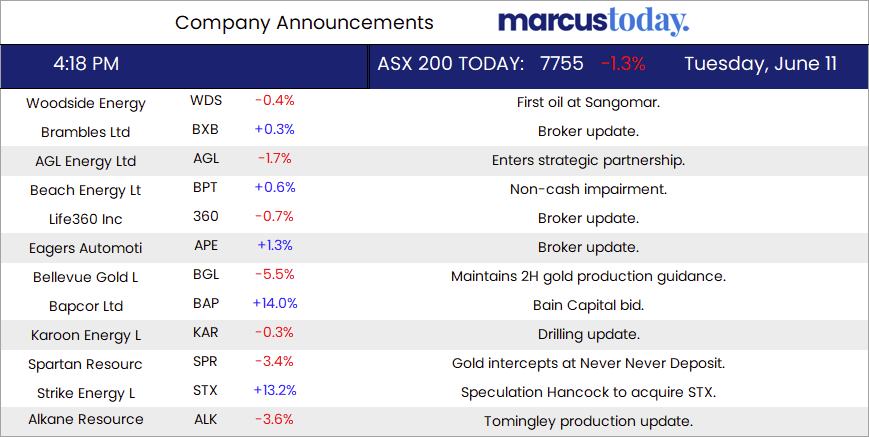

ASX 200 fell 105 points to 7753 (-1.3%) as banks pulled back from record highs and resources came under pressure on commodity price drops on US data. Iron slipping badly towards $100, BHP down 1.8%, RIO down 1.9%, and FMG off 3.2%. Base metal stocks were badly mauled, S32 off 5.2% and PLS falling 3.8%, with other lithium stocks similarly afflicted. Gold miners also whacked on bullion falls, NST down 5.1% and NEM off 3.3%, with EVN down 6.5% and DEG down 6.2%. Oil and gas stocks also fell, with WDS off 0.4% and STO down 0.8%. Uranium stocks fell hard, BOE down 5.3% with PDN sliding 5.5% and coal stocks also in trouble, WHC down 3.9%. Banks slid slightly, with the Big Bank Basket down to $215.40 (-0.7%). WBC and NAB down 1.0%, with MQG falling 1.2%. Insurers down too, with QBE off 1.2% and ASX falling 1.4%. REITs suffered as bond yields rose, 10Y yields hit 4.31%. GMG falling 1.6%, SGP down 2.6% and SCG off 2.8%. Industrials down too, TLS fell 1.1%, with WOW and COL off as utilities eased back. ORG down 2.6%, and APA falling 1.3%. Healthcare offered no harbour, CSL off 0.9%. Tech eased, with the All–Tech Index down 0.5%. In corporate news, BAP rose 14.0% on an approach from Bain Capital at 540c, AGL fell 1.7% spending $150m to take a 20% stake in Kalauza. Saint-Gobain got FIRB approval for CSR bid.On the economic front, business confidence fell back into negative territory in May. Asian markets mixed again, with China back from a holiday for Dragon Boat Festival down 1.9%, HK off 1.2%, and Japan down 0.2%. Dow Futures down 20 points. NASDAQ Futures down one point.

HIGHLIGHTS

- Winners: BAP, STX, ZIP, GNE, MSB, NXL

- Losers: CHN, EMR, WAF, GMD, RRL, RSG, CMM

- Positive sectors: Retail.

- Negative sectors: Everything else.

- ASX 200 Hi 7849 Lo 7735

- Big Bank Basket: Falls to $215.40 (-0.7%)

- All-Tech Index: Down 0.5%

- Gold: Lower at $3484

- Bitcoin: Falls to US$67718

- 10-year yields steady at 4.32%

- AUD: Falls to 66.00c.

- Asian markets lower, China down 1.2%, HK off 1.7% and Japan up 0.3%

- Dow futures down 20 NASDAQ Futures down 1

MAJOR MOVERS

- BAP +14.0% takeover offer from Bain Capital at 540c.

- STX +13.2% speculation on takeover by Hancock Prospecting.

- ZIP +7.5% changes to BNPL landscape.

- ATR +9.6% kicking back up.

- RAC +6.4% US FDA Orphan Drug designation awarded to RC220 Bisantree.

- WAF -9.1% GMD -8.8% RSG -7.7% Gold falls.

- EMR -9.7% broker downgrade.

- CHN -9.8% Gonneville met work and PFS update.

- LTM -6.1% Notice of AGM

- PEN -9.1% completion of retail offer and $106m equity raise.

- NTU -8.5% final director’s interest.

- BOC -5.9% copper bottom.

- Speculative Stock of the Day: Nothing today. LTP kicking a little after Friday’s move. Up 14.9%.

ECONOMIC AND OTHER HEADLINES

- Business confidence fell back into negative territory in May as conditions continued to gradually soften, suggesting the subdued economic activity seen in the Q1 GDP data has continued into Q2, a monthly National Australia Bank survey.

- Business confidence fell 4 points to -3 index points and business conditions eased 1 point to +6 index points overall, just below the long-run average.

- ANZ has revised its forecast for the RBA interest rate cut, now predicting the first cut to occur in February 2025 instead of November 2024. ANZ anticipates two subsequent cuts, with a probable follow-up easing in either April or May.

- Iron ore down to $105.35 in Singapore, Westpac strategists referred to China’s announcement last week that iron ore imports jumped 6% in May compared to a year earlier to 102m tonnes, marking a record for that month.

- Christine Lagarde says ECB can keep rates on hold as long as needed.

- Group behind Abba Voyage holds talks to resurrect digital Elvis.

- Tesla CEO Elon Musk threatened to ban Apple devices from his companies and expressed concerns about whether Apple and OpenAI will protect users’ information.

- European markets expected to open slightly higher.

- UK PM to announce new tax cut policies today.

And finally…..

Clarence

XXX