Happy New Year….I am back…did you miss me?

The ASX 200 bounced back strongly from the slide yesterday closing up 38 points to 7506 (0.5%). All systems go and Asian markets helping too as Japan hit 35k. Quiet trade again though. Banks were once again leading the charge, the Big Bank Basket hit $193.87 with CBA up 1.4% and WBC up 1.2%. MQG also did very well up 1.5%. Insurers flat but REITs once again pushing ahead, SCG up 0.7% and VCX up 1.0% with consumer stocks finding plenty of more friends, JBH up 3.8% and DMP up 0.6% with HVN rallying another 1.0%. Tech better, WTC up 1.0% and XRO up 0.8% with the All–Tech Index up 1.1%. Telcos better too as TLS rose 0.5% with CAR up 2.3%. In resources, Iron ore miners tried to stabilise although FMG suffered falling 1.9%. Lithium stocks bounced, PLS up 2.4% and IGO up 2.3%. S32 had a great day, up 5.0%. Gold miners slightly better, oil and gas a nothing burger. Coal stocks slid, WHC down 2.1%. In corporate news, WOR dropped 2% on Ecuador issues, PNI rose 1.2% on an investment update. Nothing on the economic front, US CPI tonight. Asian markets saw gains again, Japan up 1.9%, HK up 1.5% and China up 0.3%. 10-year yields 4.11%.

HIGHLIGHTS

- Winners: FCL, SLX, S32, ILU, CU6, TLX

- Losers: LOT, IFL, IFM, WA1, MEI, MYX

- Positive sectors: Banks. Financials. REITs. Telcos. Tech. Consumer stocks.

- Negative sectors: Oil and gas.

- ASX 200 Hi 7517 Lo 7467 Quiet. Too quiet.

- Big Bank Basket: Better at $193.87 (1.2%)

- All-Tech Index: Up around 1.1%

- Gold: Steady at $3022

- Bitcoin: Better at US$46474

- 10-year steady at 4.11%

- AUD: Steady at 67.21c

- Asian markets: Japan up 1.9% (new recent highs), HK up 1.5% and China up 0.3%.

- US futures: Dow up 50. Nasdaq up 52.

MAJOR MOVERS

- SLX +6.5% on the move on US nuclear push.

- LRS +2.3% not quite dead yet.

- JBH +3.8% extraordinary given slowing economy.

- AVH +12.6% exclusive distribution agreement.

- PCL +21.1% decent volume move.

- WOR -2.0% Denials of Ecuador issues falls on deaf ears.

- LOT -4.6% rally unravels.

- 29M -12.1% ASX Please explain.

- WR1 -10.6% lose some today.

- HGO -9.0% commences bulk mining from underground yesterday.

- Speculative Stock of the Day: CZR +42.9% – Sells Robe Mesa Iron Ore project for $102m.

COMPANY NEWS

.png)

ECONOMIC AND OTHER HEADLINES

- US CPI tonight. It is projected to have risen 0.2% in the final month of 2023, or 3.2% for the full year.

- Japan led the advance in Asia markets, extending its record-breaking rally. Holding above the 35,000 mark for the first time since February 1990.

- The Bank of Korea left its main lending rate unchanged at 3.50% for the eighth time in a row.

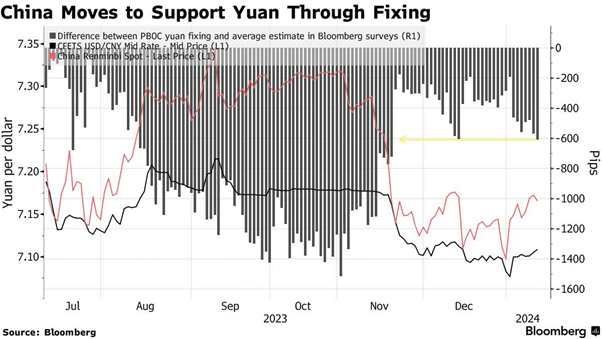

- China’s central bank pushed back against recent yuan weakness by setting its daily reference rate for the managed currency at the widest gap to estimates since November.

- Thailand has proposed a new legislation that would outlaw the use of cannabis except for medical and health-related purposes.

- China will ease some visa requirements to make it easier for foreigners to travel for business, education and tourism.

- Chris Christie drops out of race to be President.

- Italy links Ukraine aid to ‘negotiated settlement’ efforts.

And finally….

Clarence

XXXX