ASX 200 limped along with a 17-point rally to 7997 (+0.2%). Results in focus again. Some good, some bad and some ugly. Banks were mixed with a capital update from ANZ, up 0.6% and CBA better by 0.3%. The Big Bank Basket is steady around $236.73. Insurers mixed, SUN up 3.1% and NWL better on results. REITs slipped, GMG down another 1.4%, as DXS fell 8.9% on write downs. The sector followed lower. Industrials mixed, BXB down 0.3%, CPU dropped 2.2% and ALL off 1.7% with gains in SVW and WOR after MND reported and rose 11.6%. Resources found some buyers, BHP bouncing off $40, up 1.3% and FMG attracting some media coverage on its virtues, up 1.5%. Gold miners mostly firmed as did uranium miners, DYL up 3.5% and EVN up 1.4%. Lithium still depressed; coal stocks took their cue from YAL with a fall of 14.5%. In corporate news, MAD fell 11.2% on some disappointment, good results from JDO, MND and RWC, with ANN bouncing nicely up 8.9% and ARB, no shocks here, up 5.2%. On the economic front, RBA minutes revealed nothing that we didn’t already know. Bullock & Co were more likely to raise but kept things on hold. Asian markets mixed, Japan up 1.1%, China and HK fell between 0.4-1.1%. 10Y yields steady at 3.95%. Dow Futures down 5 points. NASDAQ Futures up 28 points.

HIGHLIGHTS

- Winners: MND, JDO, RWC, NXL, ANN, MAH, ADT

- Losers: YAL, MAD, CXS, IRE, AD8, MFG, DRO

- Positive sectors: Iron ore. Gold miners. Insurers. Tech.

- Negative sectors: REITs. Lithium.

- ASX 200 Hi 8025 Lo 7986

- Big Bank Basket: Continues higher to $236.73 (0.01%)

- All-Tech Index: Up 0.2%

- Gold: Drifts to $3720.

- Bitcoin: Rises to US$61069

- 10-year yields rise to 3.95%

- AUD: Higher at 67.20c

- Asian markets: Japan up 2.2%, China and HK fell between 0.4-0.9%.

- Dow futures up 1 NASDAQ Futures up 28

MAJOR MOVERS

- MND +11.6% good results and positive outlook.

- JDO +10.5% no chop here.

- NXL +8.9% powers ahead.

- RWC +8.9% results.

- ANN +8.9% bounces as it cuts 10% of jobs.

- ADT +7.3% volatility continues.

- DRR +2.5% results and dividend bounce.

- APX +8.0% rally continues. FOMO is strong.

- KMD +6.8% promising signs.

- SVL +6.3% slight recovery.

- BBN +8.9% better than expected.

- YAL -14.5% cuts dividend.

- MAD -11.2% seemed overdone.

- DXS -8.9% write downs.

- DRO -5.1% broker report.

- BIS -15.3% response to ‘please explain’.

- IRI -14.5% results reaction.

- Speculative Stock of the Day: Nothing on any volume.

ECONOMIC AND OTHER NEWS

- RBA Minutes. Nothing surprising.

- Harris backs plan to raise US corporate tax rate to 28%.

- PBoC keeps benchmark interest rates unchanged.

- At least 10 cities in China relaxed, and removed new home price guidance.

.png)

- Democrat convention kicks off.

.png)

- Mike Lynch among missing after yacht sinks off Sicily.

- Investors piled back into equities amid ‘full recovery’ in market confidence.

- European inflation number today. Markets opening slightly firmer.

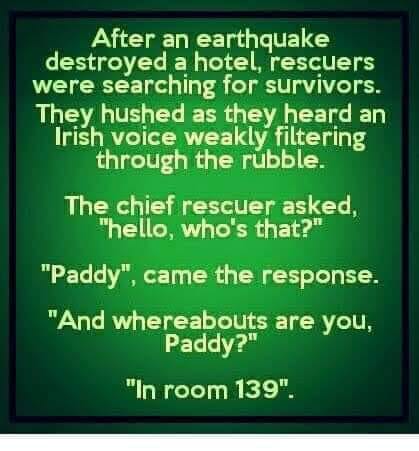

And finally…..

Clarence

XXXX