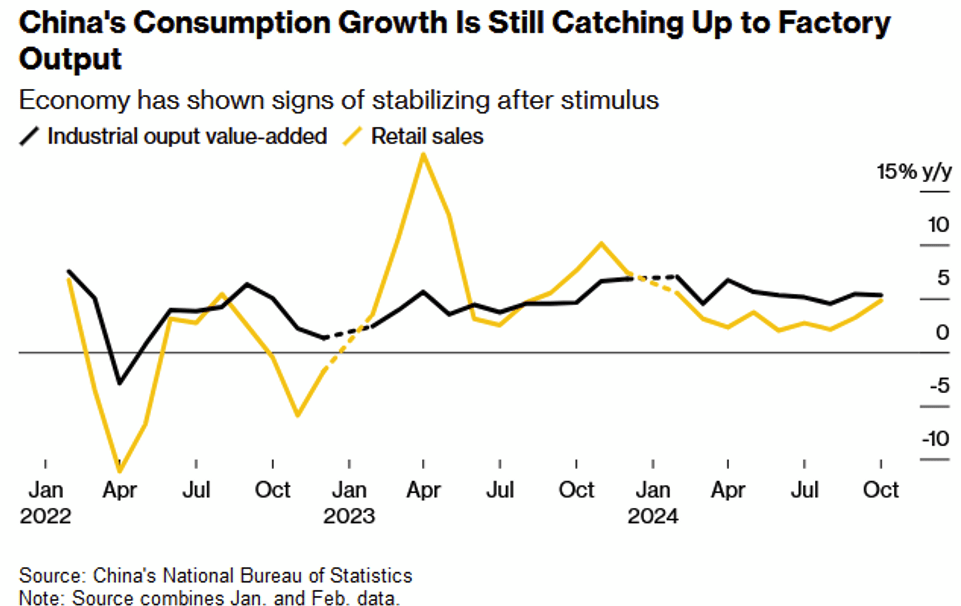

- China signaled more public borrowing and spending in 2025 with a shift of policy focus to consumption.

- HSBC reviews retail banking outside UK and Hong Kong.

- HBO parent Warner Bros to split TV and streaming into two units.

- Joe Biden grants clemency to almost 1,500 people.

- Norway campaigns to cut energy links to Europe as power prices soar.

And finally…..

The best part about getting older is that your secrets are safe with your friends. They can’t remember them either.

Clarence

XXXX