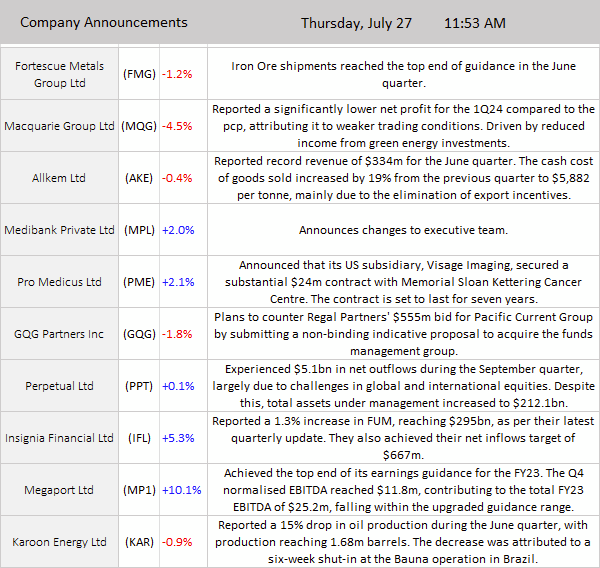

ASX 200 closed up 54 points to 7456 (+0.7%), a five-month high rebounding after an initial dip at the opening bell and now up 1.79% for the week. Tech stocks led the charge today bucking the trend and moving in tandem with the Nasdaq futures on Meta results. All-Tech Index up 2.1% and SQ2 rose 1.8% and XRO up 2.1%, Consumer discretionary enjoyed a boost, WES +1.6%, JBH +3.2% and ADH gained 10.7%. Miners in a hole, with the big trio BHP, RIO and FMG all in negative territory. Lithium no better AKE, LTR and PLS all down. Coal stocks short-circuited, losing some of yesterday’s gains. WHC down 5.9%, NHC off 5.7% and YAL down 1.9%. The big four banks closed in the green all gaining over 1%, and the Big Bank Basket is up to $183.13 (+1.4%). Healthcare in the pink today, with CSL +1.8%, RMD +2.8% and RHC up 3.2%. REITS outperformed jumping 3.4%, as bond yields dip. SCG up 4.4% and VCX up 3.6%.In corporate news, FMG down 3.4% despite reaching the top end of guidance in the June quarter, MQG -4.4% on AGM comments, AKE -3.0% reported record revenue, MP1 surged 14.4% on hitting earnings guidance, SBM off 5.7% on upped production guidance, and KAR closed flat, on a 15% fall in oil production. On the economic front, Australia’s export prices shrank 8.5% in the June quarter, reversing from a 1.6% growth in the March quarter, and import prices fell by 0.8% quarter on quarter following a 4.2% drop in the March quarter. Asian markets are up, Japan up 0.5%, HK up 1.1%, hitting a five-week high, China stocks flat. Australian bond yields lower, 10Y yield and 2Y yield down 7bps. The Australian dollar rose 0.5% to 67.89c as the US dollar slid for the third straight session. Dow Jones futures up 3 points and Nasdaq futures up 107 points. European results look positive. Futures pointing to a 0.5% rise across the board. ECB today.

HIGHLIGHTS

- Winners: MP1, IMU, SFR, IFL, INA, AX1, NCK, LRS

- Losers: RRL, WHC, RSG, NHC, ILU, MQG, CXO, CTT

- Positive sectors: Banks. Industrials. Healthcare. REITs. Retail. Tech.

- Negative sectors: Iron ore. Base metals. Lithium. Coal.

- High 7474 Low 7388. Off to the races.

- Big Bank Basket: Higher at $183.13 (1.4%)

- All-Tech index: Up 2.1%.

- Gold steady at $2906

- Bitcoin: Rises to US29458

- Aussie Dollar: Higher at 67.95c

- 10-Year Yield: Drops to 3.95%

- Asian markets: Japan up 0.8% HK up 1.4%, China up 0.3%

- US Futures: Dow up 6 Nasdaq up 120 on Meta numbers.

- European markets opening higher.

MAJOR MOVERS

- MP1 +14.4% results cheer.

- KGN +3.9% kicks higher on broker upgrades.

- SFR +9.0% quarterly report.

- AX1 +5.9% retail in demand.

- CTD +5.1% broker upgrades.

- LRS +5.7% finding support again.

- AZS +5.3% lithium back.

- EOS +13.7% defence spending.

- ADH +10.7% PMV +4.6% Retail winners.

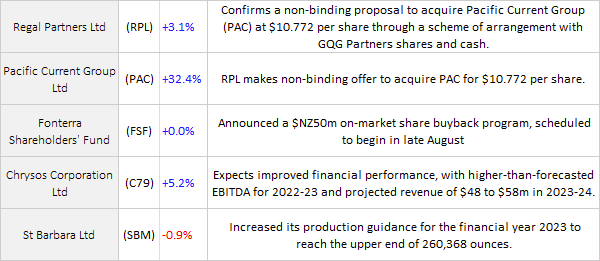

- PAC +32.2% Regal and GQG make offers.

- NCK +5.8% inflation winner.

- NXL+13.9% tech winner.

- KAR -% oil production drops.

- BUB -13.0% fails to spill milk.

- RRL -10.8% quarterly report, softer production guidance and cost issues.

- WHC -5.9% NHC -5.7% coal prices fall.

- MQG -4.4% tough times for Nick.

- CXO -4.3% Nah!

- AKE -3.0% Quarterly report.

- PAN -40.2% panned.

- BCB -10.3% coal prices.

- Speculative Stock of the Day: G50 +15.79% Gallium hits in new drilling. 308m @28.6g/t Gallium at Golconda.

COMPANY NEWS

HEADLINES

The Export Price Index fell 8.5% in the June quarter 2023, and 11.2% annually, according to data released today by the Australian Bureau of Statistics (ABS).

- Australian wine exports slumped 10% in the 12 months to the end of June, driven by a fall in shipments to its biggest markets, US and UK.

ASIAN MARKETS

- Samsung posted a 95% profit plunge in the second quarter as weak demand for memory chips continued. Samsung reported sales slipped 22% from a year ago. Global demand is expected to gradually recover in the second half of the year. Shares up on the results.

- HK raises rates 25bps.

US AND EUROPEAN HEADLINES

- Russian defence minister vows to strengthen military ties with North Korea.

- NatWest fails to stem Farage pressure as shareholders turn against board.

- VW hat it has signed a deal to jointly develop two new electric vehicles for China with Chinese EV maker Xpeng.

- Nestle results. FY organic growth 7-8%. Michelin lifts core profits guidance on higher prices.

- Renault ups guidance. Highest operating margin ever! Schneider Electric net profits grow 33%

- Shell, VW, Barclays results and Mercedes Benz sees 14% jump in net profit.

- A cargo ship carrying nearly 3,000 cars about 300 of them made by Mercedes. Twenty-five of the 2,857 cars on board were EVs and one may have caught fire and started the blaze

- Go Matildas!

And finally….I’m in A&E got a broken leg and a few cuts an bruises.

I woke up yesterday and decided to go horse riding. Something I haven’t done for a few years and It turned out to be a big mistake!

I got on the horse and we started off slowly, grew in confidence, and went a little faster, before I knew it, we were going as fast as the horse could go. I couldn’t take the pace and fell off, catching my foot in the stirrup.

It just wouldn’t stop!!

Thankfully the manager at Woolworths came out and unplugged the machine!!

Clarence

XXX