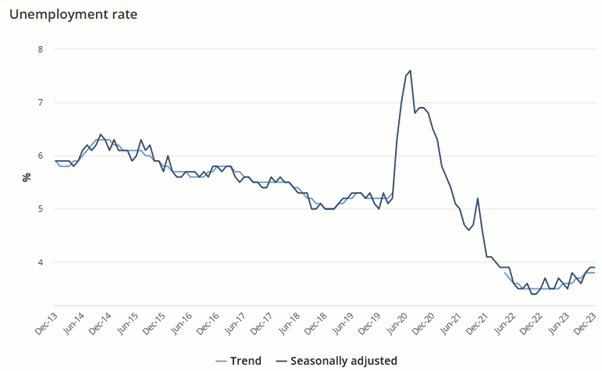

ASX 200 fell for the fifth day down around 47 points to 7347 (0.6%). Losses across the board with local jobs data showing a slow down with the headline steady at 3.9%. Seasonal factors may be a issue. Banks held steady on jobs number. The Big Bank Basket pretty much unchanged. Insurers better on higher yields, MQG down 0.7%. REITs falling fast, GMG down 1.6%, SCG off 2.4% and SGP down 3.9%. Industrials falling away, REA down 2.5%, WOW off 0.3%, TLS falling 0.5% and tech sliding too. WTC off 0.4% and XRO down 0.4%. The All-Tech Index down 0.4%. Healthcare slid, CSL down 1.1% and RMD down 1.1%. Resources back on the nose again, BHP production numbers solid but nickel an issue, off 1.8%. FMG up 1.0% and lithium stocks heavy, PLS down 2.0% and LTR falling 10.7% as Albemarle threw in the towel. Gold miners were mixed after the Red Wedding yesterday, EVN managed a small rise of 0.3%, uranium stocks seeing some profit taking. In corporate news, EML bounced 22.2% on Irish news of TSCIL withdrawal. APM was thumped 40.8% on a profit warning. In economic news, Jobs data dominated, whilst in Asian, Japan was up 0.3%, HK up 0.6% and China down another 0.6%. 10-year yields at 4.26%.

HIGHLIGHTS

- Winners: CTT, CU6, ZIP, PRN, MGX, NXL

- Losers: APM, LTR, WC8, LRS, CRN, CMW

- Positive sectors: Banks. Insurers. Gaming stocks.Retailers.

- Negative sectors: REITs. Healthcare. Oil and gas. Lithium. Tech. Staples.

- ASX 200 Hi 7372 Lo 7322. Jobs data helps.

- Big Bank Basket: Higher at $192.01 (0.1%)

- All-Tech Index: Down 0.4%.

- Gold: Eases to $3062

- Bitcoin: Settles higher at US$42639.

- 10-year yields higher at 4.26%

- AUD: Easier at 65.58c

- Asian markets: Japan was up 0.3%, HK up 0.6% and China down another 0.6%. 10

- Dow Futures down 81 Nasdaq down 62

MAJOR MOVERS

- CTT +6.6% US consumers still spending.

- MGX +3.9% solid quarter. Plenty of cash.

- PRN +3.9% contract extensions.

- BLX +2.2% switched on but no volume.

- EML +22.2% PCSIL Business exit.

- ART +9.3% kicking again.

- ZIP +4,6% US retail sales helping?

- APM -40.8% earnings downgrade.

- LTR -10.7% Albemarle crashing out of holding.

- WC8 -9.4% another life lost.

- IGO -4.4% continues lower, nickel issues.

- LRS -6.4% no Samba here.

- NMT -8.3% battery tech on the nose.

- Speculative Stock of the Day: Woomera Mining (WML) –+28.6% Blast from the past. Completion of RC Drilling program at Ravensthorpe.

COMPANY NEWS

ECONOMIC AND OTHER HEADLINES

- Jobs data as forecast but full-time employment decreased by 106,600. Part-time employment increased by 41,400 – Showing a slowdown in the local economy perhaps.

- CommSec also noted that China’s crude steel output was 67.44m tonnes in December 2023, 14.9% lower on the year, and the weakest monthly showing since December 2017.

- Singapore’s Transport Minister S. Iswaran resigned after being charged with corruption.

- China shares languished near five-year lows hit in the previous session.

- Increased government borrowing and central bank efforts to reduce balance sheets will boost debt yields, according to Goldman Sachs Group.

- Sheryl Sandberg to leave Meta’s board of directors.

- Samsung turns to AI to revive stagnant smartphone market.

- Sunak secures Commons approval for Rwanda bill as rebel MPs back down.

- JPMorgan Chase CEO Jamie Dimon said he remains cautious on the U.S. economy over the next two years because of a combination of financial and geopolitical risks.

- Goldman Sachs CEO David Solomon added that he was concerned about soaring U.S. debt levels.

And finally….

I asked my dad for advice.

He said “Never make snow angels in a dog park”

Clarence

XXXX