Did you miss me?

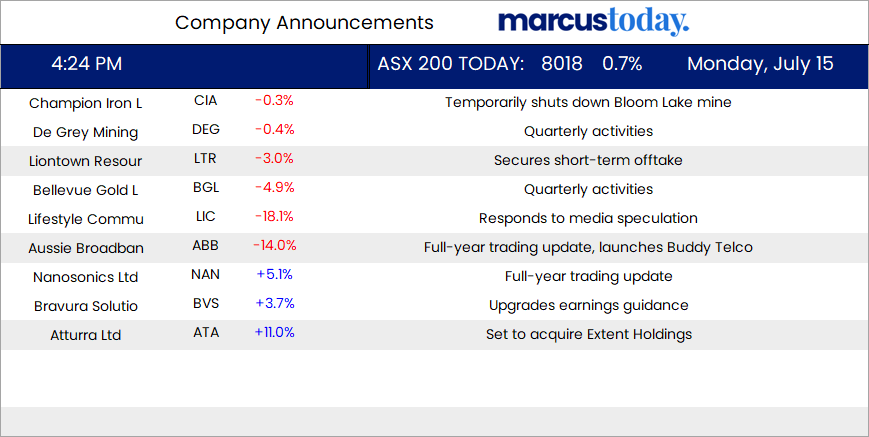

The ASX 200 pushed another 58 points higher to 8018 (0.7%) in a broad-based rally. Well off the intraday high though, on some cooling as we await reactions to Trump and US reports this week. Banks were firm but off highs, CBA up 0.8% and NAB up 0.8% with the Big Bank Basket up to $227.88 (0.8%). Other financials doing well too, ASX up another 1.2% with NWL up 1.7%. MQG pushed 0.5% ahead with insurers mixed. REITs were better with the exception of GMG falling 0.4% with SCG up 0.6%. Healthcare slightly better RMD up 2.0% and COH up 2.4%. Industrials firmed, WES putting on another 2.1% with retail stocks again finding buyers SUL up 1.3%, PMV up 1.9% and FLT up 2.8%. Tech in demand, WTC up 2.5% and XRO up 1.4%. In resources, BHP rose 0.6% with FMG double that gain. Gold miners were mixed as bullion consolidated, lithium still a little depressed and struggling for direction. Oil and gas better led by WDS up 1.3% and STO up 0.7%. In corporate news, LIC fell 18.1% on ABC media reports of issues. ABB dropped 14.0% as it launched a new cut-price NBN service, Buddy. Nothing locally on the economic front, in China, GDP data and retail sales numbers were disappointing again. Asian markets mixed, HK down 1.4%, Japan closed for a holiday, and China slightly higher. 10-year yields firmed 1bps to 4.33%.

HIGHLIGHTS

- Winners: DRO, IPX, NAN, CHC, SPR, SQ2, SEK

- Losers: LIC, ABB, IMM, ZIP, ADT, BGL, COE

- Positive sectors: Banks Iron ore Tech Healthcare

- Negative sectors: Lithium.

- ASX 200 Hi 8037 Lo 7971

- Big Bank Basket: Another record with $227.88(+0.8%)

- All-Tech Index: Up 1.4%

- Gold: Trading steady at $3561

- Bitcoin: Rallies to US$62,733 on Trump card.

- 10-year yields steady at 4.33%

- AUD: Rises to 67.74c.

- Asian markets weaker, HK down 1.4%, Japan om holiday and China slightly higher.

- Dow futures up 81 NASDAQ Futures up 70

MAJOR MOVERS

- DRO +11.1% flying again.

- IPX +6.0% fund manager backing

- NAN +5.1% good sales update.

- PGF +1.8% NTA

- SKS +15.9% fund manager pushing.

- OIL +18.0% gets ethical clearance for Breast Cancer study.

- LIC -18.1% ABC report into illegal and alleged unethical practices.

- ABB -14.0% launches Buddy.

- ZIP -7.1% sell off continues.

- BGL -4.9% quarterly report.

- CTT -2.8% change in substantial holding.

- AXE -22.2% CEO resigns and management changes.

- IMM-9.9% reverses gains.

- WC8 -8.5% slips away.

- LOT -4.1% change of director’s interest.

- Speculative Stock of the Day: Aldoro Resources (ARN) +40.9% positive niobium announcement with 62.4% achieved at Kameelburg. Not huge volume though.

COMPANIES

ECONOMIC AND OTHER HEADLINES

- Chinese GDP expansion slowest in five quarters as demand struggles. GDP expanded 4.7% in the second quarter from the same period a year earlier, undershooting economists’ median forecast of 5.1%.

.png)

- Industrial production increased 5.3% on year in June, versus economists’ forecast of 5%

- Retail sales rose 2%, compared with a predicted growth of 3.4%

- Fixed-asset investment gained 3.9% in the first six months, matching an expected 3.9% increase. Contraction in the property sector continued, with investment slumping 10.1% in the period

- The urban jobless rate was unchanged at 5% last month from May.

- President Biden calls for end to era of political violence in speech

- Alphabet is in talks to acquire cybersecurity startup Wiz for as much as US$23bn.

- Meloni seeks to bring nuclear power back to Italy.

- Chinese Third Plenum kicks off this week.

And finally….

Clarence

XXX