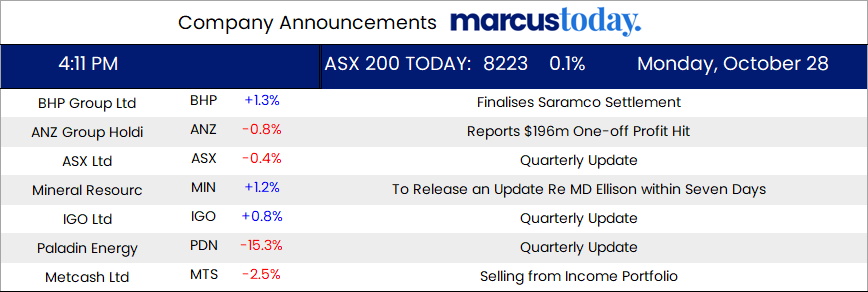

ASX 200 closes up 10 points at 8222 as caution creeps in. Quarterlies causing some serious volatility, banks under a little pressure with the Big Bank Basket down to $245.14 (0.7%) and CBA off 0.8%. ANZ eased after some accounting changes, other financials also slipped slightly. ASX down 0.4% after its AGM, insurers slightly higher, SUN up 0.9%. REITS slid, GMG off 0.6% and SGP down 0.4%. Industrials a mixed bag of lollies. Tech better led by WTC up 0.9% and XRO up 2.5% with COL and WOW easier. TLS flat with CSL off 0.6%. Resources were slightly firmer. MIN finding some support after an update on the inquiry now due a week away. BHP, RIO and FMG rallied on iron ore prices bouncing in Singapore. PLS up 3.3% with LYC also doing ok. Gold miners were a sitting target for profit takers, NST fell 5.5%, EVN down 1.9% and NEM bouncing back slightly, up 2.6%. Uranium stocks saw short sellers resume the attack, PDN were ditched post the quarterly and a Fission update, off 15.3%. BOE and DYL followed suit, coal better, but oil and gas stocks eased after oil fell 4% on muted Israeli response. In corporate news, TPW fell 0.8% on slowing retail spending, MTS down 2.5% after extending a supply contract in QLD. Nothing significant locally on the economic front. Asian markets mixed again, Japan rose 1.6% on election result, China and HK mixed. 10-year yields higher at 4.48%.

HIGHLIGHTS

- Winners: INR, VUL, BOT, SXG, CTT, DRO, RPL

- Losers: PDN, PNR, BOE, NST, ADT, WGX

- Positive sectors: Iron ore. Lithium. Tech.

- Negative sectors: Banks. REITs. Gold Miners. Uranium.

- ASX 200 Hi 8227 Lo 8200 Narrow range.

- Big Bank Basket: Down to $245.14

- All-Tech Index: Rallies 1.3%. WTC bounce continues.

- Gold: Slips to $4147

- Bitcoin: Steady at US$67664

- 10-year yields rise to 4.48%

- AUD: Slides to 65.81c

- Asian markets: Japan rose 1.8% on the election, and China and HK eased slightly.

- Dow Futures up 170 Nasdaq up 155

MARKET MOVERS

- INR +12.7% still finding friends after environmental ticks.

- VUL +12.5% quarterly report.

- BOT +6.1% quarterly report.

- ZIP +3.7% US economic strength.

- WGX -4.9% quarterly report.

- PDN -15.3% Fission deal in doubt. Operational issues too.

- ADT -4.9% quarterly report.

- VNL -21.9% convertible note and option purchase.

- LRV -13.0% options underwriting.

- LTP -10.3% quarterly activities.

- SVL -8.0% quarterly report.

- Speculative Stock of the Day: AZ9 +63.8% – Outstanding copper – Nickel discovery.

COMPANIES

ECONOMIC AND OTHER NEWS

- LDP, coalition partner Komeito fall short of a majority in first since 2009. Yen extends loss against dollar after election.

- Indonesia has blocked Apple from selling its latest iPhone 16 devices in Southeast Asia’s largest economy, saying the company has yet to meet domestic investment requirements.

- Iran’s supreme leader signals measured response to Israel’s attack.

- Starmer to pledge to ‘embrace fiscal reality’ in the Budget.

- McDonald’s Quarter Pounder burgers to return to restaurants affected by E. coli outbreak.

And finally….

Clarence

XXXX