ASX finished down 8 points to 7306 (-0.1%) in a subdued day of trading ahead of CPI release on Wednesday, with forecasts of a further decline in inflation MoM. Energy the biggest gainer as Crude continues to gain, WDS and STO both gaining 2.3% and 2.2%. Banks continuing to ease off from last week, while MQG gained 0.4% ahead of AGM on Wednesday. The Big Bank Basket fell to $179.2 (-0.2%) with CBA down 0.1% and ANZ off 0.2%. Insurers better with QBE up 0.1%. REITs gaining as bond yields fall with GMG up 0.9% and SCG up 1.5%. Healthcare flat, held down by CSL down 0.3% while RMD and TLX gained 0.4% and 7.7%. Tech continuing to gain after last week’s run. The All–Tech Index up 0.4%, as WTC gained 1.9% and XRO dropped 1.2%. Resources are mostly down as China fails to stimulate demand BHP off 1.5% and RIO off 1.3%. Gold miners mostly down, EVN down 0.3% and NST dropping 0.7%. Base metal and lithium stocks hit hard, MIN -2.6%, PLS -5.8% and AKE -5.6%. In corporate news, CXO dropped 17.2% after releasing their quarterly results, failing to impress. S32 lost 2.6% after incurring a $US1.3bn non-cash impairment. On the economic front Aussie manufacturing PMI increased to 49.6, the highest in five months, but still indicating worsening business conditions. New Zealand’s trade surplus narrowed last month to NZ$9m. Asian markets mixed, Japan up 0.8%, HK down 1.9% and China off 0.1%. 10-year yields steady at 4%. Dow futures down 32 points. NASDAQ futures down 5 points

HIGHLIGHTS

- Winners: TLX, HLS, NHC, WHC, SGF, CXL

- Losers: CXO, LRS, SYA, AGY, AZS, INR, PMT

- Positive sectors: Oil and gas. Coal. REITs. Industrials.

- Negative sectors: Iron ore. Lithium. Base metals.

- High 7333 Low 7309. Narrow range . Waiting for CPI and Fed.

- Big Bank Basket: Lower at 179.20 (0.2%)

- All-Tech index: Better up 0.4%

- Gold steady at $2913

- Bitcoin: Better at US29785

- Aussie Dollar: Falls to 67.31c

- 10-Year Yield: Falls to 3.99%

- Asian markets: Japan up 1.3% HK down 1.4%, China down 0.3%

- US Futures: Dow down 25 Nasdaq down 7.

- European markets barely changed at the open.

MAJOR MOVERS

- TLX +7.7% bouncing back on business update from last week.

- NHC +3.7% WHC +3.1% a merry old soul.

- PDN +2.0% uranium finding friends.

- FLN +7.8% 1G23 Conference call.

- GCY +17.5% Never Never resource increases to over 720Koz.

- BCB +3.6% quarterly report.

- CXO -17.2% quarterly and outlook disappoints.

- LRS -13.8% profit taking.

- AGY -11.7% plumbing lows.

- INR -9.1% quarterly.

- RED -5.0% eases off.

- VUL -5.4% illogical.

- PLS -5.8% waiting for quarterly after close.

- AKR -5.6% Livent update

- PMT -6.9% slipping again.

- SPL -5.9% profit taking.

- BKY -42.0% quarterly report.

- Speculative Stock of the Day: Not much really TBH. Melodiol Global Health (ME1) +26.3% subsidiary delivers strong revenue and EBITDA in operating units in H1 23.

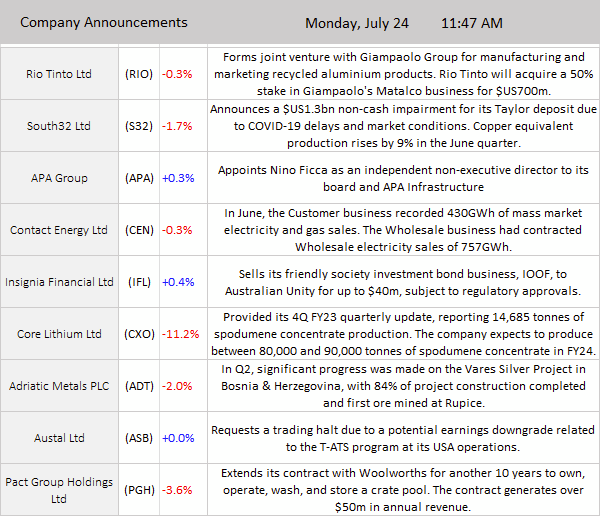

COMPANY NEWS

HEADLINES

- Chinese property stocks decline as debt gloom deepens.

- Elon Musk says Twitter will become X in corporate rebranding.

- Goldman Sachs expects record demand in oil markets to drive crude prices higher in the near term. US$86 by year end.

- Lack of an agreement following the G20 energy ministers’ meeting indicates “very substantial” uncertainty about long-run oil demand.

- European markets to open softer.

- Philips raises outlook for 2023.

- Stellantis and Samsung said they plan to open a second joint-venture plant in the U.S. to build electric vehicle batteries, with a target to start production in 2027.

- Spanish election ends in el punto muerto.

And finally……

Clarence

XXXX