Tags

Morning all,

Nasty night overseas as the Crimean referendum draws close. Bad Chinese numbers again and some rumbles of China being able to cope with sub 7.5% growth were enough to derail the rally. The Dow is now lower than the start of the year.Ooopps!

Expect a moderate fall today …SPI was down 60 points but Iron Ore and Gold were stronger although that may not be enough given the worries about the weekend. At the end of the day though RasPutin has outmanoeuvred the West in a big way…he will now have a referendum to cement this as the will of the people …democratic…game set and gold medal to the man! Sanctions and bluster from the US and Germany will not be enough.

I know what you’re thinking, RasPutin. You’re thinking “did they issue five sanctions or six?” Now to tell you the truth we forgot ourselves in all this excitement. But being this is the Security Council, the most powerful UN committee in the world and will blow your plans to hell, you’ve gotta ask yourself a question: “Do I feel lucky?” Well, do ya, punk?

Obviously yes!

Great economic numbers from Australia yesterday with the jobs beating all the estimates..I was completely wrong..must have been reading the papers! The only trouble I have is I do not believe these numbers…let’s face it, the way the ABS calculates the jobs number is pretty random..you would have thought it would be a function of asking Centrelink how many people were on the dole .Instead they phone up a number of random people and ask them if they have worked this week…depends who you ask and whether they are lying or not!!!No wonder it’s all over the place…noticed that there was no Uncle Joe or Peta Credlin presso after these figures extolling the great Australian economy…they want us cowering and scared easier to control the populous that way…endless reruns of MKR and the NRL…meanwhile ……

Idea of the day

Have been urging caution for a few weeks now as we top out for a while..I still believe that we will end the year in good shape but we have travelled a long way too quickly and like all road users we must stop, revive and survive!

The rout in the Iron Ore price appears to be over so its probably worth chipping away at the iron ore stocks..will be interesting to see whether they can overcome bad Chiese numbers,bad copper and bad markets just on the increasing Iron Ore price…

I would continue to have them on my shopping list at these prices. AGO.FMG.BHP and RIO

On another favourite of mine UNS ,where I had to admit a small case of premature excitement ,the company announced this morning that they have done a debt funding deal…looks expensive for the money but does take away the need for an equity raising so that’s a positive but with an interest rate of10.25% and them having to pay a royalty of up to 2.75% of sales. It’s not cheap…when I go to the gym Citibank are offering me plenty of money at 8.99% and I have no chance of paying it back..Think they must have gone to a payday lender or Shylock…anyway should help the share price and now they have to make the money work better than 10%!!!

Things to make me go mmmmm!!

The Internet is 25!!!Only 25…how did we do without it? Who remembers the sound the modem made when it was connecting!!!

Click here for that wonderful resassuring sound!

Minerals law opposed by cos. including BHP adopted in South Africa.

The U.S. budget deficit narrowed in February after rising employment boosted individual taxes and the Federal Reserve delivered higher earnings on its portfolio.Spending exceeded revenue by $193.5 billion last month, compared with a $203.5 billion deficit in February 2013, the Treasury Department said today in Washington.

US Retail sales rose by 0.3% against estimates at 0.2% and the prior reading at -0.4%, weekly jobless claims were 315,000 and lower than estimates at 323,000 and Business inventories climbed 0.4% which matched estimates.

Meanwhile….. KERRY SAYS `WE NEED AID FOR UKRAINE AND WE NEED IT NOW ‘But as AP reports, Congress won’t be able to authorize aid to Ukraine until after March 24 amid disagreements among several Republican. So tough!

But in a land far far away… Chinese Industrial output rose by 8.6% against estimates for a 9.5% gain,, Retail sales increased by 11.8% against estimates for a 13.5% rise and Fixed Assets less Rural rose by 17.9% against forecasts at 19.4%

China’s top envoy to Germany has said “sanctions could lead to retaliatory action, and that would trigger a spiral with unforeseeable consequences. We don’t want this.”

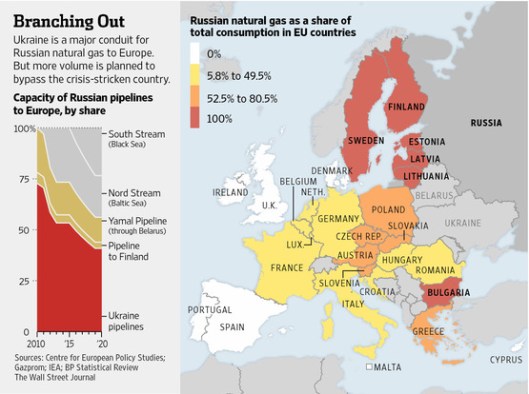

Gives you an idea of the reliance that Zombies have on Russian Gas!!!Isn’t it always about energy!!

There you go the Parachutes for LEI I talked about yesterday…don’t you love it!!! : Exit packages worth more than $24 million for former CEO Hamish Tyrwhitt and CFO Peter Gregg have been slammed by investors after the company’s independent directors recommended a revised $1.2 billion takeover offer from controlling shareholder Hochtief….after all they have done such a great job that the Spanish have been able to snap it up cheap!! That’s how you do it Paul Zahra!!

And we thought our big four banks were profitable… China’s four-biggest lenders, which reported $126 billion of earnings in the 12 months through September, sank to the lowest valuations on record in Hong Kong trading yesterday….and another aside.. Nonperforming loans increased by 28.5 billion yuan ($4.7 billion) in the last quarter of 2013 to 592.1 billion yuan, according to the banking regulator. While that’s still just 1 percent of total lending, it’s the highest amount since September 2008.

European equity investors placed more orders via computers than through flesh-and-blood traders for the first time last year, as new market rules drive more money managers to go high-tech and low-cost. The foreign exchange market has already embraced algo trading, which accounted for 68% of orders in 2013, Forex trading data showed.

And finally…couldn’t resist this one from Hans…Class….

Clarence

XXXX

Get a Global take on things at http://www.ntmarkets.com

Have a great weekend and as RasPutin says in their elections Vote early, vote often!

Any financial product advice contained in this email is general financial product advice only and does not take into account any one person’s objectives, financial situation or needs. Therefore, before acting on any financial product advice in this email, you should consider, with or without the assistance of an independent adviser, the appropriateness of the advice, having regard to your objectives, financial situation and needs.