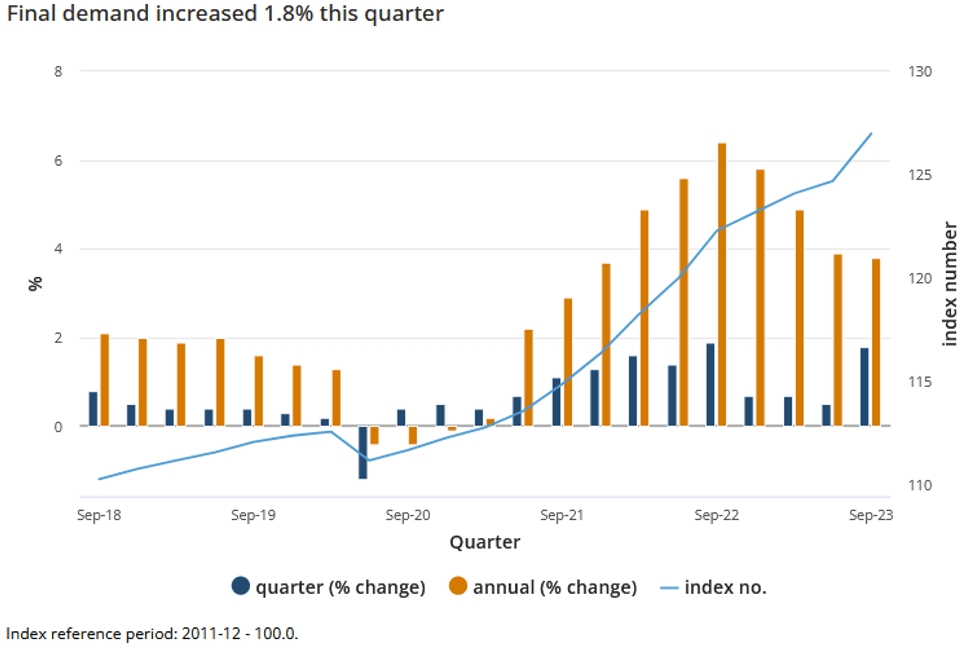

ASX 200 closed up 15 points at 6827 (0.2%) down only 1% for the week. Banks better after a run yesterday, the Big Bank Basket up to $171.72 (+0.7%). CBA leading the charge up %. MQG remain under pressure ahead of results due soon, down %. Insurers slid as yields stabilised, QBE down % and SUN off %. REITs finally found some friends, GMG up 0.2% and GPT up 1.4%. Healthcare flat, RMD down 4.0% on quarterly report. Defensive staples on the up, WOW up 0.7% and COL rallying 2.1%. Tech flat despite Nasdaq futures rallying, All Tech Index down 0.7% . Resources were mixed, iron ore continues to do ok, BHP up 0.3% but RIO and FMG unchanged. Lithium stocks marginally better as support continues, PLS up 1.8% and MIN up 2.2%. Gold miners were better again, NST up 0.3% and EVN up 0.6%. Oil and gas stocks better as crude rises in Asian trade. In corporate news, HVN rose 4.8% on sales update and buyback announcement, Hancock gets a $2.14bn dividend from Roy Hill, ORG up 0.2% on LNG news on a SA terminal. On the economic front PPI rose 1.8% this quarter. Asian markets lightly better, Japan up 1.4%, HK up 1% and China up 0.6%. European markets set to open slightly higher. 10-year yields fall to 4.80%.

HIGHLIGHTS

- Winners: CIA, SLR, HVN, AAC, WAF, APM, URW

- Losers: DYL, BXB, AD8, HLS, RMD, IMD

- Positive sectors: Banks. Iron ore. Oil and gas. REITs. Staples.

- Negative sectors: Insurers. Uranium. Tech.

- High 6846 Low 6810

- Big Bank Basket: Higher at $171.72 (+0.7%)

- All-Tech index: Down 2.5%

- Gold: Lower at $3135.

- Bitcoin: Lower at $34,105

- Aussie Dollar: Rises to 63.44c

- 10-Year Yield: Higher again at 4.86%

- Asian markets weaker Japan down 1.9%, HK off 0.6% and China falling 0.6%.

- US Futures: Dow up 106 Nasdaq up 117

- European markets looking at a mixed opening.

MAJOR MOVERS

- CIA +6.9% broker upgrades.

- AWC +5.2% slight bounce.

- HVN +4.8% sales numbers and buyback.

- MFG +2.4% change of director’s interest.

- BOC +18.8% progress in judicial review for exploration licence.

- WA1 +15.3% kicks again.

- PMT +% lithium resurrection.

- SYR +9.3% bargain hunting.

- ORG +0.2% box seat for LNG terminal in SA.

- DYL -8.0% uranium sell off.

- HLS -4.9% letter to shareholders.

- RMD -4.0% quarterly results.

- FLN -13.7% outsourced.

- BXB -5.7% broker downgrades

- SDF -4.3% AGM presentation.

- Speculative Stock of the Day: WebCentral (WCG) +177%. Great deal selling one of its businesses for an implied valuation of $165m.

COMPANY NEWS

PPI – Higher prices for construction outputs, petroleum and energy were compounded by broad-based price increases in services, particularly health and child care services

Final demand (excluding exports)

- Rose 1.8% this quarter.

- Rose 3.8% over the past twelve months.

ASIAN MARKETS

- Li Keqiang dies aged 68.

- Singapore house prices have rebounded more than expected in the third quarter, Private home valuations rose by 0.8% from the previous three months.

- Chinese smartphone and appliance maker Xiaomi announced late Thursday a new operating system.

US / EUROPEAN HEADLINES

- Israel ‘preparing ground invasion’ of Gaza, says Netanyahu.

- he foreign ministers of the United Arab Emirates, Jordan, Bahrain, Qatar, Kuwait, Saudi Arabia, Oman, Egypt and Morocco have condemned the attack son civilians in Gaza.

- US Military attacks two Syrian facilities.

- Taylor Swift joins billionaire club after Eras tour.

- Ford says UAW strike cut $1.3bn from operating earnings.

- SBF struggles to remember.

- World Cup Rugby final tomorrow.

And finally…..

There is a thin line between fishing and just standing on the bank like an idiot.

Clarence

XXXXX