ASX 200 recovered from a cautious start to close up 15 points to 8300 (0.2%) as iron ore futures kicked back above $100. BHP up 0.7% and RIO rallying 2.2%. Resources generally were solid as uranium stocks glowed hot after moves by Russia to limit exports, PDN rose 5.5% DYL up 7.0% and BOE up 7.3%. Gold too rallied with NST up 2.5% and EVN rallying 2.6% on better commodity prices and Chinese stimulus hopes. MIN a standout up 5.8% with PLS dragging the chain in the lithium space down 2.2%. Oil and gas slightly firmer, WDS up 0.4% and coal doing well, WHC up 3.3% with NHC also 2.3% better. Banks were mixed, news on NAB being sued by ASIC and leaks over a regional levy didn’t help. CBA down 1.4% and NAB off 0.2% with the Big Bank Basket $257.88 (). Insurers and financials were better again, MQG up 0.2% and SQ2 rising 1.9%. REITS mostly better, and industrials firmed. WES up 0.4% and ALL up 0.5%. Retailers a little subdued with LOV down 3.8% on a broker downgrade on store openings and CTD rising 2.3% on Conference pick. Healthcare was an interesting space with CSL down again as RFK Jnr appointment to US Department of Health would be sub optimal. Not a great lower of vaccines and looking to rip costs out of the system. Other biotechs feeling some pain as well. In corporate news, 360 fell 6.7% as the founder offloaded a parcel, NHC provided an upbeat guidance, CUV bounced 2.2% on a shift in business focus. RSG fell 5.6% after announcing a sort of settlement with the Mali government. ELD launched a rights issue and an acquisition, coupled with disappointing numbers. Nothing on the economic front, Goldman Sachs lowered its forecast for Australia’s economic growth in 2025, due to “negative spillovers” from the incoming Trump term. Asian markets mixed, Japan down 0.9%, HK up 1.2% and China rallying 1.1%. 10-year yields 4.60%.

HIGHLIGHTS

- Winners: SLX, WBT, BOE, DYL, S32, MIN, PDN, FFM

- Losers: CU6, SXG, APX, 360, NEU, WLE, RSG

- Positive Sectors: Iron ore. Gold. Uranium. Lithium. Supermarkets. Utilities.

- Negative sectors: Tech. Banks. CSL

- ASX 200 Hi 8318Lo 8244

- Big Bank Basket: Higher at $257.88

- All-Tech Index: Down 0.7%

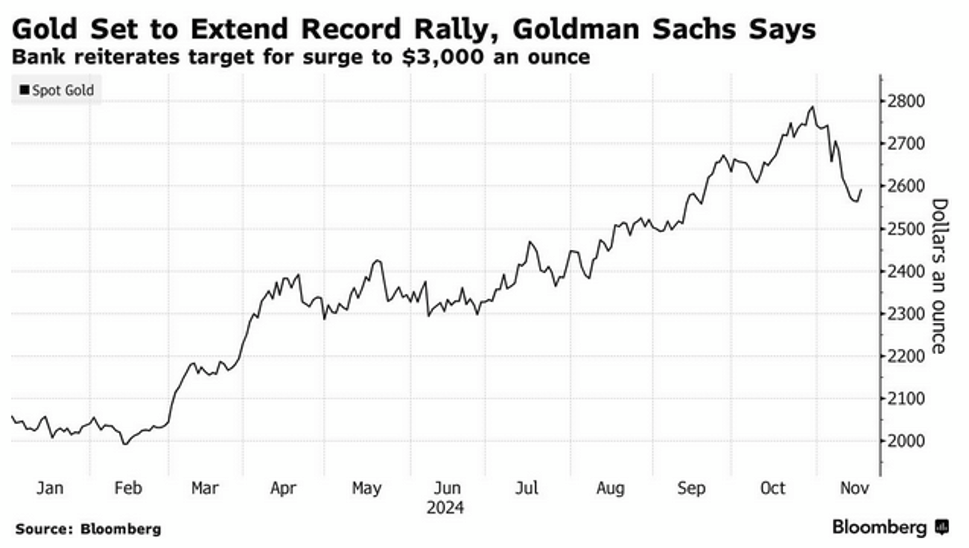

- Gold: Better at $4007

- Bitcoin: Lower at US$90763

- 10-year yields steady at 4.60%.

- AUD: Lower at 64.68c

- Asian markets: Japan down 0.9%, HK up 1.2% and China rallying 1.1%.

- Dow Futures unchanged Nasdaq up 15

- PDN +5.5% DYL +7.0% BOE +7.3% uranium surges as Russia tightens grip.

MARKET MOVERS

- PDN +5.5% DYL +7.0% BOE +7.3% uranium surges as Russia tightens grip.

- WBT +10.7% good times continue.

- MIN +5.8% solid bounce. No news is good news.

- LRV +17.9% antimony back in news.

- EIQ +8.9% integration agreement with Flagship US hospital.

- SXE +7.6% solid bounce.

- RSG -5.6% Mali update.

- CU6 -15.4% drug companies on nose due to RFK

- NEU -6.5% slips on Trump news.

- 360 -6.7% founder sells down.

- CSL -1.7% falls on RFKs vaccine views

- IMB -3.9% cleansing notice.

- Speculative Stock of the Day: NVQ +% Big volume. firm commitments for a strategic placement to raise $1.05m to accelerate the development of its blockchain-powered solutions.

- WBT +10.7% good times continue.

- MIN +5.8% solid bounce. No news is good news.

- LRV +17.9% antimony back in news.

- EIQ +8.9% integration agreement with Flagship US hospital.

- SXE +7.6% solid bounce.

- RSG -5.6% Mali update.

- CU6 -15.4% drug companies on nose due to RFK

- NEU -6.5% slips on Trump news.

- 360 -6.7% founder sells down.

- CSL -1.7% falls on RFKs vaccine views

- IMB -3.9% cleansing notice.

- Speculative Stock of the Day: NVQ +% Big volume. firm commitments for a strategic placement to raise $1.05m to accelerate the development of its blockchain-powered solutions.

.png)

ECONOMIC AND OTHER NEWS

- Iron ore prices climbed back above the key $US100 a tonne level

- Aluminium prices surged on China’s plans to scrap a tax sweetener that fuelled exports out of the country.

- Samsung Electronics unveiled a surprise plan to buy back about 10 trillion South Korean won (US$7.19bn) worth of its own stock over the next 12 months.

- Trump expands search for Treasury secretary. Trump nominates Big Tech critic Brendan Carr to head FCC.

- KKR and Bain’s $4bn takeover battle set to open up M&A in Japan.

- Gold will rally to a record next year on central-bank buying and US interest rate cuts, according to Goldman Sachs.

- The Exploration Company (TEC) announced on Monday that it has raised $160 million to fuel development of its capsule that is designed to take astronauts and cargo to space stations.

And finally…..

Clarence

XXX