Tags

Australian Sharemarket, Ben Bernanke, BHP, cba, Charlie aitken, commonwealth bank, CPU, crash, diggers and dealers, Fortescue, Reserve Bank, results preview, telstra, TLS, twiggy, Whitehaven Tinkler coal bid cash, woolworths

Morning all,

It’s not been a fun week and today will not be any better I am afraid. The good news is that for those who have been sitting on their hands waiting for the market to come back ,well here is your chance.Wall Street slumped in the last hour as the Middle east and the Fiscal Cliff took centre stage. A speech from POTUS and the Fed minutes did nothing to help the situation either. So expect the index to fall another 50 at the opening before some bargain hunting appears.Defensives and yield stocks will be first on the shopping list…that means Banks and TLS!

My Xmas target of 4700 is being sorely tested as we get further and further away from there. The ASX 200 at 4388, looks like it may test the 4300 level in teh short term..Isreali war with Hamas and Cliff warning plus Greece not good..theother issue facing the US is that profit expectations seem to have got ahead of reality and too much ‘hopium’ was placed on Uncle Ben coming to the rescue of the equity market..read yesterday that Hedge funds are at their most bullish for some time…starnge then why the market has tanked..must be everyone was long and wrong!!!Now for the reckoning…I am going to go out on a limb here but believe that at 4300 you get stuck into our market in a big way for a end of year rally..the fiscal cliff will be sorted..they have all learnt from last time and far more concillatory noises are coming out of the Republicans than last time. Maybe this will not go to the wire..if it does the Dow will have a 11 in front of it…amazing now far the US market has fallen since Obama got reelected

Idea of the day

Top shopping targets for the medium term with some price guides…

ANZ…23.20

WBC..23.80

CBA…57.00

TLS..4.05/08

Things that make me go all Ibrahimovic…one of the greatest goals of all time perhaps? Shame it was against England… You decide…

1.The Big Bogan,Nathan, has been in the news again today with stories that he has had his prize money withheld by various Jockey Clubs as he appears to owe them money too….not a good look ..again…

2.Myer Holdings, Australia’s largest department store chain, reported a better-than-expected rise in its first quarter sales as warmer weather encouraged summer clothing purchases and it offered smaller discounts on sale items…..it’s the weather stupid! Should help stock improve!!

3.Worley Parsons has warned sloppy management practises have driven rising costs on large resources developments, and branded Perth as “close to being the most expensive place for engineering in the world”

4.Mining magnate Gina Rineheart has expressed her support for Fairfax Media’s $US79.9m sale of its US agricultural publishing business, but has called for further asset sales. It’s understood the sale price represents a multiple of about 8x EBITDA..shame the rest of the best business isn’t valued on that basis!!

5.Fears are growing that Israel’s assassination of the leader of the Hamas military wing could provoke another war with Gaza, as residents on both sides of the border brace for the worst…oil reacted upwards last night but Gold stayed on the sidelines .For how long?

6.Strange days in deed as FMG moves to take a strategic stake in Tiddler OBL which is an oil and gas business…one of the BRU neighbours in NW Australia. Not sure why FMG is diversifying into the oil and gas business but interesting none the less.

7.LYC finally had some good news as the Malaysian Court has upheld their licence to produce. The stock will be back today but don’t expect them to jump above the recent issue price as there are a few stale bulls dying to get out!

8.The Wesfarmers CEO believes that consumer confidence is improving. Richard Goyder says many of the company’s retail subsidiaries, such as Kmart and Coles, have already noticed signs of improvement. At the group’s AGM yesterday, Goyder assured shareholders that sales growth at Coles is improving. Food price deflation is still continuing, but at a much slower pace than previously.

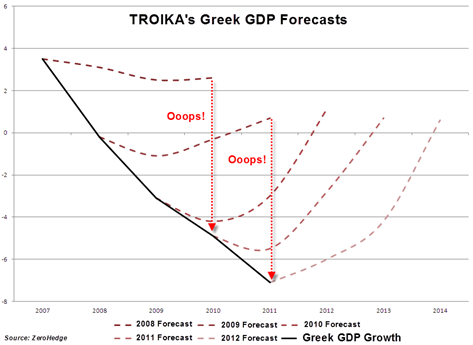

9.In Zombieland news ..a good time to look at the Troika’s forecasts on Greek Debt….not a great track record…why should that change now!!!think they need a new crystal ball this one is very busted!!

10.And it turns out the Russian social revolutionaries had some serious help in the 1917 uprising as a robot has been spotted in a image used in an VCE Exam..it’s a Battle Tech Marauder..no wonder they won….think the Spanish and Greek peeps need one now…may help them sort out their Governments..

11.And in news from the UK, it appears that International buyers are now buying more UK real estate than the local buyers…all those Zombies trying to find a home for their money..London prices continue to push ahead as Greeks and Spanish ‘invest’ their Euros!

And finally….

A man runs into the vet’s office carrying his dog, screaming for help. The vet rushes him back to an examination room and has him put his dog down on the examination table. The vet examines the still, limp body and after a few moments, tells the man that his dog, regrettably, is dead. The man, clearly agitated and not willing to accept this, demands a second opinion.

The vet goes into the back room and comes out with a cat and puts the cat down next to the dog’s body. The cat sniffs the body, walks from head to tail, poking and sniffing the dog’s body and finally looks at the vet and meows.

The vet looks at the man and says, “I’m sorry, but the cat thinks that you’re dog is dead, too.” The man is still unwilling to accept that his dog is dead. So the vet brings in a black Labrador retriever. The lab sniffs the body, walks from head to tail, and finally looks at the vet and barks. The vet looks at the man and says, “I’m sorry, but the lab thinks your dog is dead too.”

“$650 to tell me my dog is dead?” exclaims the man.

“Well,” the vet replies, “I would only have charged you $50 for my initial diagnosis. The additional $600 was for the cat scan and lab tests.

Have a good ( well as good as it can be) day

Clarence

XXX

Any financial product advice contained in this email is general financial product advice only and does not take into account any one person’s objectives, financial situation or needs. Therefore, before acting on any financial product advice in this email, you should consider, with or without the assistance of an independent adviser, the appropriateness of the advice, having regard to your objectives, financial situation and needs.