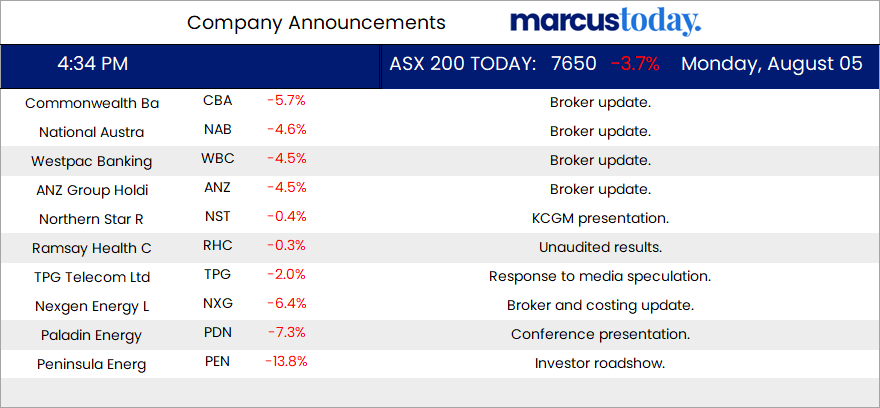

ASX 200 fell a huge 294 points or 3.7% today to 7650 as banks came under serious pressure. Financials across the region were aggressively sold off from MQG to Mitsubishi. The Big Four were torched, and the Basket dropped to $214.81 (-5.2%). CBA falling 5.7%. Insurers too sold down aggressively, QBE down 5.0% and SUN off 5.8%. REITs were also sold off despite yields remaining relatively steady. GMG down 7.1% as a tech stock, GPT off 2.6% and SGP down 3.5%. Industrials also in the seller’s sights, WES down 3.4% with WOW and COL off 2.9% and 1.2% respectively. REH down 4.7% and BXB falling 4.3%. QAN dipped 4.9% amidst a shake-up of airport slots. Tech wrecked, WTC off 8.8% and XRO falling 5.6% with the All–Tech Index down 6.1%. Resources outperformed, BHP down only 2.1% with RIO hardly changed, FMG down 1.9%. Gold miners eased despite bullion holding steady, EVN down 2.0% and GMD off 1.9% with NEM off 2.0%. Uranium fallout continues and lithium stocks mixed. PLS lower by 1.1%. Oil and gas down, WDS off 3.6% on WA environmental issues, STO fell 5.0%. In corporate news, ARG reported profits down on last year, falling 2.0%. RHC downgraded guidance to 265-270m, falling 0.3%. Nothing locally on the economic front, RBA tomorrow. No rate rise expected. Asia markets in all sorts, Japan had to have trading suspended due to the heavy falls especially in the financials. China modestly lower in comparison. Bond yields continue to slide. Australian 10Y down 7bp, 2Y down 16.8bp.

HIGHLIGHTS

- Winners: RMD, VGL, DMP,

- Losers: BOT, WA1, CU6, OPT, ZIP, VUL, SQ2

- Positive sectors: CPAP makers

- Negative sectors: Everything else.

- ASX 200 Hi 7917 Lo 7636

- Big Bank Basket: Falls heavily to $214.81 (-5.0%).

- All-Tech Index: Down 6.1%.

- Gold: Big jump to $3779

- Bitcoin: Crypto crashes to US$50830

- 10-year yields lower at 4.05%

- AUD: Lower at 64.29c.

- Asian markets crash as carry trade unwinds.

- All about the USD/ Yen.

- European markets expected to open around 2.0% lower.

- Dow futures down 400 NASDAQ Futures down 900.

MAJOR MOVERS

- RMD +2.9% broker reaction to quarterly.

- WGX unchanged completes merger.

- DMP +0.8% bounces from 10% fall last Friday.

- RED unchanged Sugar Zone extension.

- PYC unchanged TP11 Clinical trial update.

- MAU +7.1% outstanding value demonstrated by economic update at LJ.

- VVA +3.9% acquisition completed and trading update.

- PLS -1.1% tried hard to stay positive.

- FBR -18.8% Placement completed.

- CU6 -12.9% change of director’s interest.

- WA1 -13.8% Digger’s Presentation.

- OPT -12.8% succumbs to the inevitable.

- DRO -10.1% crashes below issue price.

- PNV -9.5% unwinds recent run.

- GQG -8.8% market stock.

- APX -14.4% heading back down.

- FDV -6.1% tech wrecked.

- HCH -11.4% small cap losses.

- WDS -3.6% WA EPA knocks back Browse development.

- Speculative Stock of the Day: None today unsurprisingly.

ECONOMIC AND OTHER HEADLINES

- Japan’s Topix Index has fallen as much as 8.8% today and is on pace for its worst session since the nuclear crisis in 2011. MSCI Asia Pacific Index slumps 4.3%, set to erase 2024 gains.

.png)

- The Japanese Yen has strengthened more than 2% against the dollar today. Since beginning of July the Yen has risen by around 10%.

- Japanese banks have been smashed down over 15% today for the big three. Huge unwinding of the carry trade. Buy US tech financed by low Japanese interest rates.

- Heavyweight trading houses such as Mitsubishi, Mitsui and Co, Sumitomo and Marubeni all plunged more than 10%.

- Nikkei sees worse points drop since 1987 crash.

- The Caixin/S&P Global services purchasing managers’ index (PMI) rose to 52.1 from 51.2 in June, pointing to expansion for the 19th straight month. New orders subindex rose to 53.3 in July from 52.1 in June, while the gauge of overseas demand showed the smallest expansion since August 2023. Trade data on Thursday.

- Crypto falls hard.

.png)

- Gold pushing higher ahead of European trade.

- EU capitals set to back tariffs on Chinese electric cars, trade chief says.

- Carlyle to sell power producer Cogentrix Energy in $3bn deal.

- AXA chief says proposed €5bn BNP deal could enable deal spree.

And finally….

Clarence

XXXX