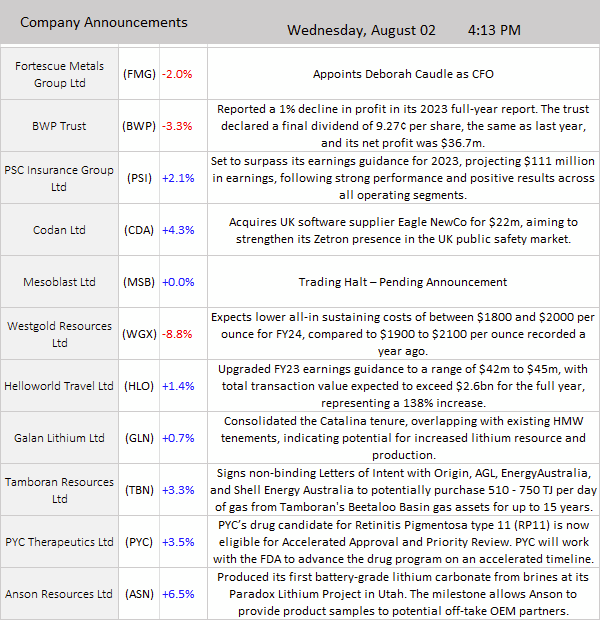

Blood on the streets in the ASX 200 today, the market closed down 96 to 7355 (-1.3%) in a broad market sell-off, losing yesterday’s gains and then some as heavyweight banking and mining stocks weighed. All sectors finished in the red today. Iron ore giants BHP, RIO and FMG all lost over 1% each. Gold stocks not so golden today, NST and NCM down 2.7% and 0.7%, respectively. Lithium stocks sad, LKE off 4.4% and MIN down 1.9%. The big four banks ended in negative territory, with CBA the biggest laggard, down 2.3%. The Big Bank Basket was down to $178.90 (-2.1%). Interest rate-sensitive Tech no better. SQ2 down 1.8%, and XRO off 0.1%. Defensive sectors had no defence against the broad sell-off, Healthcare and Telecoms stocks lower. REITS stumbled, down 2.0%, GMG -2.4%, CHC -3.8% and SGP -1.6%. In corporate news, BWP -3.3% results disappointed, PSI up 2.1% set to surpass earning guidance, HLO +1.4% upgraded FY23 earnings guidance, ASN up 6.5% produces its first battery grade lithium carbonate, and TBN +3.3% signed binding letters of intent with ORG, AGL, Shell and EnergyAustralia. In economics, Ai Group Australian Industry Index fell to -14.7, continuing its contraction for the 15th month straight. Asian markets fall as Fitch fallout sours sentiment. Japan down 1.5%, HK off 2.1% and China down 0.9%. Australian bond yields higher 10Y yield up 5bps and 2Y yield up 1bps. Aussie dollar is down 0.6% to 65.73c. Dow Jones futures down 109 points, and Nasdaq futures down 101 points.

HIGHLIGHTS

- Winners: FCL, DYL, RDX, CDA, IFT, IDX, PME, ABB

- Losers: WGX, MGH, CNI, CMM, OBL, WBT, JDO, AGL

- Positive sectors: Nothing.

- Negative sectors: Banks. Iron ore. Oil and gas. Financials. REITS.

- High 7438 Low 7343. US Credit downgrade weighs.

- Big Bank Basket: Smacked to $178.90 (2.1%)

- All-Tech index: Down 0.7%

- Gold better at $2957

- Bitcoin: Rallies to US29711

- Aussie Dollar: Falls at 65.91c

- 10-Year Yield: Steady at 4.02%

- Asian markets: Japan down 2.4% HK 2.2%, China down 0.8%

- US Futures: Dow down 100 Nasdaq down 100

- European markets opening down around 1%

MAJOR MOVERS

- DYL +6.5% and it was all yellow.

- CDA +4.3% acquisition.

- CXL +2.7% PLS FID.

- PSI +2.1% Results and outlook.

- SYM +17.1% SLC NBIO proposal.

- DRO +8.3% launches Area specific satellite denial system.

- WBT -5.2% slipping again.

- AGL -4.8% downgrade.

- E25 -7.9% reinstatement to quotation.

- WGX -8.8% FY24 Guidance.

- MGH -6.8% reverses gain from yesterday.

- IPO of the Week: ASK -4.4% down again on day two.

- Speculative Stock of the Day: American West (AW1) +22.5% Major copper discovery at Storm Copper project in Canada.

- In July 2023, the Ai Group Australian Industry Index fell to -14.7, continuing its contraction for a 15th month. Employment, new orders, and activity/sales declined, with manufacturing and construction sectors experiencing significant downturns.

- New Zealand’s jobless rate increased to 3.6% in the second quarter, while wage inflation eased to 4.3%.

- Incitec Pivot (IPL) has tapped Indonesia’s Pupuk Kaltim as the preferred buyer of its big Australian fertilisers business, fuelling expectations of a deal worth about $1.5bn.

- Asian market crumble on US downgrade. Japan down 2.3%

ASIAN MARKETS

- Beijing is keen to pick up the pace of implementing the raft of policy measures announced in recent days and turning its attention to promises to help economic recovery.

US AND EUROPEAN HEADLINES

- Economists Larry Summers and Mohamed El-Erian joined a cohort of their peers in criticising Fitch Ratings’ decision to downgrade the US.

- Trump indicted for ‘unprecedented’ attempt to overturn US election.

- Russian attacks on Ukraine silos send Chicago wheat trades higher.

- Uber makes first operating profit after racking up $31.5bn of losses.

And finally….

Clarence

XXX