Tags

ASX 200 closed down 23 points at 7727 (0.3%). Sloppy quiet markets across the board with banks down modestly. The Big Bank Basket unchanged at $207.93. ANZ fell 0.7% with MQG falling 0.1% and insurers down on lower yields, QBE off 1.3% and SUN off 1.3%. REITs dropped led by GMG down 0.8 % with SCG off 1.0% with VCX falling 0.8%. Industrials weaker but no real damage, TCL down 1.8% with COL off 1.2% and SVW down 3.1% as it increased its BLD shareholding to close to 92%. ALX saw IFM lift its holding to 26%. Tech stocks eased with the All–Tech Index down 0.5%. Resources slipped with BHP off 0.2% as Anglo knocked back the latest approach, FMG down 0.9% with gold miners weaker, NST off 1.2%. Oil and gas stocks lower and uranium shares easing back. In corporate news, GUD rose 12.2% on a late trading update yesterday. HLS up 4.7% on refinancing news and a lower debt facility. On the economic front, not much here ahead of the well-leaked budget. Asian markets slightly lower with Japan up 0.1%, HK and China pretty much unchanged.

HIGHLIGHTS

- Winners: GUD, AWC, CHN, NEU, HLS, MAH, STX, SLX

- Losers: MYX, QAL, FBU, HDN, URW, FPR

- Positive sectors: Retailers. Healthcare.

- Negative sectors: Insurers. REITs. Oil and gas.

- ASX 200 Hi 7746 Lo 7715

- Big Bank Basket: Unchanged at $207.93

- All-Tech Index: Down 0.5%

- Gold: Steady at $3551

- Bitcoin: Rises to US$62467

- 10-year yields steady at 4.33%.

- AUD: Steady at 65.99c.

- Asian markets benign, Japan up 0.2%, China down 0.3% and HK down 0.1%.

- Dow futures up 3 NASDAQ Futures down 15. PPI tonight.

- European markets opening slightly lower.

MAJOR MOVERS

- GUD +12.2% trading update.

- NEU +6.0% broker upgrade.

- CHN +6.6% the brew that is true!

- OBM +3.2% presentation in London.

- AWC +6.9% follows Alcoa higher.

- BCB +14.6% blast from the past.

- A1M +10.5% copper stock.

- SYA +12.2% good volume bounce.

- AVH +9.0% earnings slides.

- MYX -5.8% trading update.

- FBU -4.2% broker downgrades.

- BMN -2.7% uranium slips.

- SVW -3.1% moves to 92% of BLD.

- M4M -18.6% reversal from gains yesterday.

- FWD -11.1% RV issues.

- PPS -3.2% Buyback notice.

- MEI -4.8% 150% increase in Soberbo Mining Licence resource.

- Speculative Stock of the Day: Nothing on any volume.

COMPANIES

.png)

ECONOMIC AND OTHER HEADLINES

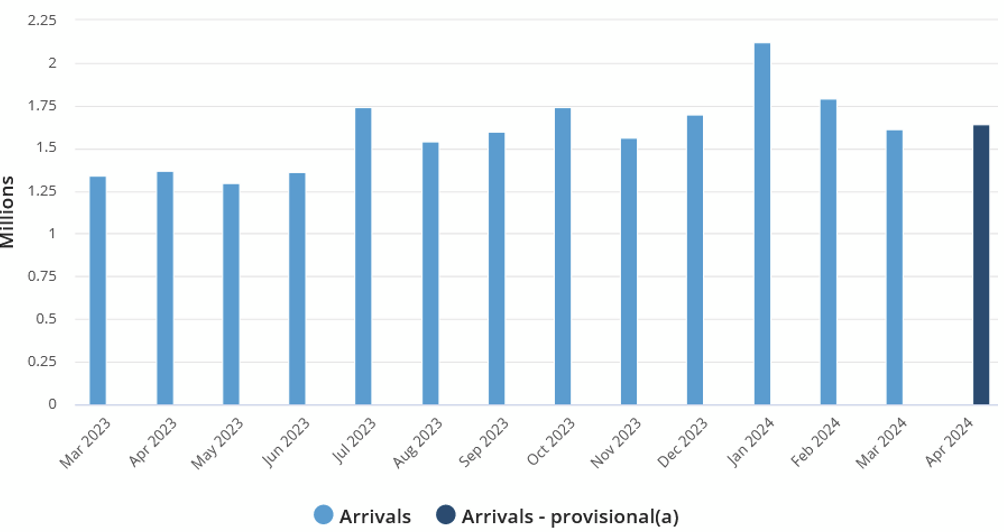

- Short-term visitor arrivals: 761,050 – an increase of 24.1% on one year earlier. Total arrivals: 1,614,830 – an increase of 20.1% on one year earlier.

- Japan’s 20-year government bond yield rose to its highest level since 2013.

- Iron ore fell after a major Chinese developer defaulted, the latest sign the debt crisis facing the nation’s steel-intensive property sector is far from over.

- Chinese car executive calls West’s claim of overcapacity a ‘fake concept’.

- Stellantis in talks with Vale to invest in Indonesian nickel smelter.

- OpenAI rolls out AI updates to GPT-4 as it seeks to get ahead of Google.

- UK jobless numbers in line. Average wage earnings above expectations.

- US PPI tonight.

And finally…..

Clarence

XXXXX