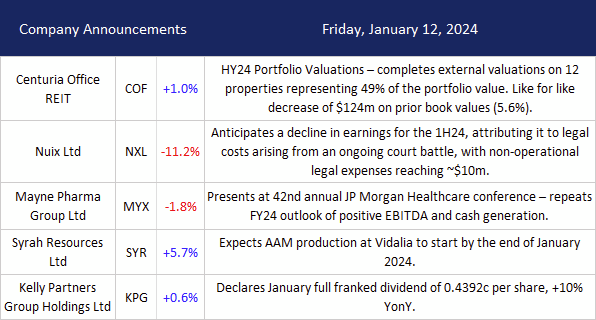

ASX 200 limped into the weekend down 8 points to 7498 to finish the week relatively unchanged. Quiet volumes again. US PPI and Chinese CPI in focus. Banks sagged with the Big Bank Basket down to $193.63(-0.1%). NAB down 0.2% and ANZ falling 0.6%. MQG slid 0.2% with insurers a little better, SUN up 0.8%. REITS mixed with GMG down 0.3% and SGP up 1.1%. In the industries, supermarkets are under pressure as the government pushes for price cutting. The rest of the industrials also drifting lower, TLS off 0.3% and BXB down 0.9% with tech under a little pressure, XRO off 0.8% and utilities falling too. ORG down 0.7% (Ex-Div)and APA down 1.9%. In resources, the ‘Three Amigos’ were a little mixed, FMG up 1.2% with BHP down 0.2%. Lithium stocks mixed, PLS down 1.1% and MIN off 1.4%. Gold miners were slightly higher, and oil and gas stocks better as the UK and US launched an attack against the Houthis in Yemen. Crude rallying around 2%. Uranium stocks on a charge as the price hit a fresh post Fukushima high. In corporate news, NXL warned of higher legal fees falling 12.9%, HLS fell 7.6% after a broker downgrade by Morgan Stanley. SYR rallied 1.9% as cold weather hit Louisiana. There was nothing locally on the economic front; Chinese CPI fell 0.3%, and PPI fell 2.7%. In Asian markets, Japan up 1.1%, China down 0.2% and HK unchanged. 10-year yields, 4.07%.

HIGHLIGHTS

- Winners: DYL, BOE, BGL, NEU, TLX. LOT

- Losers: NXL, ZIP, HLS, RED, SGT, CXL, MGH

- Positive sectors: Oil and gas. Uranium. Gold miners. Insurers.

- Negative sectors: Banks. Supermarkets. Healthcare.

- ASX 200 Hi 7504 Lo 7474

- Big Bank Basket: Easier at $193.63 (0.1%)

- All-Tech Index: Unchanged.

- Gold: Better at $3034

- Bitcoin: Settles lower at US$46035

- 10-year yields higher at 4.07%

- AUD: Easier at 67.01c

- Asian markets: Japan up 1.1%, China down 0.2% and HK unchanged.

- US futures: Dow down 30 Nasdaq down 17

MAJOR MOVERS

- DYL +7.6% BOE +5.0% uranium stocks glowing.

- NEU +4.3% kicking higher yet again.

- LOT +3.2% bounces back.

- PEN +9.4% SPP until 24th January.

- VIT +12.2% starting to move.

- CXO +7.7% broker research.

- ART +8.7% for art’s sake. Not great volume.

- WR1 +4.6% a winsome day.

- IOD +14.6% no news but flying, retracing recent sell off.

- ZIP -8.2% feeling the heat.

- CXL -4.6% falls again.

- RED -5.0% broker upgrade.

- SGR -4.6% falling to Earth.

- NXL -12.9% court costs.

- FLC -8.3% unwinds bounce.

- SHJ -6.9% gloss rubs off.

- Speculative Stock of the Day: Nothing on any volume.

COMPANY NEWS

ECONOMIC AND OTHER HEADLINES

- Taiwan election tomorrow.

- Chinese CPI fell 0.3% last month. Third straight month. PPI which measures factory-gate prices, fell 2.7% on-year. Economists forecast a 2.6% decline.

- Core inflation, which strips out volatile food and energy prices, was 0.6% in December.

- Chinese exports posted the first full-year decline since 2016 as global demand faltered. China’s exports in dollar terms rose 2.3% from a year earlier while imports expanded 0.2%.

- Full-year imports fell 5.5%, leaving a surplus of $823bn for the year.

- Exports to the US decreased 6.9% in December from a year ago, while shipments to the EU fell 1.9%.

- US PPI tonight.

- Houthis attacked by US and UK. Oil rallying.

- Nippon Steels’ takeover of United States Steel is unlikely to conclude until late this year and may extend into 2025. Argentina’s inflation hits 200%.

- Chesapeake and Southwestern to create US gas titan with $7.4bn deal.

- In the US, for the period from October 2023 through December 2023, the budget deficit totaled just shy of $510bn, following a shortfall of $129.4bn in December alone.

- If the current pace continues, 2024 would end with a deficit of just more than US$2 trillion.

And finally…..

I’ve just finished reading a book about the world’s greatest basement … It was a best cellar.

It’s my first week working at the bicycle factory and they already made me a spokesperson.

Horses have lower divorce rates. It’s because they are in stable relationships.

My laptop caught pneumonia, apparently because I left Windows open.

I thought swimming with dolphins was expensive until I went swimming with sharks … It cost me an arm and a leg.

The main function of your little toe is to make sure all the furniture in the house is in the right place.

It’s pretty obvious that if I run in front of a car I will get tired but if I run behind a car I will get exhausted.

My teachers told me I’d never amount to much because I procrastinate so much. I told them you just wait.

90% of bald people still own a comb; they just can’t part with it.

Every morning I get hit by the same bicycle … It’s a vicious cycle.

I’ve been experimenting with breeding racing deer. People have accused me of just trying to make a fast buck.

What do you call a row of rabbits hopping backwards? A receding hare line.

When I was a kid, we played spin the bottle with the girls, if they didn’t want to kiss you, they would have to give you a dollar. By the

time I was 12, I owned my own home.

Always trust a nudist … They have nothing to hide.

Clarence

XXXXX