Tags

lMorning all,

Once again Yellen cameLlllplllllpllllllllplllllllplpllllpplpl plllll pplike when the doves cry!

YELLEN SAYS FED DOESN’T SEE BUILDUP OF FINANCIAL RISKS

YELLEN SEES LIMITED EVIDENCE OF ‘REACH FOR YIELD’

YELLEN SAYS FED LOOKS OUT FOR ANY POTENTIAL ASSET PRICE BUBBLES

YELLEN DOESN’T SEE `MISALIGNMENTS’ IN ASSET PRICES

Good to see our market yesterday shake off the wobble from Wednesday…good rebound from the banks and nice to see the resources join in…expect another mildly positive day today…Taper is still front and centre and even worse than expected Zombieland growth figures didn’t dent the market enthusiasm. Not quite sure what will..targeting 5600 by Xmas…

Any shareholders in Linc Energy have today to sell them before they delist and decamp to a Singapore listing…bit like Big Nathan!

Idea of the Day

One from our team….EAX…met with the previous MD Val Duncan who ran this business very well and it has been a great success story..new CEO Scott Wooldridge now from an IT and marketing background..they are an energy broker in a fragmented industry..EAX has cash and can make acquisitions to add revenue…the removal of uncertainty on the Carbon Tax will help their business immensely and our expert bod has a price target of $4.80 in the next year…worth putting on the radar…

Still like the Iron Ore sector ..big ones are obvious BHP FMG especially and RIO although that’s my last big cap fave..prefer AGO still… but for the punter in us all..maybe a time to have another look at SDL..big deposit in the middle of nowhere Africa!Chinese had one look at it…sure if the price stays firm around 135 there will be others strangely drawn to another look…only for the punters perhaps…or having met with Brockman (BCK) they could offer some upside depending on port access negotiations..

Things to make me go mmmm!

Rio Tinto’s most important growth project has suffered another setback, with financing of the Oyu Tolgoi expansion in Mongolia delayed indefinitely.

Rio said ongoing quibbles with the Mongolian Government remained unresolved, meaning that a global effort to raise $US4 billion for the second stage of the mine could not be completed in the near term.

Freelancer (FLN) lists today..will be interesting to see how the techboom2.0 is going here..Lists at 12 pm…predicting big things…

Haven’t the guys at Anchorage Capital done well with their Dick Smith investment..$20 m into over $300m…not sure Woolies will be so happy to have stuffed it up this badly…they say that it was taking up too much management time..that’s a lot of management time even at their prices!!

ANZ, CBA, NAB, WBC: Australians have half a trillion dollars invested in the big four banks, adding to the case for tougher regulation of ¬financial institutions considered too big to fail. A new report by UBS concluded that the high amount invested by ¬Australians in banks, shares, bonds and other securities was a potential ¬“concentration risk”.

I have said it before I’ll say it again..Buy the Banks, Die with the Banks..they are 28% of our market, pay great yields and why sell them when you will have to pay large slabs of tax..just pass them on to your kids…rising dividends and safe as houses..literally…interestingly I had a lady from CBA ring me yesterday to offer me more credit …and continually see Citibank offering big lines of personal credit in their ads on Sky Biz while I am at the gym…

Iron Ore up again…and in Aussie dollars it’s pretty darn good..just saying all you analysts out there who predicted the demise of China, Iron Ore and the Aussie producers…doh! Bring on the back flips!!

BlueScope Steel: has given its first upbeat assessment of its prospects in five years, with chief executive Paul O’Malley saying positive signs of improvement were emerging in most of the group’s markets.

Given the takeover activity in the blessed cheesemaker sector …stay with the WCB..remember Ludowici..

As I was walking up the stairs, I met a man who wasn’t there, he wasn’t there again today I wish to God he’d go away!….Met a lovely American yesterday who is setting up an exchange to enable people to hedge their bitcon exposure!

Abbey Cohen the queen of the Street at Goldman Suchs has said that US stocks are not expensive. She is seeing value in record high prices. S&P 500 is trading at 16 times earnings against a long term average of around 14 times.

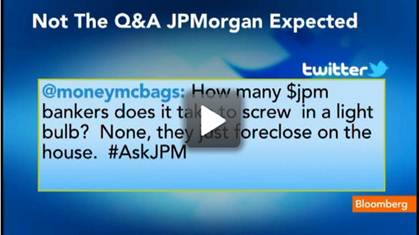

Epic fail by JP Morgan as they took to Twitter to have an ask JPMorgan session..should have known they were asking for trouble..only lasted two hours…

And still in the US …Student loans have just gone through the Trillion dollar mark and a modest 11% delinquency rate..all good then..oh and Obama has had to back track on his health care reforms.

And finally…..thanks Marilyn for this one..

A blonde, wanting to earn some money, decided to hire herself out as a handyman-type and started canvassing a wealthy neighbourhood.

She went to the front door of the first house and asked the owner if he had any jobs for her to do.

“Well, you can paint my porch. How much will you charge?”

The blonde said “How about 50 dollars?”

The man agreed and told her that the paint and other materials that she might need were in the garage. The man’s wife, inside the house, heard the conversation and said to her husband, “Does she realize that the porch goes all the way around the house?”

The man replied, “She should, she was standing on it.” A short time later, the blonde came to the door to collect her money. “You’re finished already?” he asked. “Yes,” the blonde answered, “and I had paint left over, so I gave it two coats.”

Impressed, the man reached in his pocket for the $50.”And by the way,” the blonde added, “it’s not a Porch, it’s a Ferrari.”

Have a great weekend

Clarence

XXX

Any financial product advice contained in this email is general financial product advice only and does not take into account any one person’s objectives, financial situation or needs. Therefore, before acting on any financial product advice in this email, you should consider, with or without the assistance of an independent adviser, the appropriateness of the advice, having regard to your objectives, financial situation and needs.

Get a Global take on things at http://www.ntmarkets.com