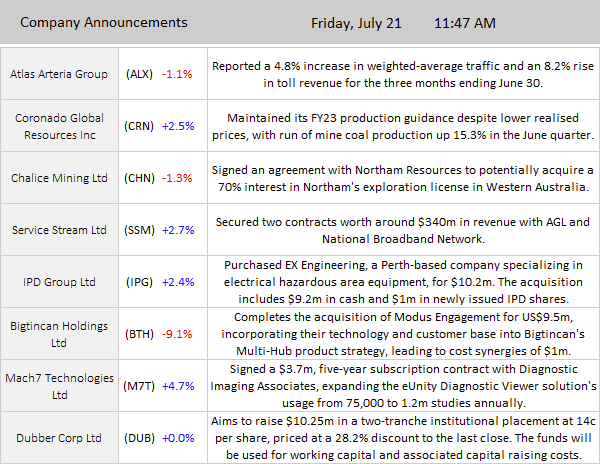

ASX finishes the week down 11 points at 7314 (0.15%) for 11-point rise for the week. Narrow range again. Low volumes. Once again, some bifurcation with banks now in focus, slipping on some profit taking. The Big Bank Basket fell to $179.59 (-0.6%) with CBA down 0.7% and ANZ off 0.8%. MQG slipping 1.4% ahead of AGM next week. Insurers better with QBE up 1.4% and SUN up 0.7%. Money managers mixed. REITs eased slightly with CHC down 0.5% and SCG off 1.1%. Industrials held up relatively well, healthcare in the green with CSL up 0.7% and RMD gaining 1.3%. TLS kicked 0.7% higher, staples better and utilities also in demand. Tech wrecked though today with the All–Tech Index under pressure down 2.1%, as WTC fell 2.4% and XRO off 3.9%. Old Skool Platforms also slid, REA down 2.6% and SEK not finding friends down 4.0%. Resources were mixed, Gold miners fell hard, NCM down 5.3% on Newmont results and NST continued to struggle down 0.8%. Base metal and lithium stocks in the doghouse, MIN hit 7.5% on broker downgrades, PLS dropped 4.5% and AKE slumped 3.3%. BHP and RIO though bucked the weakness rising 0.9% and 0.3% respectively. Oil and gas also better WDS up 1.5%. In corporate news, quiet day, ALX fell 1.0% on toll numbers, SSM up 7.3% a contract win, the Noosa Mining conference finished up and 29M slipped another 6.1% on no new apart from a update date. Nothing on the economic front today. Asian markets once again weaker, Japan down 0.1%, HK up 0.2% and China off 0.2% – 10-year yields higher again to 4.03%.

HIGHLIGHTS

- Winners: SSM. INA, SGF, PSI, CXL, ABB, CRN

- Losers: CTT, MIN, IMU, SYR, NCM, VNT, GRR, CXO

- Positive sectors: Oil and gas. Iron ore. Industrials. Healthcare.

- Negative sectors: Lithium. Gold miners. Tech

- High 7325 Low 7289

- Big Bank Basket: Lower at $179.59 (-0.6%)

- All-Tech index: Down 2.1%

- Gold steady at $2908

- Bitcoin: Steady at US28,888

- Aussie Dollar: Falls to 67.75

- 10-Year Yield: Rises to 4.02% on jobs number.

- Asian markets: Japan down 0.6% HK up 0.3%, China unchanged.

- US Futures: Dow up 54 Nasdaq up 11

- European markets barely changed at the open.

MAJOR MOVERS

- SSM +7.3% wins new contracts.

- CXL +3.3% finally a Friday bounce.

- ABB +3.0% low volume.

- CRN +2.8% activities report.

- ADT 2.6+% pops higher.

- FLT +2.3% broker upgrades.

- SPL +14.9% DEP HER2 – Radio-diagnostic shows imaging benefits

- DRE +1.7% Noosa Mining Conference presentation.

- MAY +10.1% quarterly report.

- CTT -9.4% tech profit taking.

- NCM -5.3% crushed on Newmont results.

- MIN -7.5% broker comments on new deal.

- WBT -4.7% profit taking.

- GRR -5.0% book squaring.

- SYR -5.8% sinking again.

- AVH -9.3% date set for Q2 results.

- MNS -12.5% Cleansing notice

- BTH -6.1% Business update.

- MVP -6.4% just whistle.

- BET -9.4% director’s interest.

- Speculative Stock of the Day: Perpetual Resources (PEC) +40.0% Option to acquire prospective lithium exploration tenement package. Good volume too.

COMPANY NEWS

HEADLINES

- Tech sector sell-off. All Tech Index down %. Resources mixed with lithium under pressure.

- Commonwealth Bank has reaffirmed its view that iron ore prices will decline to $US100 a tonne by the fourth quarter of this year as China’s steel demand eases in the second half.

- Japan’s inflation increased at a faster rate in June, with prices excluding fresh food rising by 3.3% from a year ago, and a deeper measure of inflation, excluding energy, decelerating to 4.2%.

- TSMC fell the most in five months, will delay production at its new Arizona-based chip plant to 2025 due to a shortage of skilled labour.

- Indian tech company Infosys slashes outlook. Stock drops 9%.

- UK Retail sales up 0.7% M/M v 0.3% in May. Far better than expectations.

- Tories get punished in UK By-Elections.

- ‘Barbenheimer’ weekend opens.

- European markets set to open slightly higher.

And finally

Clarence

XXXX