Tags

Morning all sports fans,

Three in a row down for the Dow! Disappointing company results and the spectre of Goldmans’ call on the overvalued share market in the US blunted the impact of an IMF upgrade to World Growth….The IMF raised its 2014 global growth forecast to 3.7% from 3.6%. …maybe as they have never got it right before that was also a factor!

Our market looks set to drift down again… 20 maybe?… as resources come under a bit of pressure, Gold price and Iron Ore down ,whilst banks may have a few traders take profits…BHP production numbers may underwhelm and we have CPI today at 11.30am…

Iron Ore continues to slip down to $123 last night as Chinese New Year approaches.

Yesterday saw us better as banks were bought and resources sold…this flip flop is going to be the way the truth and the future for a little while I suspect. Hard for the headline numbers to push on with all this to-ing and fro-ing

Gold stocks overseas dropped last night as Bullion fell 1% on rumblings of more tapering in coming months…

Idea of the Day

If you are looking for Biotech with promise…and who isn’t .. recently floated hopeful RGS maybe worth a look…Regeneus…they have just announced a partnership with a US based heavy weight for their trial on their Canine stem cell therapy.. Lonza is the US company..worth about $5.4 bn so it’s no fly by night operation…so if you are looking for a promising small biotech ..risk attached obviously but this space is one of the better performing ones ..this could be worth a look…expect a rise today but any buying around 50 ish should be rewarded over the next six months..!

Things to make me go mmmmmm!

Macquarie Group, alongside mining goliath Glencore Xstrata, is one of two remaining bidders still in the running to buy Royal Dutch Shell’s Australian refining and marketing business after a third group led by private equity firm TPG pulled out.

Big news this morning ..hot on the heels of Richard Coppleson retiring…cue for a shark….…Mohamed El-Erian resigned as head of bond-fund manager Pacific Investment Management Co. and will be replaced by Douglas Hodge.

Telstra has decided to limit the amount many of its customers pay for mobile phone calls. Where customers could previously be hit by bills worth thousands of ¬dollars for exceeding their monthly call allowance, the maximum Telstra now charges for phone calls is $130 a month for customers on new contracts. The limit applies regardless of how many standard voice calls are made.

In the US futures markets at 11:11:11, someone decided to dump 6,800 e-mini contracts in one second all at once as Europe begins to close and POMO ends.

Looks like the Mounties have got their man as acceptances for the Cheese makers go through 50%.

In China it’s easy to see where the fun and free money is going…not into the stock market down 13% YOY but into property…

Of course what works in China is sure to work overseas too…witness some of the rises for property near Unis!

J&J declined 2.3 percent after its earnings forecast trailed analysts’ estimates. Verizon slipped 2.9 percent as subscriber growth slowed from a record.IBM also missed expectations with the seventh straight quarter of sales decline as hardware sale or lack of it weighed on the numbers..

Portugal’s 10 year yields fell below 5% for the first time since 2010.

Davos starts today..our PM is going (they must be queuing for tickets to that one!!) …

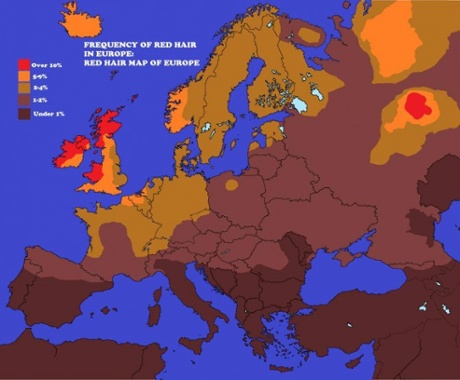

even the Pope is there talking about inequality…this is great coming from one of the richest institutions around!!!And while we are talking World inequality ..this has just been released..it is the Euro Ranga map!! Seems at least Southern Europe has something going for it!!!

even the Pope is there talking about inequality…this is great coming from one of the richest institutions around!!!And while we are talking World inequality ..this has just been released..it is the Euro Ranga map!! Seems at least Southern Europe has something going for it!!!

CPI data is released today…0.6% is the consensus …

BHP announced today that its Pilbara iron ore network produced 53.6 million tonnes of iron ore in the December quarter. The petroleum division went close to meeting expectations, producing 57.7 million barrels of oil equivalent across the broad suite of oil and gas products.

The Queensland coking coal business also responded strongly to the opening of the new Daunia mine, achieving record production.

Yesterday after spiking the Chinese authorities moved to steady the ship in their cash rates with a sharp drop in money-market rates falling the most in four weeks.

Paladin Energy MD John Borshoff has defended the price fetched from the sale of a stake in the company’s flagship Langer Heinrich mine in Namibia, with the deal set to provide significant relief to the miner’s debt position. Paladin said yesterday it would sell a 25 per cent interest in Langer Heinrich to state-owned heavyweight China National Nuclear Corporation for $US190 million.

And finally…..

And….

Two little boys, ages 8 and 10, are excessively mischievous.

They are always getting into trouble and their parents know if any mischief occurs in their town, the two boys are probably involved.

The boys’ mother heard that a preacher in town had been successful in disciplining children, so she asked if he would speak with her boys.

The preacher agreed, but he asked to see them individually.

The mother sent the 8 year old in the morning, with the older boy to see the preacher in the afternoon.

The preacher, a huge man with a deep booming voice, sat the younger boy down and asked him sternly,

“Do you know where God is, son?”

The boy’s mouth dropped open, but he made no response, sitting there wide-eyed with his mouth hanging open.

So the preacher repeated the question in an even sterner tone,

“Where is God?!”

Again, the boy made no attempt to answer.

The preacher raised his voice even more and shook his finger in the boy’s face and bellowed, “WHERE IS GOD?!”

The boy screamed & bolted from the room, ran directly home & dived into his closet, slamming the door behind him.

When his older brother found him in the closet, he asked,

“What happened?”

The younger brother, gasping for breath, replied,

“We are in BIG trouble this time!”

“GOD is missing, and they think WE did it!”

Have a great Wednesday…heading into Sky TV for Lunch money today..so phone and ask a question..watch me wriggle!!

Clarence

XXXX

Any financial product advice contained in this email is general financial product advice only and does not take into account any one person’s objectives, financial situation or needs. Therefore, before acting on any financial product advice in this email, you should consider, with or without the assistance of an independent adviser, the appropriateness of the advice, having regard to your objectives, financial situation and needs.

Get a Global take on things at http://www.ntmarkets.com