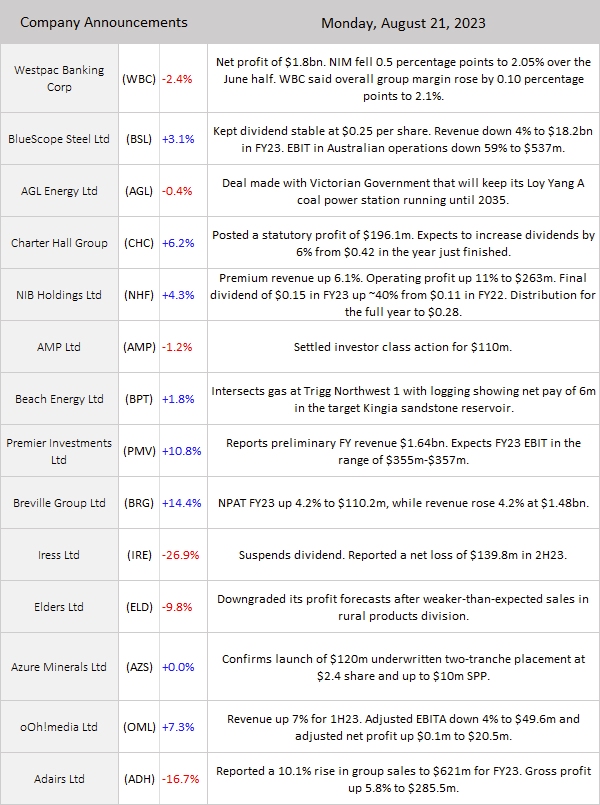

ASX 200 dropped 33points to 7116 (0.5%) as results dominated. Banks slid on WBC NIM woes down to $170.88 (0.9%) for the basket. WBC dropped 3.1% with ANZ off 1.0%. MQG better up 0.8% but insurers fell after IAG results, QBE down 1.5%. Industrials were mostly firm, WES up 0.4%, ALL up 0.7% and REH managing a % gain. REA rose as tech stock saw buyers, XRO up % and WTC rallying %. The All–Tech Index down 1.0%. Healthcare in ICU as CSL stumbled again, down 1.4%, RMD fought back from early losses, unchanged. COH continues to get a good hearing up 1.6%. REITs mixed, VCX down 4.1% with SGP up 0.2%. Resources recovered a little after China cut some rates but not by enough. BHP down 0.4% of results tomorrow, FMG up 0.4% and lithium stocks in demand, PLS up 2.5%, MIN up 1.0% and LTR doing well rallying 2.7%. Oil and gas are slightly better, WDS unchanged and coal stocks flat. In corporate news, PMV announced a strategic review and the CEO pulled the pin rising 12.2%, BRG followed up 9.0% on better margins and new product launches. AD8 proved the critics wrong with a 10.7% on record results. ELD collapsed 10.8% on profit guidance and IRE cut its dividend and sold a business to pay off dent and collapsed 35.6%. A2M was skimmed 13.6% on more Chinese woes and RWC dropped 8.3% on housing slowdown. Nothing on the local economic front. Asian markets mixed again, Japan up 0.4%, HK down 1.6%, China down 0.5%.10 -year yields steady at 4.27%.

HIGHLIGHTS

- Winners: PMV, AD8, BRG, LOV, OML, RF1, LRS

- Losers: IRE, A2M, ELD, OCL, RWC, A4N, SWM

- Positive sectors: Lithium. Tech. Consumer discretionary. Oil and gas.

- Negative sectors: Banks. Healthcare. Gold miners. Insurers.

- High 7146 Low 7120 Narrow range. Closes on lows.

- Big Bank Basket: Falls to $170.88 ( -0.9%)

- All-Tech index: Down 1.0% IRE weighs.

- Gold: Unchanged at $2962.

- Bitcoin: Slips to US26103

- Aussie Dollar: Unchanged at 64.02c.

- 10-Year Yield: Steady at 4.27%.

- Asian markets: Japan up 0.4%, HK down 1.6%, China down 0.5%.

- US Futures: Dow down 10 Nasdaq down 5

- European markets looking at a flat opening.

MAJOR MOVERS

- PMV +12.2% strategic review and CEO quits.

- AD8 +10.7% great results.

- BRG +9.0% higher margins.

- LOV +6.6% retail bounce.

- LRS +4.8% lithium rebound.

- ASK +3.7% broker upgrades.

- SYA +4.4% big volumes again.

- NXL +8.6% kicks higher post-result sell-off.

- SPZ +20.0% final report.

- RF1 +5.0% weekly NTA.

- IRE -35.6% woeful results.

- A2M -13.6% big troubles in little China still.

- ELD -10.8% profit guidance.

- RWC -8.3% results presentation.

- CXO -2.4% capital raising weighs.

- FLN -16.0% sliding away.

- AQZ -3.0% illiquid.

- ADH -15.5% resignation of director.

- Speculative Stock of the Day: Nothing on any volume.

COMPANY NEWS

HEADLINES

ASIAN MARKETS

- Chinese lenders cut the one-year loan prime rate by 10bps and kept the five-year prime loan rates unchanged despite calls for more cuts.

- Country Garden will be removed from the Hang Seng Index from Sept. 4 and replaced by Sinopharm.

US and EUROPEAN HEADLINES

- Trump says he will not appear in Republican primary debates

- Russia’s first post-Soviet Moon mission ends in space crash “The apparatus moved into an unpredictable orbit and ceased to exist as a result of a collision with the surface of the Moon.” Classic.

- German July PPI down 1.1% M/M v -0.2% forecast. July Producer prices down 6%.

And finally….

Clarence

XXXXX