Tags

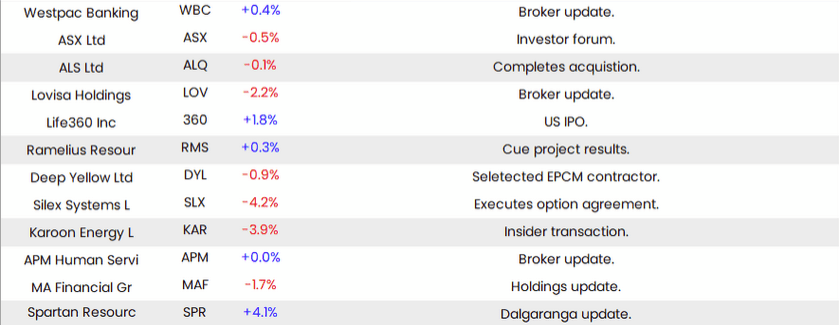

ASX 200 slips 24points to 7737 (+0.3%) in lacklustre trade. Banks held up after good gains yesterday, the Big Bank Basket at $212.35 (+0.6%). Insurers slipped back, and MQG went nowhere. REITs mostly weaker, GMG up 0.6% with others softer, SCG off 1.3% and GPT down 0.9%. Healthcare mixed CSL with a slight gain, SHL down 0.5% again. Industrials were flat, TLS up 0.3% and BXB down 1.2%. QAN rebounded 1.2% with retail still struggling. LOV down 2.2% on broker revisions. HVN off 0.7%. Resources were weaker with the exception of the gold miners, making up some lost ground from yesterday, NST up 1.0% and PRU up 3.0%. Iron ore stocks fell again, BHP down 1.2% as were RIO and FMG off 0.8% and 1.9% respectively. Lithium and uranium stocks fell, PLS down 1.8% and PDN off 1.5%. Oil and gas stocks smacked down on OPEC + news, WDS off 1.8% and BPT off 2.4%. In corporate news, 360 launched an IPO in the US. COE affirmed guidance, and John Borghetti was appointed chair of Crown On the economic front, the Balance of Payments came in a little undercooked. Asian markets mixed again, Japan down 0.4%, China flat, and HK up 0.5%. 10-year yields 4.31%. Dow Futures down 14 points. NASDAQ Futures down 6 points.

HIGHLIGHTS

- Winners: RPL, GMC, SGR, SPR, SMR, DRO, RHC

- Losers: CCP, LOT, ZIP, NEU, PNV, WC8, OML

- Positive sectors: Banks. Gold miners.

- Negative sectors: Oil and gas. Iron ore. Industrials. Tech,

- ASX 200 Hi 7768 Lo 7737 Narrow range. Iron ore futures down 0.9% in Singapore.

- Big Bank Basket: Rallies to $212.35 (+0.7%)

- All-Tech Index: Down 0.9%

- Gold: Higher at $3522

- Bitcoin: Steady at US$69,007

- 10-year yields steady at 4.31%

- AUD: Up to 66.70c.

- Asian markets mixed again, Japan down 0.2%, China up 0.6% and HK up 0.5%.

- Dow futures down 14 NASDAQ Futures down 6

MAJOR MOVERS

ECONOMIC AND OTHER HEADLINES

- The debut of Treasury’s green bond was met with a warm reception from fixed-income investors, receiving over $22bn in bids.

- Australia recorded an unexpected current account deficit of $4.9bn in Q1 2024, contrasting with a downwardly revised surplus of $2.7bn in Q4 2023 and missing market expectations of a $5.9bn surplus. This shift was attributed to a decrease in the trade surplus and an increase in the net primary income deficit.

.png)

- Australia’s corporate profits fell 2.5% QonQ in Q1 2024, surpassing market expectations of a 0.9% decline. This marked a reversal from the previous quarter’s 7.1% growth, which had been revised downward.

- Modi-led BJP’s lead narrows in official count versus exit polls.The Nifty 50 index was down 5.0% while BSE Sensex fell 1.5%, after the main stocks gauges in India hit record highs on Monday.

- UAE seeks ‘marriage’ with US over artificial intelligence deals.

- Hedge fund short sellers burnt by flurry of UK takeover bids.

- Google cuts at least 100 jobs across fast-growing cloud unit, sources say

- GameStop shares leap after Roaring Kitty claims large stake.

- NYSE cancels erroneous trades of Berkshire and other stocks after glitch.

And finally….

Clarence

XXXX