Tags

Morning all,

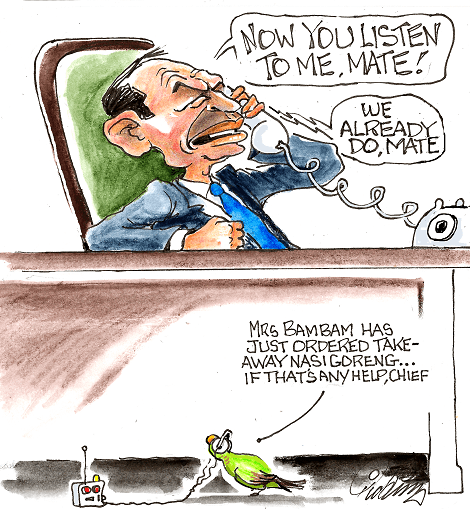

16,000 on the Dow..historic day as it closes at the all-time high. Go Fed! Mission accomplished….Uncle Ben can go out on a high and leave that horrible Tapering stuff to Janet..and after four down days on our market its time to snap back. Although I would expect only a modest rise back above 5300 maybe up 25-30 tops…Uncle Fester (Glenn) did his bit yesterday to get the Aussie dollar down as he talked about direct currency intervention..below 92 cents and a 2 ½ month low…..trouble is the fall in the dollar is coming too late to salvage business as most of it has taken such a big hit it is either gone or teethering!!

The siren calls of the IPO are rising as we get closer to Ithaca(Xmas)…of course it is going to be very tempting to give in to their song especially as they tend to be cheaper and more competitively priced than existing shares..lots of money being sucked out to go into these things although why anyone in their right mind would buy NINE is beyond me but there you go…

Idea of the Day-Did promise yesterday so here is a little more on RTD

Yesterday I talked about Rampart Energy ….looks interesting..its tiny and speculative and they are raising money..but we met with management yesterday and they are quite an impressive outfit..they are looking for unconventional and conventional oil and gas in Prudhoe bay in Alaska..this is the largest oilfiled in the US! So they are in the right place..the other good thing is the Government rebates 85% of their drilling and seismic spend in 2014/15 so needless to say that’s when they are doing seismic and drilling..just getting all the approvals now but for a speculative medium term oil and gas play it has great uside..experienced team and in the right location with good local partners..

Anyway on less speculative ones the big kahuna..BHP had its AGM yesterday and talked of the fifth pillar in Potash but more importantly we can see the results of the cost cutting and the cash that this behemoth generates…I like this one..if you do not own any BHP this should be remedied…They are benfitting from the high iron ore price the lower dollar and things in the US oil biz seem to be on track..whats not to like!!

A quick heads up I have the team from one of my favourites MOC coming in to present to us in a few weeks’ time so if you are interested in hearing this story let me know and I will save you a seat…5th December at 11.15 I believe..great story and worth hearing it from the horses’ mouth especially in the current housing market!!

Things to make me go mmmmm!

There seems to be a new bubble growing ..a bubble in commentators calling it a bubble…double bubble toil and trouble!

Very crowded out there at the moment in IPO and capital raisings as the rush to beat the Xmas window accelerates.

QAN is now being investigated for competition issue with Virgin.

Bega Cheese: executive chairman Barry Irvin says the company considered a dual share float structure similar to what Murray Goulburn is set to announce, but rejected the model based on Bega’s lack of scale and its unattractiveness to external investors. Murray Goulburn is expected to unveil plans to raise up to $500 million from outside its farmer shareholder base for the first time in its 63-year history at its AGM on Friday.

David Jones’s: annual meeting on Friday is shaping up to be the most dramatic in more than 10 years as major shareholders line up to challenge the board over its retail expertise, corporate governance and executive pay. The 175-year-old retailer is facing a possible first strike against its remuneration report and chairman Peter Mason is likely to face questions about the circumstances behind chief executive Paul Zahra’s planned departure.

Woodside Petroleum: has resumed high-level talks with its potential Leviathan partners, with chief executive Peter Coleman heading to New York to nut out revised terms of the company’s planned entry of up to $US2.3 billion ($3.44bn) into the Israeli project.

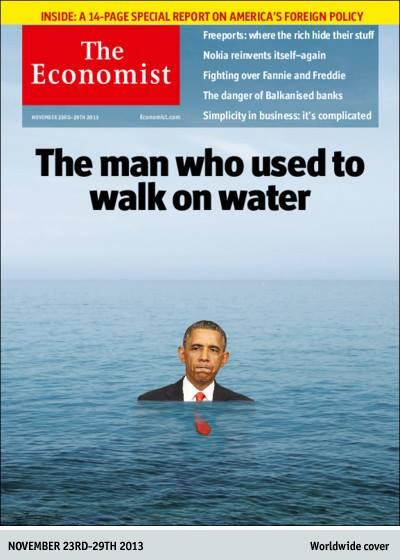

Janet Yellen has passed through to the next stage on beatification..

Investors are pouring more money into stock mutual funds in the U.S. than they have in 13 years, attracted by a market near record highs and stung by bond losses that would deepen if interest rates keep rising. Stock funds won $172 billion in the year’s first 10 months, the largest amount since they got $272 billion in all of 2000, according to Morningstar Inc. estimates.

Says it all!

Eurozone finance ministers are losing patience with Greece, said the head of the Eurogroup, Jeroen Dijsselbloem, as the country submitted its 2014 budget. Hardly surprising given the lies and reluctance to modernise a third world economy.

And it seems that the Ukraine has decided not to cosy up to the EU after all as Moscow seems to have turned their heads.All preparations to sign historic EU agreements have been halted and a Russian embrace is now on the cards!

Dr Who turns 50 on Sunday ..can’t wait for the new episode…and looking forward to the cricket!

And finally……..

Have a great weekend…catch you on Sky Biz at 5.30 tonight..lots to talk about!

Clarence

XXXX

Any financial product advice contained in this email is general financial product advice only and does not take into account any one person’s objectives, financial situation or needs. Therefore, before acting on any financial product advice in this email, you should consider, with or without the assistance of an independent adviser, the appropriateness of the advice, having regard to your objectives, financial situation and needs.

Get a Global take on things at http://www.ntmarkets.com