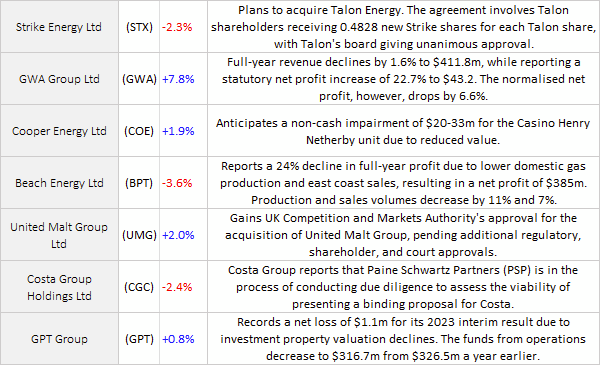

ASX 200 fell 3 points to 7277 (0.9%) as more Chinese woes hit confidence and iron ore losses mount in Asian trade. The big miners slid, BHP down 2.1% and FMG off 1.8%, with lithium stocks under pressure, PLS down 6.0%, and AKE dropping 3.9%. Base metal stocks eased too with gold miners holding in places. Oil and gas stocks gave up early gains as oil lost 1% in Asian trade. Coal stocks drifted lower with WHC down 1.2%. Banks were softer as BEN reported and lost 2.9%. CBA is down 0.7% and the Big Bank Basket at $179.01(0.8%). Insurers slid with SUN down 1.9%. Money managers also sliding lower. Healthcare lost ground with CSL under pressure yet again down 1.2% ahead of numbers tomorrow. RMD bucked the trend up 1.9%. REITS slid on higher yields; Tech eased with the All–Tech Index up 0.8% with XRO off 0.3%. Rate-sensitive industrials fell, TCL off 1.1% and REA off 0.8% as analysts digested recent results. In corporate news, CAR reported and rose 7.0%, JBH held up well on better numbers than expected, rising 2.8%. GWA posted a good result rising 7.5% and BPT disappointed yet again and slid 3.6% on lower revenue numbers. Nothing on the economic front. Asian markets wobbled on China woes, Japan down 1.2% , China off 0.7%. 10-year yields holding at 4.19% and the AUD under pressure below 65c.

HIGHLIGHTS

- Winners: TUA, GWA, CAR, RED, SGM, SWM

- Losers: LRS, ELD, VSL, PLS, STX, PWH, AKE

- Positive sectors: Tech.

- Negative sectors: Everything else

- High 7331 Low 7259

- Big Bank Basket: $179.01 (-0.8%)

- All-Tech index: Up 0.8%

- Oil falls 1% in Asia. Iron ore under pressure in Singapore.

- Gold higher at $2954

- Bitcoin: Slips to US29412

- Aussie Dollar: Fals to 64.79c

- 10-Year Yield: higher at 4.19%

- Asian markets: Japan down 1.2% HK down 2.2%, China down 0.7%

- US Futures: Dow down 48 Nasdaq down 12

- European markets looking a little weaker on the open.

MAJOR MOVERS

- CAR +7.0% vroom, vroom on results.

- GWA +7.5% results bounce.

- RED +5.0% I see RED

- BLD +2.4% broker upgrades.

- RMD +1.9% bounce continues.

- BBN +9.6% broker upgrades.

- TPD +11.4% STX takeover deal.

- IVZ +9.7% drilling to come.

- WC8 +18.2% going nuts. Tabba Tabba in focus.

- PLS -6.0% profit taking as China wilts.

- ELD -6.1% broker downgrade.

- LRS -7.9% profit taking.

- AKE -3.9% lithium falls.

- RTR -17.7% capital raising.

- IPO of the Day Lithium Universe (LU7) +90.0%

- Speculative Stock of the Day: Nothing today on volume.

COMPANIES NEWS

ASIAN MARKETS

- The yen slid to its weakest in nine months as rate gap heads towards a level when the BoJ intervened.

- Chinese private wealth manager Zhongzhi Enterprises looks to have missed some payments on high-yielding products.

- China’s Country Garden, China’s top private property developer, will suspend trading of its 11 onshore bonds from Monday. Country Garden said on Tuesday it had not paid two-dollar bond coupons due on Aug. 6 totaling $22.5bn.

- Global rice markets could come under further pressure as the world’s leading producer China grapples with heavy rain and flood risks

US and EUROPEAN HEADLINES

- US Steel rejects $7.3bn acquisition bid from rival Cleveland-Cliffs.

- The U.S. consumer is in focus this week. July’s retail sales data comes out Tuesday.

- Goldman Sachs anticipates the US Federal Reserve will start lowering interest rates by the end of next June.

And finally…..

Clarence

XXXXX