The ASX 200 closed flat, near unchanged, up 1 point to 7325, after jumping over 50 points in early trade before unemployment data killed the market’s mood raising bets of further tightening from the RBA. The Aussie dollar jumped 0.6% to 68.15c, clawing back recent losses, and bond yields rose with 2Y yield up 12bps, and 10Y yield up 9bps on jobs data. Financials performed well today, with the big four banks all ending in positive territory. The Big Bank Basket up to $180.66 (+0.3%). Interest rate-sensitive tech stocks are in demand tracking their US peers despite the market betting on further rate hikes to come. CPU +1.4%, XRO +0.3% and WTC +0.6%. Gold miners were punished today in a broad sell-off. NST fell 6.6%, NCM off 0.4%, and EVN down 0.5% despite gold production exceeding guidance. Miners flat, even as iron ore slipped. FMG up 1.4%and RIO up 0.4%. Defensive sectors underperformed, with healthcare and Telecoms in the red. RMD off 0.8%, RHC down 1.0%, and TLS fell 0.12% after confirming its plans to cut 472 jobs. REITS fell as bond yields rose. In corporate news, MIN +5.2% after it agreed to sell its interest in the Kemerton Lithium refinery, ZIP +2.3% on better results, with revenue up 21%. FLT up 4.0% on upgraded profit guidance, NXL surged 36.6% after announcing it anticipates sales to rise 20% to reach $183m, QBE +2.4% confirmed guidance, BHP flat, meeting production expectations, STO down 0.1% after trimming production forecast, and SMR up 5.8% on solid production results. In economics, Australia’s jobless rate was unchanged at 3.5% in June, and China left interest rates unchanged. Asian markets mixed, Japan down 0.8%, HK up 0.3% and China down 0.3%. Dow Jones futures up 4 points, and Nasdaq futures down 59 points.

HIGHLIGHTS

- Winners: LRS. AZS, GMD, NEU, SMR, GRR

- Losers: TLX, NST, CXL, BRN, IMU, TUA, WBT

- Positive sectors: Fund managers. Tech (just)

- Negative sectors: REITs. Healthcare. Oil and gas. Gold

- High 7383 Low 7322 Jobs data kills rally.

- Big Bank Basket: Higher at $180.66 (+0.2%)

- All-Tech index: Flat.

- Gold steady at $2903

- Bitcoin: Steady at US$30,111

- Aussie Dollar: Slips to 68.24c

- 10-Year Yield: Rises to 3.95% on jobs number.

- Asian markets: Japan down 1.1% HK up 0.4%, China unchanged.

- US Futures: Dow unchanged Nasdaq down 71

- European markets to open slightly lower.

MAJOR MOVERS

- GMD +7.9% sprints higher.

- LRS +9.7% going great.

- GRR +5.3% bounce continues.

- NEU +6.3% basking in broker upgrades.

- SMR +5.8% quarterly activities report.

- MIN +5.2% restructures Albemarle deal.

- FLT +4.0% guidance upgrade.

- AZS +9.7% doing ok too.

- NXL +36.6% very positive surprise upgrade.

- HLO +9.1% is this one you are looking for? Riding the FLT coattails.

- TLX -14.6% business update and CLSA downgrade.

- NST -6.6% broker downgrades.

- CXL -5.7% low volume but slipping again.

- IPD -8.7% gives some back.

- DRO -6.7% profit taking.

- POS -3.2% on the nose still.

- HAS -5.0% slipping again.

- BRN -5.1% gives back the Wednesday gains.

- Speculative Stock of the Day: 1CG +33.3% Last week’s revenue announcement still warms.

COMPANY NEWS – HIGHLIGHTS

ECONOMIC & OTHER HEADLINES

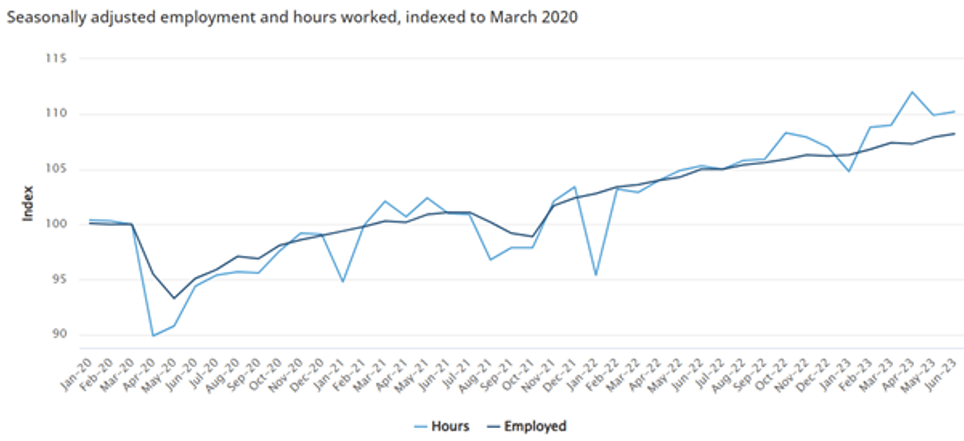

- Australia’s unemployment rate stayed unchanged at 3.5% for June after being revised down from 3.6% in May. The economy added 39,000 jobs in June, compared to 61,700 jobs added in May.

