Tags

ASX 200 finished slightly higher by 7 points to 7666 (0.1%) in a quiet day. Results once again dominated as US market closed tonight for Presidents’ Day. Resources were the steadying influence today on hopes of Chinese stimulus and better economic news post the LNY. BHP up 0.9%, RIO up 1.6% and FMG flat. Selected lithium stocks showed promise; PLS dropped 2.4% after a volatile session, LTR up 7.2%, S32 gained 2.1%, and MIN up 0.6%, IGO fell 3.2% despite nickel moves, gold miners eased back slightly and oil and gas stocks drifted lower. Banks were firm as WBC results cheered, positive comments from CEO helping, CBA up 0.7% and the Big Bank Basket up to $204.04 (0.8%). MQG eased back again as fund managers and ASX fell. REITs also in the doghouse as bond yields rose again, 4.18%. GMG dropped 1.9% and VCX off 1.0%. Healthcare too fell as CSL slid 1.1% and RMD down 0.9%. Tech also slid with XRO down 2.3% and the All-Tech Index down 0.4%. TLS found some friends up 1.0% and industrials were flat.. WES a standout again up 1.7%. In corporate news. APM revealed a private equity approach, A2M surged higher after a solid first half, BLD saw a bid by SVW to tidy things up, NXL and LLC disappointed, RWC couldn’t make up its mind post results finishing up 6.6% and BSL announced plans to take Colorbond to US. Asian market back online, but China struggled to find a footing up only 0.7%, HK fell 1.0% and Japan up 0.5%. US markets closed for President’s Day.

HIGHLIGHTS

- Winners: APM, IMD, SYA, A2M, GWA, LTR, RWC, CUV

- Losers: LLC, NXL, IPX, NHC, ORA, ING, RED

- Positive sectors: Banks. Insurers. Defensives. Iron ore.

- Negative sectors: REITs, Healthcare, Tech, Supermarkets.

- ASX 200 Hi7683 Lo 7653

- Iron ore falls 3% in Singapore.

- Big Bank Basket: Rallies to $204.04 (0.8%)

- All-Tech Index: Down 0.4%.

- Gold: Higher at $3087

- Bitcoin: Steady at US$52137

- 10-year rises to 4.17%.

- AUD: higher at 65.38c

- Asian markets: Japan up 0.5% China up 0.7% HK down 1.0%.

- Dow Futures up 19 Nasdaq up 32

MAJOR MOVERS

- APM +47.6% takeover approach from CVC.

- IMD +17.5% results. Glorious mud.

- SYA +16.4% rally kicks on.

- A2M +12.5% cream rises.

- RWC +6.6% flushed with success.

- LTR +7.2% Gina talk?

- 29M +43.2% oversold and copper rally.

- LKE +12.5% lithium is back.

- OPT +7.7% pushing up again.

- ORA -6.6% HY24 results weaker than expected.

- LLC -14.0% results hurt.

- NHC -7.9% soft coal prices.

- ING -5.0% broker comments. GPT -% nasty numbers.

- NXL -11.6% legal bills mount.

- STK -9.1% new mineralised structure at Duck til Dawn.

- HZR -9.9% capital raising $9m and SPP to come

- Speculative Stock of the Day: Way 2 VAT (W2V) +33.3% Launch of world’s first AI auditing product.

.png)

.png)

ECONOMIC AND OTHER HEADLINES

.png)

- Star faces a second Sydney casino inquiry.

- Australia’s barley sales to China have soared since Beijing scrapped tariffs six months ago.

.png)

- Fortescue chair slams Germany for U-turn on EU supply chain rules.

- Chinese Premier Li Qiang called for “pragmatic and forceful” action to boost the nation’s confidence in the economy.

- Goldman Sachs strategists have boosted their forecast for a second time in a few months as the stock market eclipsed the significant 5,000 milestone this month. It now sees the S&P 500 rising to 5,200 by the end of this year.

.png)

- Oppenheimer blitzes 2024 Bafta Film Awards with seven wins.

- Biden pins blame for Russian battlefield victory on Congress inaction.

- Natural gas prices plunge as US set for warmest winter on record.

- European leaders appeal for more support for Ukraine after recent Russian wins.

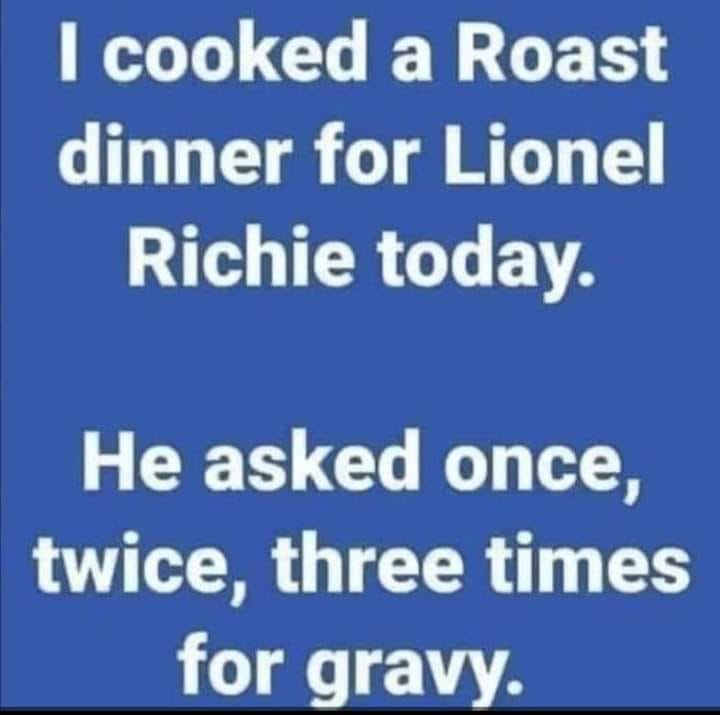

And finally…..

A priest, a minister and a Rabbit walk together into the blood donation centre.

The nurse asks “What’s your blood type?”

The Rabbit says “I’m probably a Type O”.

Clarence

XXXX