ASX 200 fights back to be down only 26 points to 8048 (-0.3%). Plenty of R&R today. Results and resources. Banks were firm as usual. The playbook remains the same even as CEOs appear in Canberra. CBA up 0.2% and NAB striding ahead with a 0.6% gain. The Big Bank Basket up to $237.86 (+0.4%). Other financials also slightly firmer, with MQG up 0.7% and ASX up 1.1%. REITs mixed, GMG down 0.5% and GPT up 0.6%. Industrials were weak, led lower by WES, down 4.1%, with outlook statement weighing. WOW fell 2.4% on numbers and reaction, retail slightly lower, JBH down 0.7% and LOV fell another 2.6% on broker verdicts. WEB fell 5.6% on broker downgrades following annual report. Tech better, WTC up 0.8% and XRO up 1.1%, with the All–Tech Index down 0.15%. Resources once again a graveyard, BHP fell 0.6% RIO off 0.8%, with FMG rising slightly on better broker commentary. Gold miners sold off hard, RED down 12.3% on worse-than-expected results, DEG down 2.0% and BGL falling 4.5%. Lithium was depressed again with PLS down 3.0% and MIN falling 8.1% on a dividend miss and higher debt. Uranium and coal stocks also on the nose. In results today, QAN in rehab up 0.8%, CTT in the doghouse after soft numbers down 20.0%, SLX cratered down 13.0%, and CUV rose 10.9% on its numbers. BGA rose cream-like to the top up 9.4%, and SXG also in demand. On the economic front, nothing really significant ahead of US PCE. Asian markets dead, Japan unchanged, HK up 0.1% and China off 0.4%. 10-year yields rose to 3.95%.

HIGHLIGHTS

- Winners: CUV, ACL, BGA, SXG, PTM, RMS

- Losers: CTT, SLX, RED, HGH, KLS, BOE, MIN, KAR

- Positive sectors: Banks. Tech.

- Negative sectors: Resources. Supermarkets.

- ASX 200 Hi 8061 Lo 8018

- Big Bank Basket: Higher at $237.86 (0.4%)

- All-Tech Index: Down 0.1%

- Gold: Drifts higher to $3,701.

- Bitcoin: Lower at US$59349

- 10-year yields rose to 3.95%

- AUD: Firmer to 68.16c

- Asian markets: Japan unchanged, HK up 0.1% and China off 0.4%Dow Futures up 139 points. NASDAQ Futures down 74

MAJOR MOVERS

- CUV +10.9% results and investor presentation.

- ACL +9.4% financial results.

- BGA +9.4% say Cheese on results.

- PTM +5.6% results and FUM.

- WBT +15.2% short squeeze maybe.

- TTT +12.1% low volume.

- EBR +4.5% final PMA submitted to FDA.

- CTT -20.3% results and soft outlook.

- SLX -13.0% results.

- RED -12.3% results.

- KLS -8.7% broker research.

- BOE -8.3% Annual report.

- MIN -8.1% cuts dividend.

- KAR -7.4% Bauna issues.

- ERA -14.3% hedge funds take a bath.

- EXR -16.7% operations update.

- FEX -11.9% FY results.

- Speculative Stock of the Day: Hyterra (HYT) +67.7% FMG is acquiring a 38.9% strategic interest at 3.4c.

ECONOMIC AND OTHER NEWS

- Australian private new capital expenditure (capex) fell 2.2% in the June quarter 2024, 0.3% higher than June quarter 2023.

.png)

- Who needs official rate cuts! US 30-year mortgage rate falls to lowest level in 16 months.

- French authorities issue preliminary charges against Telegram CEO.

- Goldman Sachs wins challenge to Fed over stress tests.

- Biden and Xi to speak by phone amid effort to boost US-China relations.

- Finland is on the cusp of becoming the world’s first country to bury spent nuclear fuel in a geological tomb where it will be stored for 100,000 years.

- European markets opening unchanged.

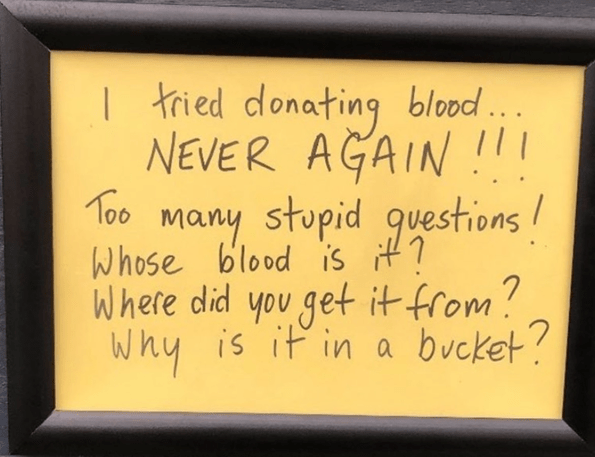

And finally…

Great cause…give generously…

https://www.mycause.com.au/p/346889/one-bloody-long-run-for-gus

Clarence

XXXX