- NSW numbers lowest in history. Well since 1980.

Key statistics

- In trend terms, in June 2023:

- unemployment rate remained at 3.5%.

- participation rate remained at 66.8%.

- employment increased to 14,045,800.

- employment to population ratio remained at 64.5%.

- underemployment rate increased to 6.4%.

- monthly hours worked increased to 1,956m.

- Commonwealth Bank’s economics team has called for an August rate increase to take the cash rate to 4.35%. The bank said it felt this may be the last increase this cycle, with inflation data due on July 26.

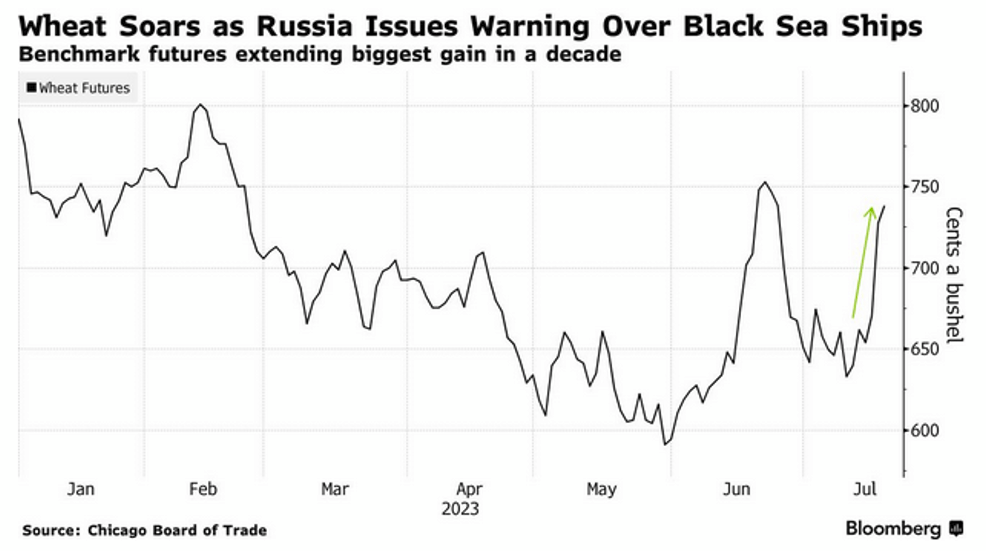

- Wheat futures continue to rise. Russia’s Ministry of Defence warned that all vessels in the Black Sea heading to Ukrainian ports would be considered potential carriers of military cargo starting Thursday.

- National Australian Bank fraudster Helen Rosamond has been sentenced to 15 years in jail for a scheme “breathtaking in its audacity”.

- TSMC posted a second-quarter profit plunge Thursday as demand for consumer electronics continues to slump. TSMC reported revenue slipped 10% from a year ago to NT$480.84bn. Net income down 23.3%.

ASIAN MARKETS

- China left its one year and five-year loan prime rates unchanged at 3.55% and 4.2% respectively, days after it also left its medium term facility loan rates unchanged at 2.65%.

US AND EUROPEAN HEADLINES

- EU trade chief warns US over compromise on steel dispute.

- Microsoft and Activision have delayed the deadline by 3-months. UK will decide by the end of August.

- Barbie film opens.

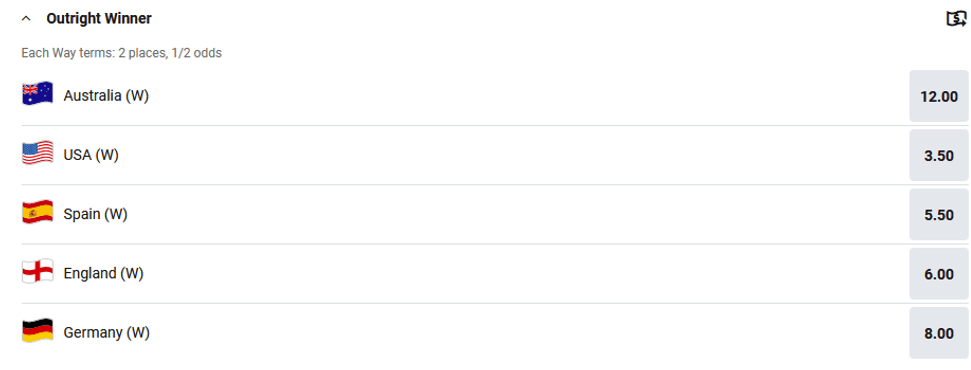

- Finally for the punters out there. Go Matildas….