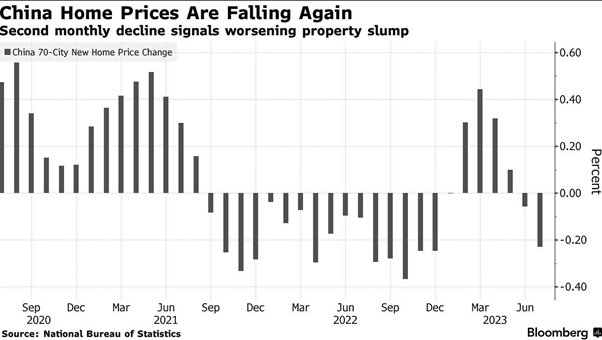

Blood on the streets on the ASX 200 today, market down 110 points to 7195 (-1.5%), posting its biggest drop in six weeks. REITs put up some resistance following solid earnings reports VCX +2.4%, MGR +5.3% and SCG +1.5%. Energy stocks fell, as crude oil fell for a third day after a drop in US inventories, STX off 3.5%, BPT down 2.8% and WDS -0.9%. Tech stocks tracked the Nasdaq lower, SQ2 -4.0% and WTC down 3.7%. All-Tech Index down 2.4%. Iron ore giants BHP, RIO and FMG all lost over 2%. The big four banks were all negative; CBA went ex-dividend today down 3.6%. Big Bank Basket down 2.5% to $174.79. Bullion prices were steady, but gold stocks were caught in the broad market sell-off NCM down 1.3% and EVN off 1.7%. Industrials weaker across the board; construction stocks were slammed dragged lower by FBU -9.3% disappointing earnings report. Healthcare eased, but RMD managed to buck the trend up 0.1%, CSL off 0.4% and RHC down 1.8%. Elsewhere, WES down 0.8%, QBE off 1.0% and MIN falling 3.6%. In corporate news, lots of results today ahead of a Super Thursday tomorrow. TCL down 0.7% despite toll income rising 26%, CPU down 3.3% reported revenue jumped 27% and flagged a $750m share buyback, BAP up 5.5% despite margins getting squeezed, the company kept its final dividend, and NWL down 1.6% recorded record EDITDA and a 26.3% jump in FUA. In economics, RBNZ leaves rates on hold. China’s new home prices fell 0.1%, marking the fifth decline this year amid a prolonged property crisis. Asian markets are lower on concerns over China’s stuttering economy, Japan down 1.3%, HK down 1.4% nearing a two-month low, and China off 0.5%. Australia’s 10Y yield down 6bps to 4.19%. Aussie Dollar sinks to nine-month lows down 0.1% to 64.51c. Dow Jones futures down 5 points, and Nasdaq futures up 6 points.

HIGHLIGHTS

- Winners: AZS, CDA, PSI, INR, BAP, MGR, SUL

- Losers: FCL, FBU, TPW, SWM, MP1, ARU, BRN

- Positive sectors: REITs in places. Coal.

- Negative sectors: Banks. Tech. Iron ore miners. Gold.

- High 7285 Low 7185

- Big Bank Basket: $174.79 (-2.5%)

- All-Tech index: Down 2.4%

- Gold: Higher at $2952 as AUD slips.

- Bitcoin: Slips to US29183

- Aussie Dollar: Slides to 64.50c.

- 10-Year Yield: Lower at 4.21%.

- Asian markets: Japan down 1.2% HK down 1.4% China down 0.5%

- US Futures: Dow down 6 Nasdaq up 5

- European markets looking weaker on the open. FTSE under pressure on miners, and CPI in line

MAJOR MOVERS

- AZS +7.6% punters still finding reasons to buy.

- BAP +5.5% results cheer.

- CDA +7.2% trading update.

- MGR +5.3% results bounce.

- VCX +2.4% results.

- OPT +11.6% signs of life.

- PMT +7.5% James Bay in focus.

- DLI +10.5% on the march again.

- AW1 +25.0% storming ahead on recent copper discoveries.

- FCL -15.7% results.

- FBU -9.3% underwhelming.

- TPW -7.0% brokers stick knife in

- NXL -3.6% tech sell down.

- SWM -6.3% football not enough.

- 360 -4.9% profit taking.

- ARU -5.7% Gina not happy.

- SFR -3.7% copper play slides.,

- GUD -3.4% not so today.

- LLC -3.7% broker downgrades.

- Woodside Energy (WDS) and officials representing workers at some of its LNG facilities are likely to hold more talks next week after failing to reach an agreement on issues that could lead to strike action.

- New Zealand’s central bank held the cash rate steady at 5.5% but hinted that more rate rises.

ASIAN MARKETS

- Chinese drugmakers develop copycat versions of ‘miracle’ weight-loss drug.

- Trouble at mill for Zhongrong International as it missed payments on dozens of products and has no immediate plan to make clients whole. Problems run deeper perhaps.

- JPMorgan raised its 2023 global emerging markets corporate high-yield default forecast to 9.7% from 6%.

- UK July CPI the focus. Core CPI 6.8% bang on forecast. Big drop from previous month.

- European markets set to open lower. FTSE down around 130.

- Biden to visit Hawaii amid criticism of wildfire response.

- North Korea admits it is holding US Soldiers Travis King. Apparently, he crossed over on concerns about racism in the US army.

- Matildas to beat England 2-1 in extra time.