Tags

The ASX 200 falls another 44 points to 7582 (-0.6%). Off the lows and relatively unchanged post the RBA decision to keep rates unchanged and a surprising bias to the upside on rates. Growth forecasts were downgraded slightly. Once again banks were steady despite flashing overbought levels, CBA down 1.0%. The Big Bank Basket $198.15 (-0.5%), MQG dropped 1.0%, with GQG pushing ahead up 2.9% on Indian exposure. MFG up 1.3% on FUM numbers. REITs under a little pressure as bond yields rose, GMG down 1.3% and GPT off 2.0%. Tech slipped as the All–Tech Index fell 0.9%, with WTC down 3.9% and XRO off 2.8%. Industrials holding firm, healthcare mixed with COH down 6.9% on a broker downgrade, CSL up 0.6% and RMD off 0.8%. Resources once again led the falls, iron ore falling again, BHP down 1.0% with RIO off 0.6% and FMG slipping 2.9%. Lithium stocks once again smashed, PLS off 1.5% and MIN down 1.7%. Gold miners are under a little pressure, NST off 0.8% and NEM down 1.2%. Oil and gas unchanged, coal stocks are a little weak on falling coal prices. In corporate news, MYR ran hard on slightly better numbers, up 14.3%, and NCK had a great day, up 16.6% on better-than-expected numbers, beating guidance. On the economic front, retail sales a little underwhelming, with the RBA adopting a slightly hawkish bias. Asian markets seeing some signs of recovery with Chinese moves to bolster the market. HK up 3.3%, and China up 1.9%. India Nifty 50 up 0.2%. 10Y yields up to 4.155%. Dow Futures up 1 point. NASDAQ Futures up 47 points. European markets expected to open slightly higher. UBS results in focus.

HIGHLIGHTS

- Winners: NCK, MYR, IMU, NXL, ZIP, SLX, KGN

- Losers: WAF, COH, A4N, LTM, CIA, MAD, RED

- Positive sectors: Oil and gas.

- Negative sectors: Banks. Iron ore. Lithium. Tech.

- ASX 200 Hi 7614 Lo 7542

- Big Bank Basket: Slips slightly to $198.15

- All-Tech Index: Down 0.9%

- Gold: Unchanged at $3112

- Bitcoin: Settles a little lower at US$42821

- 10-year up to 4.13%

- AUD: Higher at 65.11c post RBA on hold.

- Asian markets: Japan down 0.6%, HK up 2.1%, China up 1.8%

- Dow Futures up 1 Nasdaq up 47

MAJOR MOVERS

- NCK +16.6% beats expectations.

- MYR +14.3% positive trading update.

- MFG +1.3% FUM.

- BRN +21.2% chip stocks heading higher.

- SYR +8.4% change in substantial holding.

- WAF -10.6% higher AISC at US$1300oz.

- COH -6.9% broker downgrade.

- LTM -5.2% what a start to life. Collapsed.

- CIA -4.4% iron ore falls.

- RED -4.4% merger with SLR weighs.

- A4N -6.6% falls continue.

- CXL -9.1% fall continues.

- AGY -9.5% lithium stocks under pressure.

- 4DS -9.2% profit taking.

- WTC -3.9% tech sell off.

- Speculative Stock of the Day: JAN +47% on a $45m contract with NSW DoE.

COMPANY NEWS

.png)

ECONOMIC AND OTHER HEADLINE

RBA keeps rates unchanged. Job not done yet.

.png)

- Australian retail sales volumes rose 0.3% (seasonally adjusted) in December quarter 2023. This follows a revised fall of 0.1% in September quarter 2023 and a fall of 1.1% in June quarter 2023.

- UBS numbers out this morning.

- The oil market will face a supply shortage by the end of 2025 because the world is not replacing crude reserves fast enough, Occidental CEO Vicki Hollub said.

- Palantir reported fourth-quarter earnings after the bell Monday. Revenue for the quarter increased 20% year over year to $608.4m.

- Beijing rolled out more measures to stem a stock rout, such as tightening trading restrictions. On both domestic and offshore funds.

- China Sovereign Fund says it will buy more ETFs.

- Red Bull Racing’s Christian Horner faces an internal probe.

- The Kremlin declined to say whether or not Putin would grant an interview to Tucker Carlson, former Fox host.

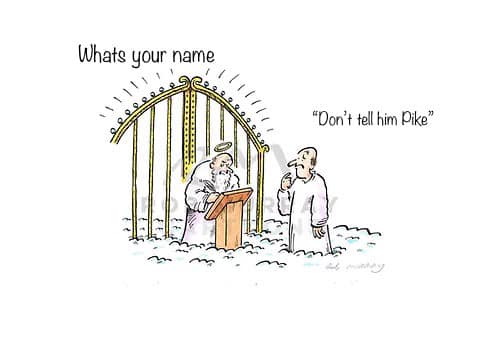

- Vale: Ian Lavender, the last of the Dad’s Army cast dies.

And finally…..

Clarence

XXXXX