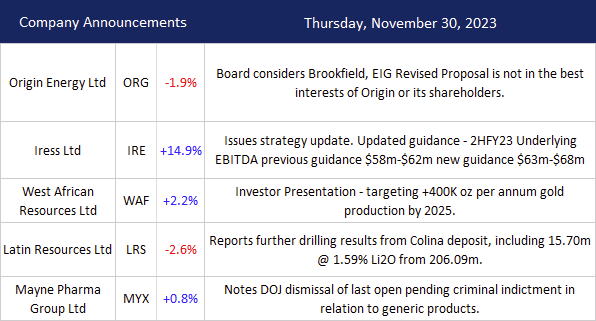

ASX 200 finished up 52 points at 7087 (0.5%) after a late afternoon surge. A turnaround in the iron ore miners helped on news that nickel from Indonesia would not get a break. BHP up 0.2%, RIO up 0.4% and FMG up 0.9%. Lithium turns around too with PLS reversing early losses to close up 2.3% with gold miners seeing some profit taking in places. Oil and gas were in pause ahead of OPEC, coal stocks eased. Meanwhile Banks once again pushing ahead, CBA up 1.3% and the Big Bank Basket up to $178.88. MQG spurted ahead by 2.1% with insurers doing well. QBE up 1.3% and SUN up 2.5% on its bank appeal. Healthcare better overall with CSL unchanged after a good day yesterday, RMD up 2.3%. REITS slightly better SCG up 0.8%. Industrials firm, TLS up 1.1% and staples higher, WOW up 1.8% and COL up 0.9%. Interest rate sensitive stocks doing ok, TCL up 1.0% and AIA up 1.0%. Tech also in demand, WTC up 1.2% and XRO up 1.0% with the All-Tech Index up 1.0%. In corporate news, ORG knocked back Plan B, falling 1.9% in the process. IRE jumped 14.9% on an update. LTR rose 2.2% on a new director appointment. In China we saw some disappointing economic data and we await the virtual OPEC meeting. Asian markets firmed Japan up 0.2%, China up 0.2% and HK up 0.2%. 10-year yields falling down to 4.38%.

HIGHLIGHTS

- Winners: IRE, TPW, IMU, CDA, IMD, MGR, HVN, VCX

- Losers: CTT, RDX, HCW, PPC, JDO, CXO, GRR

- Positive sectors: Banks. REITs. Insurers. Industrials Tech.

- Negative sectors: Nothing really. Coal maybe.

- High 7076 Low 7023

- Big Bank Basket: Higher at $178.88(1.2%)

- All-Tech index: Up 1%

- Gold: Higher at $3075

- Bitcoin: Higher at $37997

- Aussie Dollar: Firmer at 66.43c

- 10-year yields back to 4.38%.

- COP 28 begins. OPEC Plus meeting. Ceasefire in Gaza for another 24 hours.

- In Asian markets, Japan up 0.2%, China up 0.2% and HK up 0.2%.

- US Futures: Dow futures up 140 Nasdaq up 35

MAJOR MOVERS

- IRE +15.9% Strategy update.

- TPW +9.9% broker upgrades.

- IMU +4.8% good news keeps on coming.

- HVN +4.5% broker upgrades.

- OPT +25.0% AGM address. Positive vibes.

- EML +11.0% bounces back slightly.

- RFG +8.9% AGM commentary.

- CU6 +9.6% Phase III CLARIFY trial commences.

- 4DS -28.57% AGM commentary.

- INR -8.8% sell off continues.

- CTT -10.4% shareholder sell donw.

- CXO -3.5% broker downgrades.

- WC8 -3.2% another life used.

- LRS -2.6% Colina high grade results.

- Speculative Stock of the Day: Cooper Metals (CPM) +67.3% Brumby Ridge copper discovery confirmed 71m @2.8% Cu.

COMPANY NEWS

ECONOMIC HEADLINES

- Good news for Australian nickel producers with no deal between President Joko Widodo and Joe Biden on allowing Indonesian nickel to access huge subsidies under the IRA in the US.

- Activity in China’s manufacturing and services sectors shrank in November. The official manufacturing purchasing managers index fell to 49.4, the second straight month of contraction.

HEADLINES

- Henry Kissinger dies aged 100.

- South Korea left rates unchanged at 3.5%.

- One of China’s largest investment banks has warned its analysts against making any bearish calls and to avoid showing off their lavish lifestyle.

- OPEC Plus looms. Virtually.

- Microsoft will have an observer role on OpenAI’s new board.

- Emboldened US union launches membership drive across 13 carmakers.

- Musk suggests advertisers are trying to blackmail him.

And finally….

I got a couple of glove puppets for sale if anyone wants to take them off my hands, also a parachute for sale, its never been opened so slightly bloodstained

Clarence

XXXX