ASX 200 lost 16 points to 7426 (0.2%) in lacklustre trade dominated by M&A activity in LNK, ABC and PSQ. Monday M&A day ahead of Xmas break. Banks drifted lower with the Big Bank Basket unchanged at $188.20. Insurers suffered as yields fell again, QBE down 0.6% and SUN off 1.8%. Fund managers lower with REITs under pressure, GMG up 0.1% and VCX down 2.4%. Industrials weaker, TLS off 0.9% with staples easing, WES down 0.5% and WOW down 0.7%. Tech held up on lower rates, WTC up 0.1% with the All–Tech Index up 0.2%. Resources mixed, PLS up 1.3% and AKE running 1.7% higher ahead of the vote this week, Iron ore miners mixed, Oil and gas faltered, WDS down 0.3% and STO falling 1.6%. Gold miners flat and coal mixed. In corporate news, LNK had a bid from Mitsubishi, up 27.0%, ABC saw the Barro Group bid 320c in cash, up 31.3% and PSQ also saw a NBIO rally 18.0%. ZIP fell 2.4% on a funding package. TAH up 23.1% after saying it would keep its Victorian wagering and betting business. SGP fell 3.6% after announcing a deal to buy 12 LLC communities. Nothing substantive on the economic front. Asian markets weaker, Japan down 0.9% China down 0.2% and HK off 1%%. 10-year yields fell again to 4.07%.

HIGHLIGHTS

- Winners: ABC, NEU, LNK, TAH, CXO, JDO, MRM

- Losers: AD8, PXA, ADT, ASB, KGN, CMW

- Positive sectors: Lithium.

- Negative sectors: REITs. Staples. Insurers. Oil and gas.

- ASX 200 Hi 7444 Lo 7406

- Big Bank Basket: Unchanged at $188.20

- All-Tech Index: Up 0.2%

- Gold: Eases to $3012

- Bitcoin: Softer at US$41057

- 10-year yields lower at 4.07%

- AUD: Steady at 67.14c

- Asian markets weaker, Japan down 0.9% China down 0.2% and HK off 1%%.

- US futures: Dow futures and Nasdaq futures up slightly…

MAJOR MOVERS

- ABC +31.3% Barro family bids.

- NEU +29.5% positive trial results.

- LNK +27.1% bid from Mitsubishi at 210c.Pls 16c in dividend.

- TAH +23.1%’wins’ Victorian licence.

- RIC +4.3% agreement to acquire Oceania Meat.

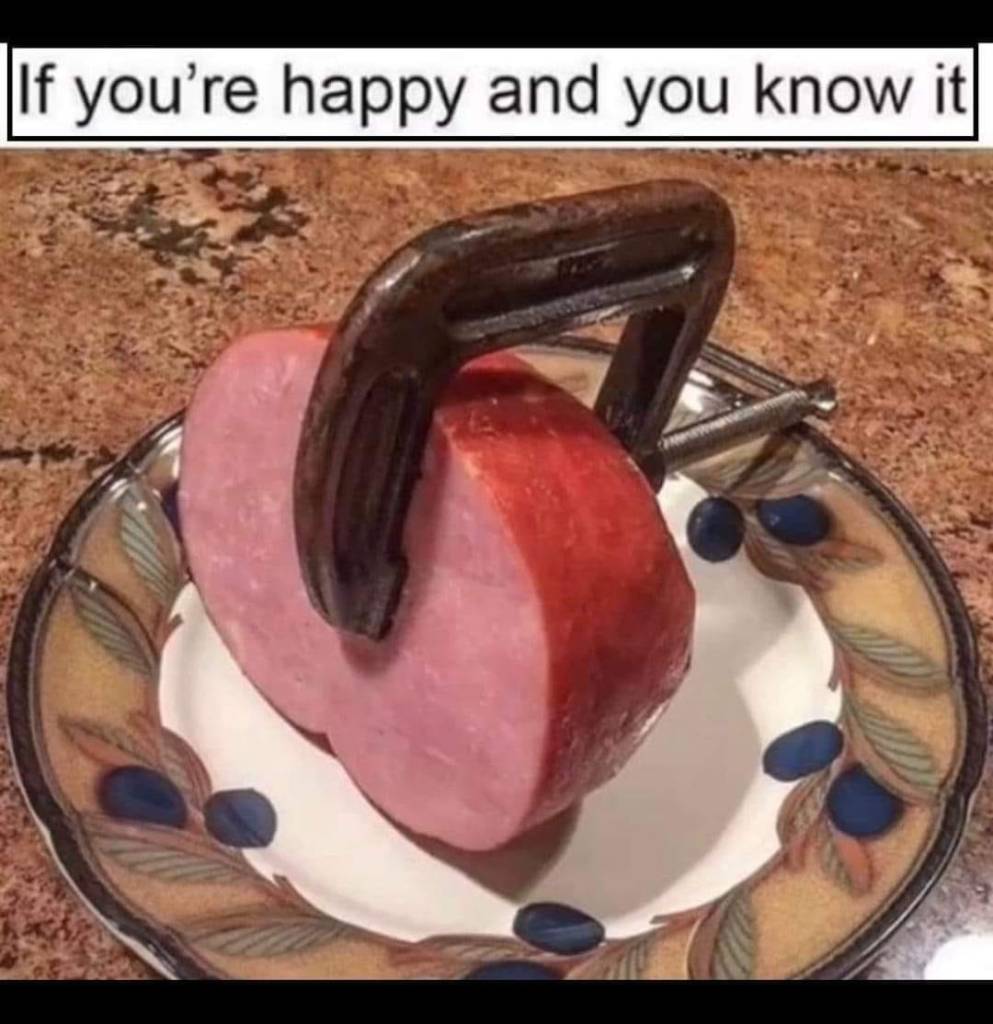

- PSQ +18.00% smile you have a bid.

- AZL +15.4% oversubscribed placement at premium.

- VGL +14.6% cloud adoption and industry update.

- AD8 -4.5% profit taking.

- KGN -3.7% no news.

- ZIP -2.4% funding package.

- ABB -3.3% sellers take upper hand.

- STK -47.5% ‘excellent’ drill results.

- 4DS -8.6% slipping.

- Speculative Stock of the Day: Nothing on any volume. Bid stocks excepted.

COMPANY NEWS

.png)

ECONOMIC AND OTHER HEADLINES

- The Bank of New Zealand-BusinessNZ Performance of Services Index (PSI) was at 51.2 in November, up 2 points from October, but below the survey’s long-term average of 53.5.

- The BOJ is in the midst of its last monetary policy meeting of 2023, with its decision due Tuesday. A majority of forecasters expect the central bank will end the world’s last negative rate regime by April, according to a Bloomberg survey.

- China will release its loan prime rates on Wednesday, while inflation data from Japan is due Friday.

- North Korea fired what appeared to be a long-range ballistic missile on Monday,

- German far-right party makes fresh electoral breakthrough.

- Chileans reject second attempt to rewrite constitution.

And finally….

Clarence

XXXX