Good morning,

Yesterday’s action was scary and felt like panic..however I believe it is still too early to start dipping toes in the water..we may try to stabilise and push a little higher but I would use any transitory rallies as a opportunity to lighten the load and get some cash in the bank…I am a great fan of a web site called www.zerohedge.com and although it is a very subversive and bearish conspiratorial site they do have some great commentary and would urge those that have an interest in what’s happening around the World to subscribe to their site..it is well worth it…anyway ‘Zombieland’ is lurching towards a messy and expensive collapse..the Great Euro experiment will end in tears…welcome back to the Drachma and the Lira perhaps…

Everything I am reading at the moment is universally negative, even worse than listening to Nick Cave on repeat for hours. It is hard to see this ending well..someone wrote that this is not about how Greece defaulted but the Euro bureaucrats answer to the original problem. Now at some stage the Central Banks will start the Presses again and Gold which is now 20% off its highs and therefore in a bear market will have a rally…but at the moment everything is being thrown out.

Our market will try to make a fist of it today with SPI only down 3 but it will be nervous and could go either way in a hurry if the shorts cover or the panic continues…AUD just above 99c but should help Gerry Harvey!

I am just glad we are in this resource boom..BHP/RIO etc all showing how wonderful it is out there in resource land..be careful in the mining services which have made hay whilst the sun shone ..they may be in for some cancellation of projects..

Few things to ponder today

- Japan is now a D-List Country, adult diapers outsold baby diapers this year for the first time ever…ageing populations are not good for an economy..see charts below.

- 2.BHPs top brass look like they are about to pull the spending in Australian Infrastructure projects..softening up by Nasser and Kloppers with high costs the focus..the days of earning 200 grand driving a truck in the Pilbara may be coming to an end..

- Facebook investors feeding the turkeys while they gobble as they look to sell more shares to the public.gotta be the sign of the top perhaps in these social media stocks

- JP Morgan still thinks that losing $2bn is a hedge..yeah..these guys have a lot more exposure than this if it goes ***s up….and they are supposed to be the smart guys in the room.

- 1bn Euros has been withdrawn from Greek banks since the election..new election due 17th June..same result only more emphatic expected…say yia sou to the Drachma and Kali nichta to the Euro

- More profit downgrades this time from Toll… CBA has posted a third quarter profit of 1.75bn buckaroos pretty much in line and up 3% from previous year.

- The only person in the World more deluded than Craig Thomson is the Japanese Government who are raising economic estimates..must be all those nappies they are buying!!

- Thursday’s session will bringa few talking points – GDP prints for both Japan and Spain, and the US Philly Fed . Spain will auction EUR1.5bn-2.5bn across three lines in the 3y and 4y sectors. Italy’s Monti, France’s Hollande, Germany’s Merkel and the UK’s Cameron will also hold a video press conference ahead of the G8 meeting.

- Lagarde and the IMF now talking openly about the Greek Exit..at least it derived from a Greek word..should make it easier…Bob Marley even sung about it..

- Back on Radio today at 12.30…only Newcastle but it’s a gig..Sky TV on Monday!

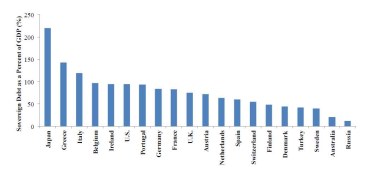

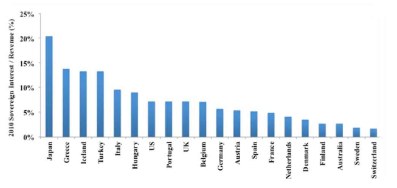

Thought the following charts would be of interest..shows the amount of debt some countries have..makes us look very good..Japan not so good!!

Something to bring a smile perhaps in these dodgy times…

What economic model correctly forecasts the outlook for the European economy: A double-dip recession, a V-shaped recovery, or something else?

The bathtub. A steep decline, then a period of stagnation, then it goes down the drain.

Clarence

XXX

Any financial product advice contained in this email is general financial product advice only and does not take into account any one person’s objectives, financial situation or needs. Therefore, before acting on any financial product advice in this email, you should consider, with or without the assistance of an independent adviser, the appropriateness of the advice, having regard to your objectives, financial situation and needs.