Morning all,

Overnight we may have seen the first cracks in the growth forever story of the tech stocks as Twitter plunged after releasing its numbers and showed slowing growth..the problem with all these silicon darlings is much like the Chinese economy…those 12% growth numbers cannot go on forever..as the company gets bigger they slow to more normal levels of growth and thus become a saturated business ..now we all worry about 7.5% growth in China at some stage Faceplant etc will all lose growth options as there is only so much advertising you can stuff in front of peoples’ eyes..and if I get another facebook movie of someones’ life today…I will scream….come on, it is just making me feel that my life is so uninteresting…

Anyway I digress(rant).Markets overnight were relatively sanguine. Few disappointed punters on the US jobs numbers last night. Gold popped then settled a tad higher…everyone is so bearish on Gold …like everyone was so bullish the Dow…just saying that crowded trades can bite you on the proverbial…The Dow has fallen 1000 points since everyone got mega bullish!!!

My call yesterday was way off the mark I am afraid…not even a dead cat bounce from our market…calling it up today though..not much but maybe some bargain hunters around…it has reached my target of 5100 convincingly..bit of a worry..think we will flirt with 5000 before some sanity returns and buyers step back in..don’t think the ANZ court case helped sentiment for the banks yesterday but it is a drop in the bucket…trouble is the banks have done the heavy lifting in our market..without them we are becalmed at best and slippery at worse.

Idea of the Day

Now those of you who read this missive in the morning will know that I have been raving about UNS…and of course now have some egg like material splattered across my face as the stock promptly dropped 10% yesterday..seems the issue is that social media traders are suggesting that the company will have to raise money …now maybe they will but they have said that they are putting in place a debt facility rather than a dilutive equity raising…social media apparently was a buzz with negative stories..maybe I need to check these out more before I get excited.. anyway I am sticking to my buy on the stock and believe (hope) that I am right..it was always a longer term trade anyway and so now you can just buy more for your money!!!!!

Things to make me go mmmmm!!!

Re Qantas, Treasurer Joe Hockey could still provide government assistance to Qantas Airways, saying the government’s edict about ending corporate welfare does not apply to the airline because it does not operate in a free-market environment…..really Joe? Nothing for the fruits but still possible for our national carrier!!! Good to see there is some rhyme and reason here!!!

Wendy Deng writing love letters to Tony Blair about his legs!!!No wonder Rupert was cranky!!

Was talking to a client who raises cattle in the West….things are pretty dire out there with prices $1.30kg for their stock!!!!The drought seems to be attracting no attention from the media or from our leaders who seem to be ignoring their pleas for help…shame! Shame! shame!!I thought one of our great growth opportunities was providing food for a growing middle calls in Asia…not sure how that is going to happen!!!Of cpurse Woolies sells it to us at 30 bucks a kilo!!!

Falling turnover in Tabcorp’s NSW and Victorian wagering businesses have offset much of the growth experienced in the gambling provider’s digital, media and premium gaming services, with net profit inching up 2.3 per cent to $74.6 million in the first half. The profit is slightly higher than consensus estimates of $73.3 million.

Yesterday I was asked on Sky my views on Echo Entertainment..avoid…no reason to be there at all..move along!!!

Sad news in Argentina as Nine people have died as the Banking records of the country go up in flames…

Nine first-responders were killed, seven others injured and two were missing as they battled a fire of unknown origin that destroyed an archive of bank documents in Argentina’s capital on Wednesday.

The fire at the Iron Mountain warehouse took hours to control…The destroyed archives included documents stored for Argentina’s banking industry, said Buenos Aires security minister Guillermo Montenegro.The cause of the fire wasn’t immediately clear…..this comes amidst discrepancies on the Central Banks foreign reserves!

Greece extending its 30 year debt to 50 years…bless…

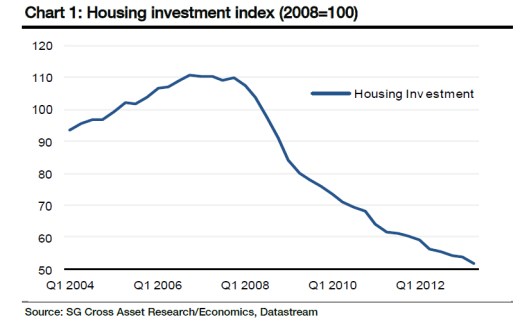

And of course the Spanish housing crisis is fixed…well make up your own mind…

The US Labor Department may report in two days that businesses added 188,000 employees in January after an 87,000 increase in December, according to the median forecast of economists surveyed by Bloomberg. Companies added 175,000 payrolls last month as colder-than-normal weather limited progress in the U.S. job market, a report from ADP Research Institute

From yesterday SMH business section..may be of interest as we go into reporting season…

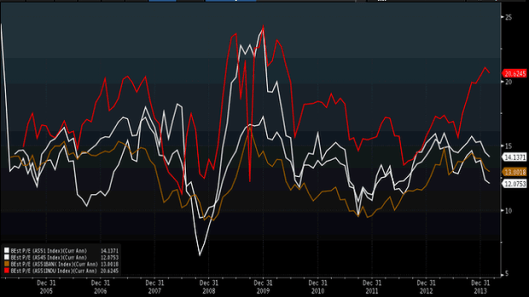

The chart below from Bloomberg shows the industrials sub-index of the ASX 200 trading on a forward P/E of over 20 (the red line), against the benchmark’s estimated P/E of 14.1 (the white line beneath it).

Banks (the brown line) as a group are trading at 13 times, and resources (unfortunately also a white line, the bottom one) are at 12 times.

So why are industrials trading at such a premium? It may be that the market is now prepared to buy into more cyclical industries in anticipation of a return to life in the non-mining corners of the economy. And perhaps they are prepared to look through more expensive valuations based on this financial year, in anticipation of earnings growth in the next.

The RBA’s rather downbeat assessment of the local economy while at the same time suggesting the next move in interest rates will be up rather than down is not great news for investors buying companies now based on a rebound in interest-rate sensitive sectors in 2014-15.

Twitter Inc. (TWTR) posted slowing user growth and a net loss that was wider than analysts’ estimates in its first earnings report as a public company, sending shares down as much as 15 percent in extended trading.

We are on the cusp on the Winter Olympics when the spotlight will be shone on Russia…I only hope that the event will be free from terrorism… love this Russian quote from a former PM on economic reforms!!! “We hoped for the best, but things turned out as usual.”

And finally….very topical…..

A man had 50 yard line tickets for the Super Bowl.

As he sat down, he noticed that the seat next to him was empty.

He asked the man on the other side of the empty seat whether anyone was sitting there.

“No,” the man replied, “The seat is empty.”

“This is incredible,” said the first man.

“Who in their right mind would have a seat like this for the Super Bowl, the biggest sporting event in the world and not use it?”

The second man replied, “Well, actually, the seat belongs to me. I was supposed to come with my wife, but she passed away. This will be the first Super bowl we haven’t been together since we got married in 1967.”

“Oh, I’m sorry to hear that. That’s terrible. But couldn’t you find someone else — a friend or relative, or even a neighbour to take the seat?”

The man shook his head. “No, they’re all at the funeral.”

Have a great Thursday

Clarence

XXXX

Get a Global take on things at http://www.ntmarkets.com