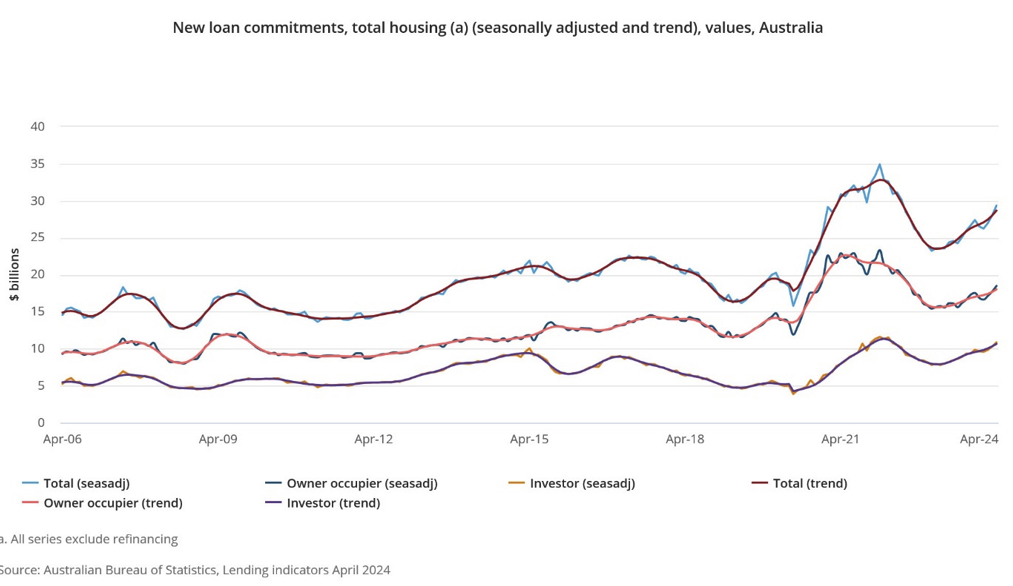

ASX 200 pushes another 53 points higher to 7822 (0.7%) with banks leading us ever higher. CBA hitting records up 1.1% as they started making Ai chips, the Big Bank Basket up to $215.88 (+1.0%). MQG also doing well with financial generally in the green, insurers up around 1.5% and REITs better on rate cut hopes and falling yields. Industrials too up, WES up 1.0% and WOW and COL up around 0.7%. TLS gained 0.6% and tech in demand. The All–Tech Index up 0.6% with WTC and XRO both doing well. Resources were a mixed bag, BHP quietly firm, RIO slipped 0.9% and FMG down 0.3%. Gold miners drew strength from the bullion price with NST up 1.3% and EVN up 2.1%. Lithium and base metals stocks mixed, PLS up 1.4% and MIN down 0.3%. Uranium stocks still sold off, PDN down 0.4% and NXG off 3.1%. In corporate news, IEL dropped 7.5% on an update following government moves to curb international students. SKC suspended its dividend in a trading update, MFG revealed some stability in FUM gaining 1.3%. On the economic front, we had building approvals and lending which showed room to move for the RBA perhaps. Meanwhile, Asian markets were better Japan up 0.7%, China down 0.2% and HK flat. 10-year yields down to 4.22%

HIGHLIGHTS

- Winners: LRS, CRN, NAN, SLR, CSC, RPL, GMD, ZIP, OBM

- Losers: SKC, IEL, DRO, WA1, MP1, MSB, A4N, LFG

- Positive sectors: Banks. Financials. Healthcare. Tech Industrials. Gold.

- Negative sectors: Nickel.

- ASX 200 Hi 7838 Lo 7778.

- Big Bank Basket: Rallies to $213.81 (+1.0%)

- All-Tech Index: Up 0.6%

- Gold: Higher at $3556

- Bitcoin: Steady at US$70942

- 10-year yields fall to 4.22% on GDP.

- AUD: Steady at 66.59c.

- Asian markets mixed Japan up 0.7%, China down 0.2% and HK flat.

- Dow futures down 19 NASDAQ Futures up 10

MAJOR MOVERS

- LRS +6.5% nice bounce.

- ZIP +4.8% rally continues on BNPL changes.

- GMD +4.9% bullion price rise.

- CSC +5.6% copper buyers.

- IPX +4.5% change in substantial shareholding.

- CRN +6.5% AGM presentation.

- BRE +10.7% high grade RE grades at Sulista project.

- DXB +10.2% powering ahead.

- AVH +3.7% US bounce follow through.

- NTU +7.1% first strike.

- SKC -13.7% trading update.

- IEL -7.5% trading update.

- DRO -4.1% large block trades at 135c.

- CXO -16.0% continues to fall.

- AGY -8.3% lithium remains depressed.

- MP1 -3.8% initial director’s interest.

- NXG -3.1% uranium under pressure.

- MSB -3.8% slipping lower.

- Speculative Stock of the Day: FTL +150% acquisition of copper project in Newfoundland.

COMPANIES

.png)

ECONOMIC AND OTHER HEADLINES

Building Approvals -The April 2024 seasonally adjusted estimate:

- ECB – D- Day Today. Cut expected.

- Fund managers give cool reception to prospect of Shein London IPO.

- ‘Most exciting moment’ since birth of WiFi: chipmakers hail arrival of AI PCs.

- European markets opening slightly higher.

And finally….

Have you ever seen me tie my shoes with the power of my mind?

I thought knot…

Clarence

XXXX